The surging popularity of exchange-traded funds (ETFs) in Canada, their birthplace, and around the world is dramatically changing the way that clients, financial advisors and financial services institutions are accessing all kinds of investments, from large-capitalization stocks to gold futures.

Through ETFs, ordinary investors can gain exposure to diverse portfolios of securities in sectors of the financial world that once were the exclusive domain of large financial services institutions and sophisticated securities traders. “Many financial strategies that were cost-prohibitive, illiquid or inaccessible to small investors are now available through ETFs,” says Michael Cooke, head of distribution for PowerShares Canada, a division of Toronto-based Invesco Canada Ltd. “It’s the democratization of investing.”

Heavy demand for ETFs is giving rise to proliferating product choices, as well as the emergence of new and innovative product providers and a growing league of specialists called “ETF portfolio strategists” who help individual clients and financial advisory firms through the thickening forest of ETFs.

ETFs also are facilitating change in the financial advice business, encouraging competitors such as robo-advisors and hastening the conversion to a fee-based model by many advisors who are looking for inexpensive and convenient products to build client portfolios in an era of growing cost scrutiny.

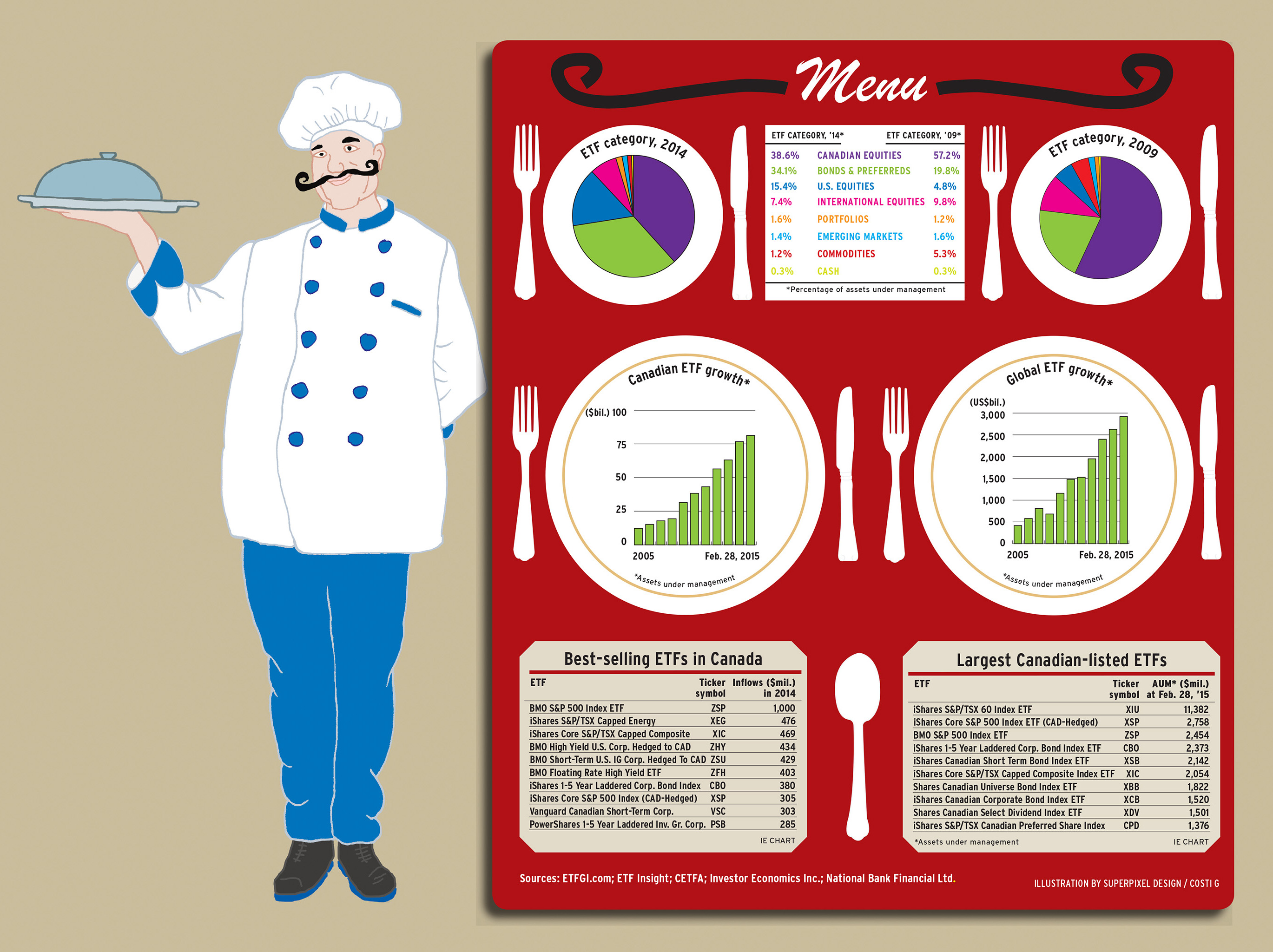

According to research provided by London, U.K.-based ETFGI LLP, an ETF research and consulting firm, global ETF assets under management (AUM) more than doubled in the past five years to US$2.79 billion as of Dec. 31, 2014, with almost 6,000 ETFs trading in 49 countries. The level of AUM held in ETFs has shown a 10-year average compound growth rate of 24%. Net annual inflows of US$338 billion set a record in 2014, and strong flows continue this year, with AUM rising to US$2.9 trillion by the end of February.

“ETFs are being embraced by institutions, financial advisors and retail investors,” says Deborah Fuhr, managing partner at ETFGI. “[ETFs] are a useful way of obtaining exposure to all kinds of asset classes and a tool that can be used for a variety of tactical and strategic portfolio allocations.”

Earlier this year, a four-day conference in Florida, sponsored by New York-based research firm ETF.com, attracted almost 2,000 attendees who came from all corners of the globe to exchange views, gather wisdom, commune with experts and sniff out the latest ETF trends.

Booming start

“It’s an ETF revolution,” proclaimed Dave Nadig, chief investment officer of ETF.com, at the conference. He predicts that AUM in U.S. ETFs could surpass mutual fund AUM by 2024. “And we’re only at the elbow of the hockey stick, in terms of where ETF growth is going.”

In Canada, the “revolution” is marching in lockstep, as ETF AUM finished 2014 at $77 billion, up by $13.7 billion (or 22%) from a year earlier – the largest year-over-year increase in the Canadian industry’s history, according to the Canadian Exchange Traded Fund Association. At yearend, 340 ETFs were listed in Canada; of these, 63 were launched in 2014. Five years ago, there were about 100 ETFs in Canada.

And 2015 is off to a booming start, with new ETF inflows and positive market movements in the first two months bringing AUM to a new high of $81.4 billion as of Feb. 28.

The world’s first exchange-traded, index-linked product, a precursor to modern-day ETFs, was listed on the Toronto Stock Exchange in 1990 under the name of Toronto 35 Index Participation Units (TIPs). After a few name changes, TIPs ultimately morphed into iShares S&P/TSX 60 Index ETF, the largest Canadian-listed ETF today, with about $11 billion in AUM. Innovations such as fixed-income ETFs and currency-hedged ETFs also were introduced first by Canadian providers before catching on in the larger global market. Now, Canadian product manufacturers are developing ETFs that offer access to an underlying strategy of pure active management, an alternative to the traditional, index-based strategies that evolved into the ETF. “ETFs have evolved from a satellite oddity, increasingly finding their way into investment portfolios at both the retail and institutional levels,” says Ben Johnson, director of global ETF research at Morningstar Inc. in Chicago. “It’s come to the point at which ETFs are often the core building block in portfolios.”

A recent report from BMO Asset Management Inc. (BMOAM) of Toronto predicts that by 2020, the global ETF industry will double to US$6 trillion in AUM, and that Canadian-listed AUM will reach $200 billion, with the Canadian industry experiencing faster growth than the global average.

“The cost of ETFs has been going down dramatically, and a lot of innovations have come to the market,” says Alain Desbiens, vice president of BMOAM in Montreal. “Rather than [advisors] spending their time managing portfolios of individual securities for clients, advisors are moving toward low-fee, managed products. The transparency of ETF portfolios is an important benefit in helping advisors conduct their due diligence and determine suitable asset allocations for clients.”

Desbiens points to numbers from Morningstar that show ETFs have drawn substantially more new AUM in the U.S. than mutual funds have since the global financial crisis of 2007-09; he expects the same trend in Canada. In the six-year period from 2009 to 2014, US$967 billion of new money flowed into ETFs in the U.S., dwarfing the US$186 billion of net sales for mutual funds. However, ETFs have a long way to go to surpass U.S. mutual fund AUM of US$16 trillion, still far larger than the US$2 trillion in ETFs.

In Canada, in the same six years following the global financial crisis, ETFs saw $43 billion in inflows, while a much greater $170 billion has gone into mutual funds. Mutual fund assets in Canada as of Dec. 31, 2014, stood at $1.1 trillion. At $77 billion, ETF yearend AUM amounted to 6.5% of the Canadian mutual fund market, up from 2% a decade ago.

“The great advantage of ETFs in the distribution paradigm is their lower cost compared with the vast majority of their mutual fund brethren,” says Barry Gordon, president and CEO of ETF provider First Asset Investment Management Inc. of Toronto. “Value for what you pay is important.”

“Smart beta” ETFs growing

ETFs also offer intra-day liquidity, tax efficiency due to low portfolio turnover and, thus, lower exposure to capital gains and transparency about holdings. Although the first generation of ETFs was based on broad stock market index averages, such as the S&P TSX 60, the product choice among ETFs has mushroomed, allowing investors to access a variety of asset classes, narrow market niches and sectors, and even prepackaged balanced portfolios.

“Smart beta” or “factor-based” ETFs are the biggest area of growth, as the market is saturated with ETFs offering exposure to standard, broad market indices that weight securities based on their market capitalization. The newer, customized smart beta ETFs offer an automated, rules-based approach that selects and weights securities based on factors other than market cap. These new factors include growth and value characteristics, low volatility or dividend yield. Thus, smart beta ETFs’ performance may deviate from broad market averages. In the ETF spectrum, smart beta lies somewhere between purely passive index investing and subjective active management.

According to Toronto-based Investor Economics Inc., as of Jan. 31, 2015, 11% of the Canadian ETF market was in smart beta products, 10.6% was in actively managed products and the rest was in plain-vanilla index products.

The most popular category – broad Canadian market index ETFs – carry the lowest costs. Management fees start as low as five basis points per year, and costs increase as the geographical reach and complexity of the ETF’s underlying strategy increase, with actively managed ETFs charging the highest fees. While some ETF providers compete by offering ETFs based on popular benchmarks at rock-bottom fees, other ETFs are building share through product innovation.

“At Vanguard, we have tended toward being a provider of market-cap weighted ETFs, and come out with products that fit enduring investor needs, not ‘flavour of the day’,” says Atul Tiwari, managing director of Vanguard Investments Canada Inc. in Toronto, the industry standard-setter for low fees across its ETF family. “When it comes to indexing, we believe that market-cap weighting is the real index. That’s where you get the market’s true return.”

In an era of prolonged low interest rates, ETFs also offer diverse strategies, including a choice of durations, geographical regions, issuers and credit risks. Among the choices are ETFs designed to protect against interest rate increases, such as those with exposure to floating-rate debt, short-term bonds, convertible bonds or laddered portfolios of bonds or preferred shares. Fixed-income ETFs account for about 31% of Canadian ETF AUM, while equities-based ETFs make up 66%; commodities and portfolio ETFs comprise the rest.

ETFs also offer variety in broader international exposure to equities, an attractive option as Canadians look beyond their resources-dominated domestic market. Increasingly, ETFs are becoming available in both hedged and unhedged versions, allowing investors to choose whether they want currency fluctuations to influence portfolio returns.

As the market for ETFs in Canada grows, so does the competition. Earlier this year, Questrade Inc., a subsidiary of online brokerage Questrade Financial Group Inc. of Toronto, became the tenth ETF provider to enter the Canadian market. Questrade’s six ETFs are based on indices devised by U.S.-based Russell Investments Group. Furthermore, Calgary-based alternative strategies specialist Auspice Capital Advisors Ltd. has filed preliminary prospectuses and is expected to join the club soon.

Although the iShares division of BlackRock Asset Management Canada Ltd., with $46 billion in AUM in its family of ETFs, remains the ETF market leader in Canada, the firm’s market share has declined somewhat. The runner-up is the BMO Exchange Traded Funds division of BMOAM, with $21 billion, one of the most significant gainers in AUM; followed (a long way behind) by Horizons Exchange Traded Funds Inc. and Vanguard, with slightly more than $4 billion each. Next in line are PowerShares Canada, First Asset Investment Management, RBC Global Asset Management Inc., Purpose Investments Inc. and First Trust Portfolios Canada Co.

© 2015 Investment Executive. All rights reserved.