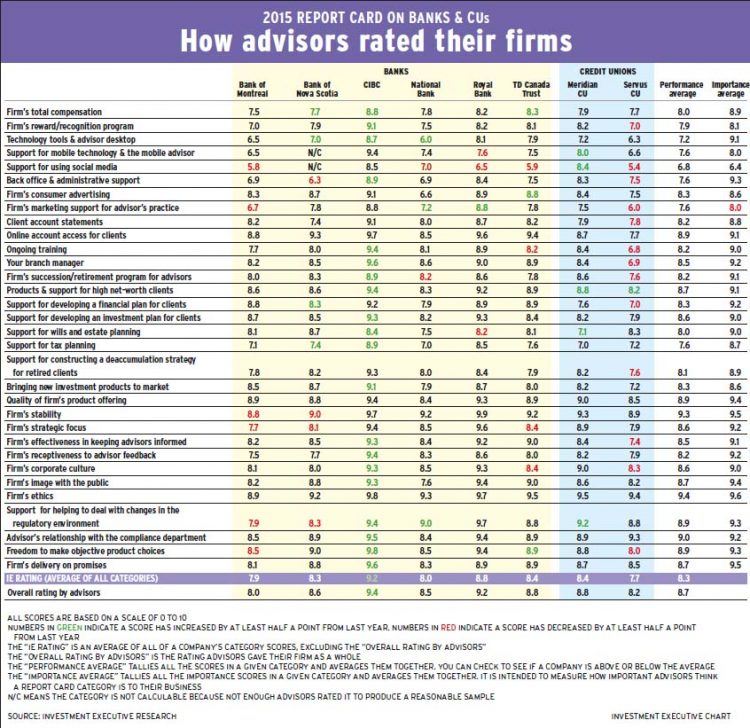

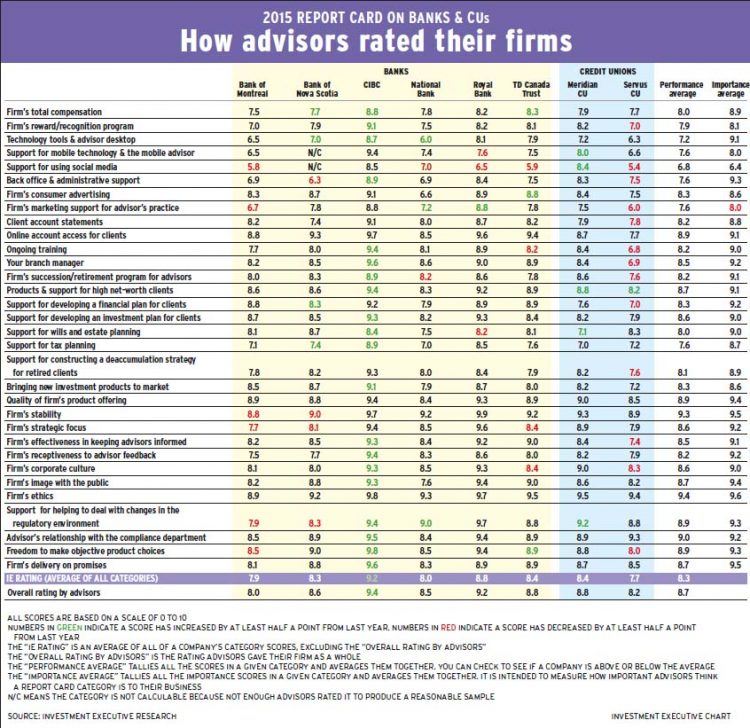

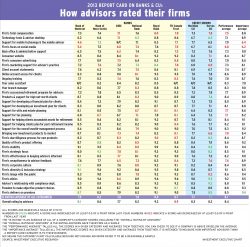

Report Card on Banks and CUs 2015 main chart

How advisors rated their firms

How advisors rated their firms

Advisors praise their firms' online platforms, which have significant integration of investment and banking accounts

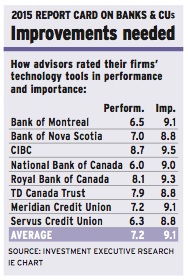

Advisors have many concerns about their firms' technology, and several firms have much room for improvement

Banks and credit unions need to provide advisors with a variety of training opportunities delivered in various ways

Comprehensive programs matter to these advisors as they can't sell their books of business to fund their retirement

Advisors lauded compliance staff who are approachable and take the time to make sure all regulatory requirements are met

Advisors want their firms to have teams of specialists to help with clients' increasing needs in wealth-management services

CIBC and Meridian received great praise from their advisors, while the other firms in the survey have areas to improve

Having a diverse list of products available - including a steady stream of carefully selected new ones - is a big help to advisors

For a variety of reasons, most advisors say their firms' marketing support efforts have fallen flat

Advisors want to be recognized and appreciated for their work, but it must be balanced with strong, competitive pay

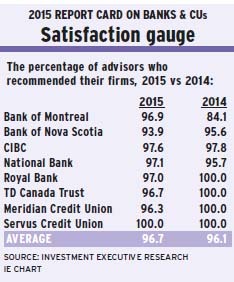

Advisors at all the banks and credit unions in the survey are happier. Many firms garnered major ratings increases

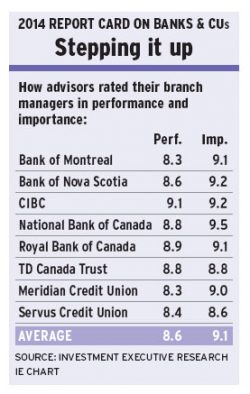

Many advisors say their branch managers fulfil a critical role in providing leadership, mentorship and ongoing support

Flexible work hours, collegial work environments and support for charity-related initiatives please advisors

All firms saw their ratings in this category rise after most increased their digital offerings

How advisors rated their firms

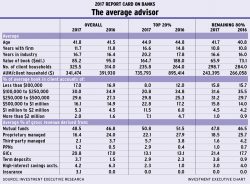

Advisors ramp up client rosters to stem their losses in AUM

How advisors rated their firms

Firms are failing to live up to their advisors' expectations regarding the back office. Most issues are related to the staff

Advisors say there are various reasons why they feel their feedback is ignored. Will their firms step up and begin to listen?

Advisors still are concerned that certain key metrics are omitted from the calculation used to determine their pensions

Although advisors at most firms say there is much work to be done, those with two banks report significant levels of satisfaction

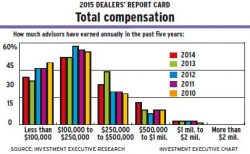

Deposit-taking institutions need to do much better when it comes to advisors' compensation structures

There were lower ratings across the board - and for three banks, in particular.But there also were bright rays of light

Younger advisors are joining the business in greater numbers