The financial advisory business is inextricably tied to the markets – and booms and busts are just part of the deal. But the business of mutual fund dealer representatives appears to be declining at a time when equities markets have been remarkably strong, raising concerns that the decline may be structural rather than cyclical.

The data obtained for Investment Executive’s 2015 Dealers’ Report Card show that the average mutual fund dealer rep’s business is being pared back at time when the mutual fund industry overall is enjoying solid growth. According to this year’s Report Card, the average advisor reports having $34.4 million in assets under management (AUM), down from $36.5 million in 2014.

This decline is not monumental, but it also isn’t insignificant – particularly as it comes against the background of record AUM levels and double-digit growth rates for the mutual fund industry overall.

The Investment Funds Institute of Canada reported that total mutual fund AUM was $1.22 trillion as of March 31, up by more than 15% over the previous 12 months. In fact, slightly more than one-third of the increase in industry AUM in that period came from net sales, with the balance powered by market gains.

Yet, amid this environment of both net sales and market gains, the average mutual fund dealer rep saw his or her book deteriorate. This suggests that advisors in other sales channels, such as brokerages and deposit-taking institutions, are the chief beneficiaries of the mutual fund industry’s growth – and that those gains are coming at the expense of advisors whose practices are with traditional mutual fund dealers.

In addition, new forces, such as robo-advisors’ low-cost, high-tech approach, are entering the scene and may be posing a competitive threat to the traditional mutual fund dealer channel.

Indeed, the average mutual fund dealer rep is losing clients. Overall, advisors reported a modest decline in the number of client households that they are serving, down to 201 from 207 in 2014.

Furthermore, reps also signalled a deterioration in their productivity, as measured by AUM per client household. This metric ticked downward to $208,136 from $219,920 last year.

Based on the data, the average mutual fund dealer rep lost a handful of clients over the past year – and the clients who remain have smaller accounts. These trends suggest that advisors are losing the long-running battle among the investment industry’s various distribution channels for the high net-worth clients so highly coveted by firms and advisors alike.

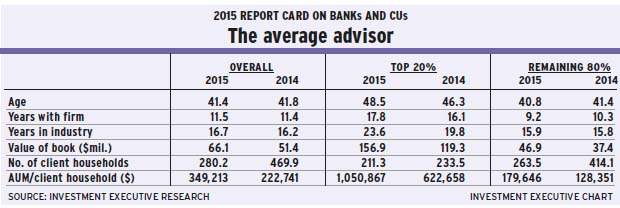

In order to drill down further into the survey data, IE segments the overall population of mutual fund dealer reps into the top 20% of producers and the remaining 80%, as based on AUM/client household.

The same underlying trends are evident among both the top performers and the smaller producers, as both sets of advisors are suffering a decline in average AUM and productivity.

For the top 20% of reps, average AUM was down a bit year-over-year to $67.2 million from $69.2 million in 2014. Although the top performers still hold a sizable edge over the remaining 80% of advisors (who reported just $26.4 million in average AUM, down from $27.8 million last year), the data indicate that the deterioration in AUM for mutual fund dealer reps isn’t sparing the industry’s top echelon.

Moreover, average productivity for the industry’s top performers also was down from last year. This year, the top 20% of advisors reported that average AUM/client household now sits at $519,012, down from $566,728 last year.

Again, these advisors still enjoyed much greater productivity than the remaining 80% of reps – by a margin of almost four to one – but the output of the top performers appears to be somewhat weaker than in last year’s survey.

Indeed, the falloff in productivity is more pronounced for the top performers than it is for the rest of the industry because the decline in average AUM among the elite advisors was accompanied by a small increase in the number of client households being served. And with a diminishing AUM base spread over a slightly bigger client roster, the negative impact on productivity is intensified.

In contrast, among the remaining 80% of advisors, the metrics for average AUM, number of client households served and average AUM/client household all have deteriorated a bit vs the previous year.

For both segments of the mutual fund industry’s advisors, then, it appears that reps are losing some portion of their higher-value clients. This observation is backed up by the account distribution data. According to the results of this year’s Report Card, the average rep’s book now has 32.1% of client accounts in the sub-$100,000 category, up from 27.9% in last year’s survey.

The next account category – the $100,000-$250,000 range – also has seen its share of the average rep’s book increase year-over-year to 25.4% from 24.7%.

Conversely, advisors reported that allocations to every account category above the $250,000 mark has declined year-over-year. This shift toward lower-value accounts reinforces the sense that fund dealer reps are suffering some losses in the ongoing fight over the highly prized high net-worth clients.

This trend is evident even among top performers, with their allocations to sub-$250,000 accounts rising to 27.7% of the average book this year, up from 22.4% in last year’s survey. At the same time, the top performers reported that their share of accounts worth more than $1 million has declined to just 19.5% of the average book in the latest survey from 24.2% in 2014.

The fact that the mutual fund dealer business may be losing some of its higher-value clients to other distribution channels also was reflected in the asset- allocation data. The average dealer rep reported that mutual funds now comprise an even larger share of his or her book. This year, mutual funds accounted for 71.2% of the average rep’s book, up from 65.5% in 2014. At the same time, allocations to other securities, such as equities and bonds, are down from the previous year; similarly, insurance product revenue is down as well.

These trends suggest that the underlying shifts in the makeup of the average mutual fund dealer rep’s client base over the past year have resulted in books that are more focused on the core mutual fund investor and may be less devoted to clients with more complex financial situations.

This increasing dedication to mutual funds also was reflected in the revenue mix reported by mutual fund dealer reps.

For example, fee- and asset-based revenue sources now contribute 69.7% of the average rep’s gross revenue, up from 63.1% in 2014. Reps’ reliance on almost every other sort of revenue declined year-over-year. Most notably, transaction-based revenue now accounts for just 26.4% of the average rep’s revenue, down from 32.5% in 2014.

This drift toward fee- and asset-based revenue and away from transactions also may reflect the higher reliance on mutual funds and the diminishing importance of direct holdings of securities that are evident in other areas of this year’s survey.

The smaller allocation to insurance for the average rep, which was down to 14.6% of total product distribution in this year’s survey from 19.3% in 2014, also generated notably lower insurance revenue for the average rep. Average annual insurance revenue has dropped by almost half vs the previous survey, to $48,621 this year from $91,231 last year.

All of these trends – lower AUM, weaker productivity, lower average account sizes and decreasing revenue – also are, of course, affecting the bottom line for many advisors. Specifically, the distribution of advisor compensation appears to be shifting toward the lower end of the pay scale, according to the results of this year’s survey.

The single largest annual compensation category for mutual fund dealer reps remained the $100,000-$250,000 category, which accounted for 36.6% of the overall advisor population. That’s virtually unchanged from the 36.9% of advisors who reported earning that amount in last year’s survey.

However, the proportion of reps who fell into the lowest-paid category – those earning less than $100,000 a year – was up to 26.3% this year from 23.7% last year. In addition, the share of reps who reported earning $250,000-$500,000 a year also was down to just 22.2% of the rep population vs 28.9% in last year’s survey.

Against these trends, the one bright spot is the $500,000-$1 million category of annual compensation. The percentage of reps that reported that they fall into this category was up to 12.4% from just 8% last year. Although some of that increase may reflect the drop in compensation for advisors who claimed to be earning more than $1 million a year in previous surveys, the size of the gain is more indicative of reps rising into that compensation category.

So, although the mutual fund dealer industry appears to be suffering a bit on average, that pain is not necessarily universal. Many reps appear to be making out just fine. Although some advisors surely have seen their income decline, a minority appear to be bucking the trend and enjoying richer compensation.

Overall, though, the mutual fund dealer industry does appear to be under intense competitive pressure, which is costing these advisors AUM and some share of high-value clients.

The challenge for these advisors will be to turn these trends around in an environment in which everything from technological innovation (such as the emergence of robo-advisors) and regulatory reforms (which aim to enhance transparency for clients and may put pressure on advisors to justify the cost of their services better) represent substantial headwinds.

© 2015 Investment Executive. All rights reserved.