When Rebecca Tascona is asked about her career in banking, she talks about the value of a strong work ethic, setting clear goals and the guidance of role models and mentors. On this last point in particular, she mentions working for women in top executive positions who held “great and challenging mandates,” and the encouragement that example provided to her along the way.

“When an organization is walking the talk, it can be extremely inspirational,” says Tascona, vice president and chief administrative officer at BMO Wealth Management, a unit of Bank of Montreal (BMO) in Toronto. “Working for an organization that respects, supports and acts on diversity and encourages future leaders, whether male or female, is very important.”

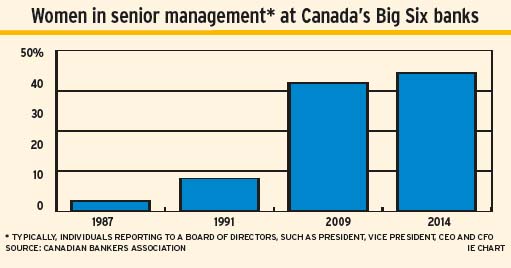

The Canadian banking industry has been on the leading edge in hiring and developing the careers of women. According to the Canadian Bankers Association (CBA), women comprised 62% of the workforce at the Big Six Canadian banks, excluding subsidiaries; 34.5% of senior management positions; and slightly more than 50% of all middle-management roles in 2014, the most recent year for which the CBA had statistics.

Executives at Canadian banks and other deposit-taking institutions say they understand the importance of diversity, including promoting and encouraging women at all levels in the organization, both as a way to attract and retain talent – and as a business opportunity.

“If our workforce reflects the diversity of the communities that we serve, we are going to understand clients’ needs better. And that’s actually great for business,” says Ellen Pekeles, senior vice president of operations at Vancouver City Savings Credit Union (Vancity).

Organizations that have women at their most senior levels send a “powerful message to women starting out in their careers,” Pekeles says. At Vancity, six of nine board members and five of seven senior executives, including Pekeles and CEO Tamara Vrooman, are women.

Bridging the gap between inclusion goals and actual results, though, requires the buy-in of senior leadership. Firms must have diversity programs in place, establish goals and measure progress toward those goals.

BMO, for example, has set a goal of achieving a 40% representation of women in its senior leadership roles by the end of this year, up from the current 38%. The bank also is considering ways to further remove barriers and allow future female managers to get ahead.

“We need to continue to think critically about how we build our leadership pipeline of female talent,” says Sonya Kunkel, chief inclusion officer and vice president of talent strategies with BMO in Toronto. She adds that the bank is ensuring that there is a “critical mass” of women in senior decision-making roles.

Client expectations are contributing to the urgency of making progress on diversity and inclusion goals, senior managers say. The opportunity in wealth management is a case in point.

“Women [today] represent, or control, about a third of investible assets in Canada,” says Lee Bennett, senior vice president, financial planning, with Toronto-Dominion Bank (TD) in Toronto. “And, historically, women outlive men, so they’ll continue to grow their control of household investible assets.”

While female clients don’t necessarily require the guidance of a female advisor, Bennett says, the overall demographic trend points to the importance of being able to understand and address the needs and goals of female clients. “Hiring women advisors just makes sense,” says Bennett, who also is chairwoman of the Women in Leadership group at TD.

At the branch-level financial planner role, the banks have been generally more successful vs brokerages at attracting, developing and retaining female planners and advisors. At TD, for example, about 41% of planners are women, says Bennett, who adds that she would like to see the ratio of female to male planners be close to even within the next four to five years.

The banks’ relative success in attracting women to the financial planner role can be credited to the strategy’s visibility at the retail level, Bennett says, where women in other roles at a branch can see what the job entails. The compensation structure, too, in which a commission payout is matched with a base salary, may be attractive to women who want to make the leap to that role, but also want to ensure work/life balance.

“We could show, through women who were successful [in the planning role], that [women] could have a very successful career offering financial planning and advice to clients, and still have a family,” Bennett says.

The challenge in finding and attracting women advisors at the brokerage level is more acute, as the ratio of women to male advisors is still low – significantly less than one-third – in that industry.

“We just do not have enough women in both advisor and leadership roles in my business today,” says Dave Kelly, president and national sales manager with TD Wealth Private Wealth Management (TD Wealth PWM), the bank’s high net-worth advisory business, in Toronto. “This is a huge focus for the leadership team.”

Kelly says that TD Wealth PWM will be undertaking some independent research this year to look at issues such as compensation and benefits, and ways that new advisors establish their businesses, to see how the role can be adapted to be more welcoming for women. Kelly says that between now and 2020, he will be striving for a 50% mix of women and men for TD Wealth PWM’s new and replacement advisors.

Bringing new female recruits into the advisory business remains a challenge, says Jennifer Lemieux, vice president and branch manager with RBC Dominion Securities Inc. (DS) in Kingston, Ont. While young women in universities and colleges might be aware of roles in other areas of financial services, the advisor often is not completely understood, Lemieux says.

“It’s always viewed as numbers-driven, and focused on stock selection,” says Lemieux, who is co-chairwoman of the women’s advisory board at DS. “I have heard so many women say, ‘I had no idea it was much more focused on developing relationships, and dealing with families’.”

Lemieux says firms need to be innovative in the way they look for the next generation of women recruits.

“They sometimes don’t put resumés on our desks, as some of the male advisors out there do,” Lemieux says. “You have to work harder to find them, you have to tap them on the shoulders in the communities and say, ‘This is an interesting business that you might not have considered’.”

© 2016 Investment Executive. All rights reserved.