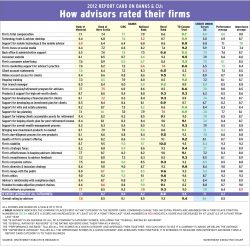

2012 Report Card on Banks & CUs main chart

How advisors rated their firms

- June 20, 2012 October 31, 2019

- 23:00

How advisors rated their firms

Advisors experience some steep declines in their productivity

Firms in the survey still have some gaps to close

Advisors praise their firms' efforts in providing comprehensive product shelves

The high standing of Canadian banks among their global peers is helping advisors attract clients and retain business

Strong branding initiatives were praised significantly by advisors, as were certain marketing support strategies

Financial advisors who work at deposit-taking institutions are increasingly of two minds when it comes to the leadership of their firms

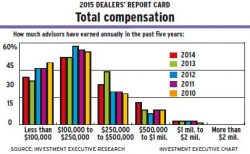

Firms are doing better than ever when it comes to compensation, but advisors still see much room for improvement

Financial advisors surveyed for the Report Card say they like the stability of their firms

Ratings for deposit-taking institutions continue to improve, as do the metrics for advisors’ businesses (includes main chart and one other)

Those with deposit-taking firms are becoming more competitive with the traditional retail investment industry (includes chart)

Although advisors are seeing their take-home pay increase, their satisfaction with compensation is not keeping pace

The two credit unions in this Report Card have seen dramatic improvements in a variety of areas over the past year

Advisors say that the banks and credit unions could be doing a lot better when it comes to tech tools and back-office support

As client and advisor dissatisfaction with account statements continues to mount, much praise emerges for clients’ online access

Banks and credit unions are putting serious efforts toward promoting diversity in the workplace

Credit unions’ community initiatives and the banks’ solid footing during the financial crisis led to advisor satisfaction (includes chart)

Some firms received higher ratings from their advisors in a plethora of categories, while others struggled mightily

Low interest rates may be the culprit

The two banks received the highest ratings from advisors, including increases across the board (Includes main chart)

The value of support has increased as banks begin setting minimum targets for financial plans

Some advisors complained about their firms’ training programs; others could not be more pleased

Advisors praise the power of a branding message delivered through ads and community events

Having access to defined-benefit plans and equity-ownership programs makes a positive difference

But expectations are not being met, as advisors with all firms — including those rated highest — see room for improvement