Although many insurance firms are providing strong back-office support for new business, a new application-processing system at two firms has led to major delays and lost business, leaving insurance advisors extremely frustrated.

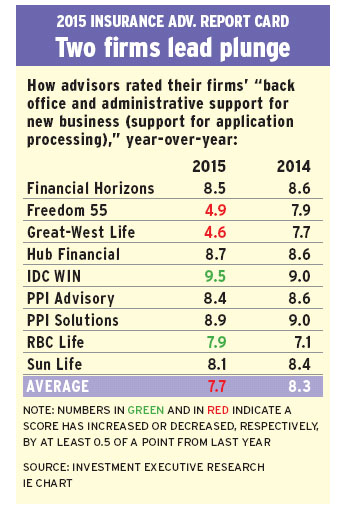

This year’s Insurance Advisors’ Report Card reveals mixed results in “back office and administrative support for new business (application processing)” – a critical category for advisors to keep their clients satisfied and their businesses running smoothly.

The survey results highlight the fallout from a revamped application and underwriting system known as New Business Now, unveiled by Winnipeg-based Great-West Lifeco Inc. in July 2014 at all three of its Canadian insurance subsidiaries – Winnipeg-based Great-West Life Assurance Co. (GWL), Toronto-based Canada Life Assurance Co. and London, Ont.-based London Life Insurance Co. The system has been plagued by a variety of implementation issues and technological problems.

Those issues have left advisors in the affected distribution networks extremely frustrated with lengthy wait times to get their clients’ policies issued. As a result, GWL’s performance score in the application-processing category plummeted to 4.6 from 7.7 in 2014, while London-based Freedom 55 Financial, a division of London Life, saw its rating tumble to 4.9 from 7.9 last year.

“This year, it’s been awful,” says a GWL advisor in British Columbia. “[The firm] implemented technology that was supposed to make our life easier, but it’s just made it more difficult.”

“I’ve lost a lot of cases in the past few months because [the platform is] so slow,” adds a Freedom 55 advisor in Ontario. “It’s terrible.”

New Business Now includes a responsive, web-based insurance application as well as a broader overhaul of the companies’ application and underwriting processes. The goal was to make the application process faster, more flexible and more efficient for advisors and their clients, says Troy Haugen, senior vice president, individual insurance, new business, with GWL, London Life and Canada Life.

But a year after the system was launched, that goal still hasn’t been reached, Haugen admits: “We have had various unforeseen challenges across all three of our companies. We’re still not achieving our vision for this program. We know that it’s been difficult for our advisors and their clients.”

In particular, the new system’s rollout was hampered by technological issues, slower than expected processing times and data-entry problems, among others – all of which created a massive backlog of pending applications. In turn, many advisors have had to wait more than three months for applications to be processed. With the old system, advisors said, some applications were processed in as little as 24 hours.

“[The firm] took something, they broke it and now they’re trying to fix it,” says a Freedom 55 advisor in Ontario. “It’s a disaster. What we had was fine.”

Many of the initial problems have been resolved since the launch of New Business Now, and the firms are focused on fixing the remaining problems and reducing the backlog of applications.

“We know that for advisors, a measure of their success is getting business processed and placed accurately and on time,” Haugen says. “We can assure advisors and their clients that our service levels will be strong again, with time.”

Despite advisors’ frustration, many said they appreciate both their firm’s efforts to resolve the problems and the regular status updates advisors receive.

“[The firm] is working diligently on it,” says a Freedom 55 advisor in Ontario. “There’s definitely been a big push to get the backlog handled.”

In contrast, other firms appear to be providing strong back-office support for new business. For example, advisors with Mississauga, Ont.-based IDC Worldsource Insurance Network Inc. (IDC WIN) rated their firm at 9.5 in the category, up from 9.0 last year. IDC WIN advisors commended their managing general agency’s (MGA) support team for being efficient and responsive.

“Everything gets processed right away with no errors,” says an IDC WIN advisor in B.C. “If there are [errors], they’re dealt with quickly.”

Similarly, advisors with Kitchener, Ont.-based Financial Horizons Inc. said their MGA’s back-office staff are accessible and helpful.

“There’s very good support and no issues,” says a Financial Horizons advisor in Ontario.

The MGA recognizes the importance of efficiency, given the often lengthy process of issuing a life insurance policy, says Patricia Ziegler, chief operating officer with Financial Horizons. “I don’t think there’s an advisor who doesn’t speak about the length of the underwriting process,” she says. “We certainly do whatever we can to expedite it.”

Many insurers recently introduced electronic insurance applications as part of an effort to speed up application processing, and most of the advisors surveyed for this year’s Report Card were enthusiastic about these new tools. In fact, in a new supplementary question added to this year’s survey, 61.6% of advisors said they have embraced e-apps.

“[E-apps] are faster and more accurate,” says an advisor in B.C. with Toronto-based PPI Advisory.

Given that each insurance carrier has a different e-app, though, learning to use each one can be a daunting task. Although most carriers provide e-app support, some advisors said they’d like more help from their MGAs.

IDC WIN is already offering this, says its president, Ron Madzia: “What we’ve done is make sure our business-development executives are fully trained on these systems, [so] if any of our advisors need help, they can help them.”

© 2015 Investment Executive. All rights reserved.