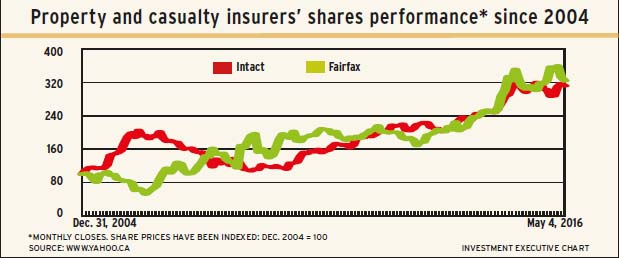

Property and casualty (P&C) insurers’ stocks aren’t on the radar of a lot of investors, but you and your clients might consider Fairfax Financial Holdings Ltd. and Intact Financial Corp., both based in Toronto. These companies have good prospects and the shares are reasonably priced.

“These are world-class companies, with world-class management,” says Dave Britton, portfolio manager at Sionna Investment Managers Inc. in Toronto.

A key to success in the P&C industry is discipline. This is a very volatile business, with premiums moving up and down depending on market conditions, says Britton. Companies “need to step back when premium levels are low because otherwise they can write a lot of bad business.” Both Fairfax and Intact follow this prudent strategy and, as a result, almost always make underwriting profits.

That said, the two companies have much different approaches. Intact is a traditional P&C insurer with excellent operating metrics and a strategy of growing through acquisitions and using technology to improve customer service. Intact generally delivers steady growth in earnings and an increasing dividend, currently 58¢ with a yield of 2.8%.

Fairfax is primarily an investment company. Its P&C operations are used mainly to accumulate assets, with the investment of those assets being the main focus. Fairfax is a deep value, long-term investor that takes major stakes in undervalued companies. Fairfax also invests in derivatives to protect capital if financial markets plunge. The result is much more volatile earnings than Intact’s. But, on the plus side, there is potential for big gains. Fairfax pays an annual dividend, unchanged at US$10 since 2009. Due to the recent drop in the Canadian dollar, the dividend has risen to $14.50.

Here’s a look at the two companies in more detail:

Fairfax financial holdings ltd. This company has an excellent long-term track record, with annual average increases of 20.4% in book value per share over the past 30 years.

Fairfax, modelled on Warren Buffet’s very successful Nebraska-based Berkshire Hathaway Inc., uses deep-value investing expertise to top up P&C earnings. Indeed, Fairfax relied entirely on investment returns during the 1986-2006 period, when the firm’s insurance operations ran at a loss. Since then, Fairfax has worked on its underwriting and now generally makes a profit on the insurance operations.

About two-thirds of Fairfax’s insurance premiums come from the U.S. The firm also operates in Canada, the U.K., Brazil, Asia, eastern Europe and the Middle East. The company has a large reinsurance subsidiary, Odessey Re, which accounts for about a quarter of Fairfax’s premiums. Much of the rest of the company’s business is in specialty insurance in all kinds of niches, ranging from marine, energy and terrorism risks to workers’ compensation and recreational vehicles. Fairfax even offers pet and horse insurance.

Investment returns averaged about 10% a year in the 1986-2010 period, but only 3% in the past five years. However, as Prem Watsa, Fairfax’s chairman and CEO, states in his 2015 letter to shareholders: “This [reduced return] has been by design, as we worried about the speculation in financial markets and the potential for a 50- to 100-year financial storm.”

The firm is particularly worried about the possibility of widespread deflation and has purchased hedges and derivatives to protect shareholder value if that happens. This strategy has been a drag on earnings, but both the company and analysts such as Ed Lugo, portfolio manager at Franklin Templeton Investments Corp. in New York, think it’s a good strategy.

Lugo likes Fairfax’s management, culture and long-term track record. He also appreciates Fairfax’s focus on protecting capital. “If deflation takes hold,” he says, “Fairfax could do very well.”

Danesh Rohinton, research analyst at Cambridge Global Asset Management, a unit of CI Financial Corp. in Toronto, agrees. Using derivative contracts to protect capital is an “intelligent way to protect capital long-term.”

Fairfax’s value investing style resonates with both Lugo and Rohinton. Taking major stakes in undervalued companies is key. Fairfax “spends time researching and actively following its holdings,” says Rohinton.

Fairfax’s 22.2 million shares outstanding are priced currently at around 1.3 times book value, which a report from Virginia-based analysts at RBC Capital Markets Inc. states is an “attractive” entry point.

The RBC report has an “outperform” rating on the stock, with a one-year price target of US$600 ($773). Fairfax stock closed at $655 a share on the TSX on May 4.

Intact Financial Corp. Canada’s P&C industry is very fragmented, so there’s lots of potential for growing by acquisition. Intact is the biggest player, with a 17% market share, which is twice that of Intact’s closest competitor. Intact is in a good position to buy other firms because it has a return on equity of about 17% vs the 10% long-term average for the industry.

Size is a huge advantage. “The more customers you have, the more information you have and the more you can segment the market,” says Britton. “This means the better your underwriting, the better your claims management and the better your customer service.”

Intact is big enough to have all its claim adjusters in-house. The firm also has collision centres at which customers can drop off their keys, do five to 10 minutes of paperwork and pick up a rental vehicle. Good customer service leads to referrals, which are key in this business.

Rohinton says that Intact also offers telematics, devices that are installed in cars to show how safely policyholders drive. Resulting premium discounts can be up to 25%.

The biggest challenge for Intact is online competition. The possibility of www.google.com offering home and auto insurance worries Intact’s management, says Britton.

But he adds, that would be more of a threat to smaller competitors, thus potentially providing opportunities for Intact to make more acquisitions. Intact already offers online insurance through www.belairdirect.com.

Intact will be negatively affected by the fire in Fort McMurray, Alta., which a report from Montreal-based National Bank Financial (NBF) estimates could cost Intact $214 million.

NBF’s report has a “sector perform” rating on Intact stock, with a one-year price target of $97 a share. The 131.5 million shares outstanding closed at $87.82 each on May 4.

© 2016 Investment Executive. All rights reserved.