Canadian fund portfolio managers expect that Canada’s economy will grow by only about 2% or less this year. The reasons range from weaker spending by debt-laden consumers or the softening housing market to the still-struggling manufacturing sector.

But portfolio managers such as Darren Lekkerkerker, a portfolio manager in Toronto with Pyramis Global Advisors LLC, a Fidelity Investments company, say there is reason for optimism. Lekkerkerker still expects to find “good opportunities in the market.”

For Paul Taylor, chief investment officer, fundamental equities, with BMO Asset Management Inc. in Toronto, the key is taking a close look at large-cap stocks in sectors resistant to market ups and downs: “Generally, you would be fishing more in the non-cyclical than the cyclical sector.”

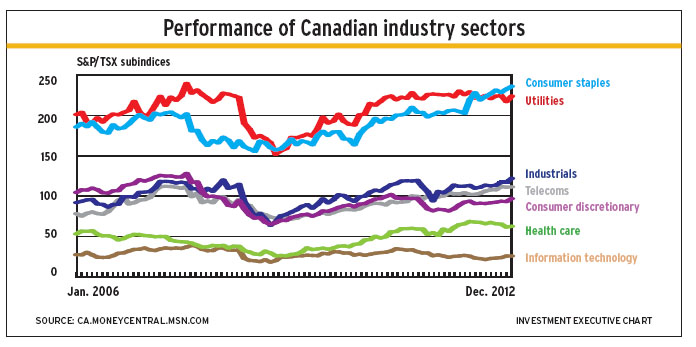

Those sectors generally include consumer staples, utilities and health care industries that supply services with steady consumer demand.

But other portfolio managers are finding opportunities in more volatile sectors, such as consumer discretionary and technology: no matter what the outlook, Canadians are unlikely to give up chatting on their cellphones while sipping takeout coffee.

Here’s a look at what’s ahead for Canadian equities, excluding resources (see page B10) and financial services (see page B8):

– CONSUMER STAPLES. This is a sector in which people will continue to buy, whether or not they are optimistic about the economy.

“The staples are staples,” says Taylor. “They are things that you will need regardless of the economic environment or where the equities market goes.”

Although some clients might worry about an increase in food costs for grocers due to shortages created by droughts last year, Warren Fenton, director of equities and portfolio manager at Acuity Investment Management Inc. in Toronto, says the sector is still attractive. The current cost increases caused by adverse weather, he says, are short-term.

Some grocers, such as Metro Inc., consistently provide Fenton’s investment funds with returns regardless of general economic or global climate concerns. “All Metro does,” he says, “is deliver like the Energizer bunny every quarter, year after year.”

Taylor likes Loblaw Cos. Ltd. because of the recently completed upgrade of the company’s information-technology platform: “This should allow [Loblaw] to make sure the right products are at the right stores, at the right price for consumers.”

Couche-Tard Inc. is another possibility because of its recent expansion into Europe with the acquisition of Statoil Fuel & Retail ASA in Norway. Over the past few years, says Lekkerkerker, Couche-Tard has built its profits by acquiring other convenience-store chains, cutting costs and integrating the acquired businesses.

Another perennial favourite, Shoppers Drug Mart Corp., has hit a rough patch due to regulatory changes for generic drugs. But, Fenton says, the company should work through these challenges over the next year or two.

A brief look at the sectors:

– CONSUMER DISCRETIONARY. In this sector, Taylor looks for companies that share some of the characteristics of the consumer staples sector. These include Canadian Tire Corp Ltd. and Tim Hortons Inc.

Canadian Tire’s three business lines automotive, clothing retailer Mark’s Work Wearhouse and general merchandise for the home are fairly recessionproof, Taylor says. And the low cost of food and beverages at Tim Hortons outlets means few consumers will feel the need to give up their morning brew.

Most consumers also will continue to buy T-shirts and socks. Lekkerkerker likes Gildan Active Wear Inc., which has a large share of the wholesale T-shirt market and is “the most efficient and lowest cost manufacturer,” he says. The company missed its forecast earnings numbers last year due to an increase in cotton prices, Lekkerkerker notes, but those costs have since declined.

Fenton favours Dollarama Inc. because its sales are unlikely to decline even in tough economic times, given its cheap prices. Dollarama also has a strong management team and has been expanding its stores and products.

@page_break@Hudson’s Bay Co. is a pick of Fenton’s. He notes that it’s one of the few places to buy reasonably priced, brand-name clothing. The firm also is rejuvenating its stores.

– TELECOMMUNICATIONS. For Ed Sollbach, analyst, portfolio strategy and quantitative research, with Desjardins Securities Inc. in Toronto, virtually every company in this sector is a win. He notes that Rogers Communications Inc., BCE Inc. and Telus Corp. all have stable returns and tend to be more defensive companies.

“It kind of works in a risk on’ or risk off’ scenario in our view,” Sollbach says. “If the market does poorly, these stocks are going to outperform; and if the market goes up, we think they go up with the market, too.”

– INFORMATION TECHNOLOGY. There are some interesting companies in this sector, despite the fall from grace of Research in Motion Ltd.

Sollbach points to Open Text Corp. and MacDonald Dettwiler and Associates Ltd.

– HEALTH CARE. Lekkerkerker particularly likes Valeant Pharmaceuticals International Inc., because of its recent mergers. After Valeant purchases a company, he explains, cost reductions typically are passed on to shareholders.

– UTILITIES. Some portfolio managers view this sector as being overvalued because it is very crowded by investors looking for yield. As a result, share price valuations have risen.

– INDUSTRIALS. Portfolio managers are a little hesitant about this sector because of uncertainty around big players such as Magna International Inc. and Bombardier Inc.

Taylor is staying away from Bombardier because it’s struggling to gain new orders and to deliver its C-series aircraft: “The company has bet a lot of capital on that C-series business, and it’s just not obvious that it is going to hit pay dirt on that.”

Fenton is looking at Magna with interest: “The North American auto business looks phenomenal.”

The major risk for Magna, he adds, is in its exposure to the European market.

A less risky bet, says Sollbach, are railways. He favours Canadian Pacific Railway Ltd. and Canadian National Railway Co. Not only do both firms have strong returns on earnings and profit growth, but they also stand to gain as growth in Asia picks up and more goods are sent across Canada in trade with countries such as China.

– SMALL-CAPS. After hitting a low during the recent recession, says Ralph Lindenblatt, portfolio manager with Franklin Templeton Investments Corp. in Calgary, Canadian small-cap equities have rebounded, with share prices almost doubling since bottoming in November 2008. Some interesting sectors, he adds, include capital goods, industrials, transportation and technology.

Brandon Snow, principal and portfolio manager with Cambridge Advisors, a unit of CI Financial Corp. in Toronto, notes that tech companies are often well-run businesses that don’t need a lot of financing but are sometimes underappreciated and followed sparingly by analysts.

One company Snow likes is Enghouse Systems Ltd., which provides call-centre software to telecom firms. “It’s a pretty boring business,” says Snow, but one with a “nice chunk” of recurring revenue.

Within small-cap industrials, Lindenblatt holds steel fabricator Canam Group Inc., which is trading below book value. It has about 75% market share in Canada and 20 plants across North America. Lindenblatt expects some acquisitions to start paying off this year.

Within consumer discretionary, Snow likes DHX Media Ltd., which owns the largest library of children’s content in the world. Snow notes that companies such as Netflix Inc., Apple Inc. and Amazon.com Inc. are starving for content for mobile phones, televisions and tablets: “What you’re seeing is an inflation of the cost of content, which means that [DHX’s] cash flows are going up.”

Another pick is Bauer Performance Sports Ltd. Not only does this company have a strong position in hockey equipment, but it also recently purchased a major lacrosse line. Even the recently ended National Hockey League lockout had an upside, says Taylor, because locked-out players were taking their equipment with them to play in Europe and “spreading the gospel” of Bauer.

© 2013 Investment Executive. All rights reserved.