SPECIAL SPONSORED CONTENT

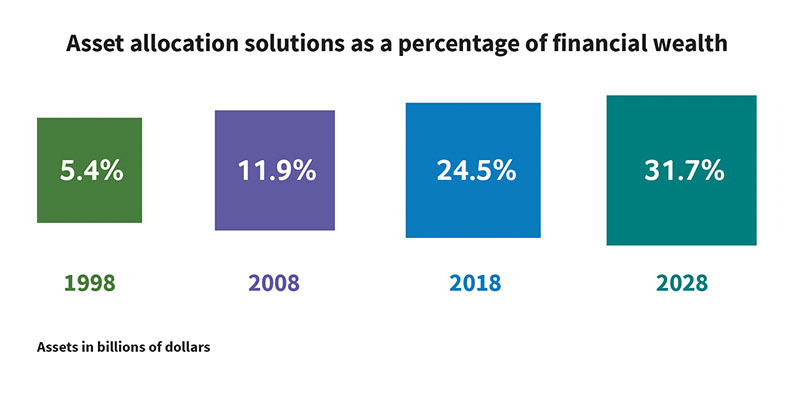

We know that there’s been a long-term trend towards managed solutions, and we’ve been proud to offer our advisors and customers these types of products for years. A report from Investor Economics shows the percentage of investors’ wealth in asset allocation or managed solutions has been growing since the late 1990s and is projected to continue to grow in the future. 1

To protect and grow wealth in today’s low yield and expected return environment requires a new way of constructing portfolios. You’re simply not going to get big returns from a portfolio of bonds like you may have 15 years ago; you need to diversify, explore differentiated asset classes and take bigger risks to achieve the same level of returns. Staying on top of all the different moving parts within a portfolio is no easy task, and data shows that investors—and their advisors—are looking to managed solutions to help.

Managed solutions help advisors shift their focus—instead of spending time building portfolios, monitoring fund performance and rebalancing, they’re able to provide more robust client support and holistic financial planning, and can find new opportunities for their business. This is where advisors can really set themselves apart.

At Canada Life, we’re proud to offer managed solutions for a broad spectrum of client needs, including:

- Asset allocation funds. Instead of creating and managing a diverse portfolio of funds themselves, advisors can leave it to a team of experts. Our strategic asset allocation funds are managed by professional investment managers, and each fund is a diversified portfolio of investments, invested in different industries, countries and types of holdings. This provides customers with a simple yet sophisticated solution—they get a diversified portfolio to help reduce risk and provide stability through multiple market conditions, but only need to invest in one fund.

- Constellation Managed Portfolios. Constellation is a managed program that takes a goals-based approach to investing, so advisors can create individual portfolios tailored to each of their clients’ goals and is based on their timeline and risk level for those goals. I like to think of Constellation as the “engine” behind an advisor’s advice. It features strategic asset allocation models and automatic rebalancing engine that together, monitor and automatically rebalance clients’ portfolios based on market conditions. For clients, this helps ensure that their portfolios stay the course towards meeting their financial goals. For advisors, this gives them the ability to delegate investment responsibilities so that they can boost their productivity, sharpen their efficiency and easily scale their business, all while providing exceptional service.

Our managed solutions can help advisors focus on what matters most – supporting their clients and providing them with diversified, resilient portfolios to set them on the path to success. Learn more at https://www.canadalife.com/campaigns/strength-and-stability.