PAID CONTENT

With public equity valuations appearing increasingly stretched, advisors and investors are redoubling their efforts to find areas of value in the marketplace. In this environment, assets offering both consistent yield and backed by tangible value are gaining renewed attention. The essential retail asset class has emerged as one such opportunity, underpinned by fundamentals rooted in steady demand and intrinsic value.

A matter of public perception

In many respects, retail investing faces an uphill battle in public perception. Persistent reports of store closures and the demise of legacy enclosed mall retailers2 sometimes typecast the industry in a negative light, even though the reality is more nuanced. Differences in consumer spending habits and traffic patterns between discretionary and essential retail mean not all retail assets are created equal.

With its profoundly more resilient demand profile, the essential retail segment offers a distinct counterweight to the mainstream messaging. Unlike discretionary retail, this sector is defined by grocery, food service, banking and pharmacy-anchored retail properties that maintain consistent shopping volumes, regardless of economic climate. And since these tenants are less reliant on discretionary spending, their sales and, by extension, the landlord’s income tend to be stable in most economic conditions. For investment portfolios, that means exposure to an asset class built on everyday needs, offering steady income potential profile, lower volatility, and resilience through economic cycles.

Performance supported by fundamentals

Canada’s long-term population growth story3 has been a major tailwind for retail demand. Despite attempts to curtail this growth in the near term, Canada’s population is forecast to grow steadily through 2075.4 This sustained growth—particularly in secondary and tertiary markets, which are expanding faster than primary markets on average5—is driving healthy rent-paying capacity and rental increases at lease renewal.*

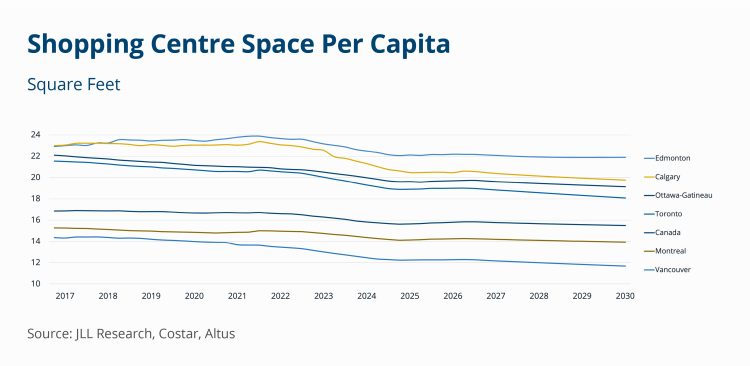

At the same time, the supply of vacant, available retail space has progressively declined. Elevated construction costs since the pandemic have constrained development activity—exacerbating a pre-existing under-supply issue—with new space deliveries down sharply from pre-2020 levels. Increasing land acquisition costs and competition from residential and mixed-use developments have further served to limit new retail construction starts. The impact of these two factors is clearly reflected in the data.

* As with any real estate investment, factors such as tenant turnover, fluctuations in interest rates, and other market conditions can impact performance.

This supply–demand imbalance has led to substantial rental rate growth for essential retail operators like Skyline Retail REIT, especially for new lease origination and renewals. Its focus on smaller, high-growth communities has proven to be a competitive advantage as migration away from major urban centres continues unabated.6

Real value investors can rely on

In today’s market, investors are caught between paying premium valuations for public assets and the need to deliver above-average returns. With the Street already getting defensive on risk7, essential retail offers a compelling solution to this very challenge. While every market carries some degree of uncertainty, the sector’s focus on consumer staples provides a solid foundation of support, largely immune from sentiment risk and the unsustainable valuations risk assets represent. This value proposition is reflected in current Canadian property market trends.

Among the four major property types, the retail sector has demonstrated the strongest positive momentum over the past year, with Q1 2025 values rising 0.74% sequentially and 4.1% year-over-year8, according to Altus Group. The most sought-after sector across all property types in Canada is food-anchored retail and has remained that way for seven consecutive quarters.9 Food-anchored retail typically refers to commercial centres anchored by grocery stores and supermarkets that serve as the primary draw for consistent foot traffic.

This is precisely the market segment that Skyline Retail REIT prioritizes within its portfolio strategy. Approximately 80% of the Fund’s assets are anchored by essential retail tenants, many of which are nationally recognized grocery or financial institutions. The REIT manages over 5.2 million square feet of gross leasable area across four Canadian provinces, focusing on the acquisition of high-quality, well-located properties in growing secondary markets.

By concentrating in these areas, the REIT is positioned to benefit from favorable long-term rental growth driven by enduring demographic expansion and constrained new supply.

Strong fundamentals and continued opportunity

While defensive sectors have sidestepped the spotlight amid the frothy sentiment in growth sectors, we believe this is precisely the environment where essential retail proves its worth. As value investing returns to favour, investors are likely to rediscover the appeal of tangible assets and stable income—an environment we believe is taking shape today.

By providing historically stable unit value and income growth in various economic environments, Skyline Retail REIT can help investors capitalize on two inextricable trends in Canada today: rising population and constrained retail supply. And it can do so without resorting to paying excessive premiums that make choosing the right investment today exceedingly difficult.

Craig Leslie

President, Skyline Retail REIT

¹ S&P Global Market Intelligence’s Annual Private Equity and Venture Capital Outlook Indicates Optimism amid Macroeconomic Caution. News Release Archive, 1 Apr. 2025, https://press.spglobal.com/2025-04-01-S-P-Global-Market-Intelligences-Annual-Private-Equity-and-Venture-Capital-Outlook-Indicates-Optimism-Amid-Macroeconomic-Caution?utm_source

2 CBC/Radio Canada. (2025, March 7). Hudson’s Bay files for creditor protection, intends to restructure. CBC News https://www.cbc.ca/news/business/hudsons-bay-creditor-protection-1.7477926

3 Canada clocks fastest population growth in 66 years in 2023, Reuters. (2024, March 27). https://www.reuters.com/world/americas/canada-clocks-fastest-population-growth-66-years-2023-2024-03-27/

4 Government of Canada, S. C. (2024, June 24). Population projections: Canada, Provinces and Territories, 2023 to 2073. The Daily. https://www150.statcan.gc.ca/n1/daily-quotidien/240624/dq240624b-eng.htm?utm_source

5 Ali, M. (2025, April 1). Inside the shift: Why secondary markets are leading Canada’s real estate growth. Wealth Professional. https://www.wealthprofessional.ca/investments/alternative-investments/inside-the-shift-why-secondary-markets-are-leading-canadas-real-estate-growth/388777?utm_source ⁵

6 McQuillan, K. (2024, April 24). Leaving the big city: New patterns of migration in Canada. The School of Public Policy Publications. https://journalhosting.ucalgary.ca/index.php/sppp/article/view/78322?utm_source

7 Pitcher, J. (2025, October 19). Wsj.com. The Warning Signs Lurking Below the Surface of a Record Market. https://archive.ph/TPQi9

8 Ray Wong, R. S. (2025, May 1). Canadian Cre Valuation Analysis – Q1 2025. Canadian CRE Valuation Analysis. https://www.altusgroup.com/insights/canadian-cre-valuation-analysis-q1-2025/?utm_source

9 Jennifer Nhieu, R. W. (2025, October 7). Canadian Cre Investment Trends – Q3 2025. altusgroup.com. https://www.altusgroup.com/insights/canadian-cre-investment-trends/

Disclaimer for Skyline Wealth Management:

Skyline Wealth Management Inc. (“Skyline Wealth Management”) is an Exempt Market Dealer registered in all provinces of Canada. The information provided herein is for general information purposes only and does not constitute an offer of securities. Sales of interests in any investments offered by Skyline Wealth Management are only made to certain eligible investors pursuant to regulatory requirements and available exemptions. Any information provided herein is current as at the date of publication and Skyline Wealth Management does not undertake to advise the reader of any changes.

Commissions, trailing commissions, management fees and expenses all may be associated with investments in exempt market products. Please read the confidential offering documents before investing. The indicated rate of return is the annualized return including changes in unit value and reinvestment of all distributions and does not consider sales, redemption, distribution or optional charges or income taxes payable by any unitholder that would have reduced returns. There is no active market through which the securities may be sold, and redemption requests may be subject to monthly redemption limits. The payment of distributions is not guaranteed and may fluctuate. The payment of distributions should not be confused with an exempt market product’s performance. Distributions paid as a result of capital gains realized by an exempt market product, and income and dividends earned are taxable in your hands in the year they are paid. Exempt market products are not guaranteed, their values change frequently, and past performance may not be repeated. Nothing in this email should be construed as investment, legal, tax, regulatory or accounting advice. Prospective investors must make an independent assessment of such matters in consultation with their own professional advisors.