New trust rules coming

Beginning in 2021, most family trusts will be required to file tax returns with the CRA even if those trusts don't earn income or make…

- By: donalee Moulton

- October 12, 2018 November 9, 2019

- 00:09

Beginning in 2021, most family trusts will be required to file tax returns with the CRA even if those trusts don't earn income or make…

With various provincial elections slated for next year and uncertainty surrounding the introduction of a federal carbon tax, there were not many tax changes implemented…

There are several tax-planning strategies that you and your clients should consider - from crystallizing capital gains and losses to maximizing charitable donations and TFSAs…

Investing in bonds to take shelter from the potential tumble in stock prices also carries great risk

If you’ve shifted to passive investing, here are ideas to create advisory value for clients

Sovereign and corporate emerging-market bonds carry greater risk, but offer potential for significant pick-up in yield to bonds from developed markets

Find out what research presented at the ETF Summit reveals

Experts describe how they use the funds

Bond investors are giving up a lot of yield by taking on government bonds to avoid the potential default in corporate bonds

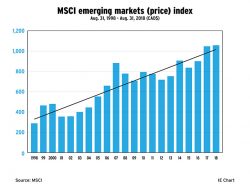

In spite of their periodic ups and downs, emerging markets have trended higher over time, providing long-term investors with greater risk-adjusted returns than developed markets

Demographic trends, a rising middle class and increasing domestic consumption are among the factors that make emerging market increasingly attractive to investors

Short-term interest rate tightening is likely to flatten the yield curve if not accompanied by expectations of higher future inflation

The federal government’s final proposals received royal assent on June 21

This event is now available for complimentary viewing across Canada via our Virtual Conference

This event is now available for complimentary viewing across Canada via our Virtual Conference

Lower income levels, lack of confidence in investing and greater exposure to eldercare issues may be contributing factors

Research found that advisors are far more likely to choose proprietary investment funds for their clients

Keep on top of all the latest tax changes in Budget 2018. Watch this webinar replay with noted tax expert Jamie Golombek.

Feds fall short of promoting sustained growth: IIAC

Changes to income sprinkling, passive investment income and the small business tax rate

The government’s proposal limits access to the lower small-business rate rather than taxing passive income above $50,000 at potentially punitive tax rates

The federal government intends to implement several measures to increase gender diversity, which “leads to more growth,” said Finance Minister Bill Morneau

Feds also aim to modernize the deposit insurance system and implement a framework for resolving systemically important financial market infrastructure firms

The new “use-it-or-lose-it” benefit would increase the duration of EI parental leave by up to five weeks for parents

The government will be investing money to improve the fairness and integrity of the tax system as well as introduce new rules