Heady times are here for insurance advisors. Those surveyed for Investment Executive‘s (IE) 2014 Insurance Advisors’ Report Card have seen notable increases in the number of client households they serve, their assets under management (AUM) and their take-home pay.

In particular, the average number of client households that advisors are serving now is up to 657.8 vs 603.7 last year and the average AUM in their books of investment business has jumped significantly to $21.1 million from $16.9 million year-over-year.

In turn, advisors’ total compensation also has risen, with the percentage of advisors earning $100,000-$500,000 per annum increasing to 52.4% from 50.5% year-over-year; the percentage of advisors earning less than $100,000 a year has dropped to 27% from 31%. (See story on page 1.)

“We’re in this business to make a living,” says an advisor in Ontario with Kitchener, Ont.-based Financial Horizons Inc. “And I do make a comfortable one.”

Yet, despite these positive metrics, advisors’ satisfaction level with their firms and managing general agencies (MGAs) has not risen in kind. That’s evident in the lower performance ratings that advisors gave their firms and MGAs in a variety of categories that are key to running advisors’ practices. (See page 12.)

Furthermore, Financial Horizons and Calgary-based PPI Solutions Inc. each saw their performance ratings in nine categories slip by half a point or more, including “support for insurance planning,” “support for helping clients plan for post-retirement income” and “firm’s strategic focus.”

“The tool kit is really good,” says a PPI Solutions advisor in Alberta, “but I think the current retirement projector tool we have needs to be beefed up. We could have better calculators to figure out what people will need.”

PPI Solutions’ sister MGA, Toronto-based PPI Advisory, also saw its ratings in nine categories decline by half a point or more. Several advisors were frustrated about the lack of availability of both living-benefits products and actuarial support.

Nevertheless, both PPI Advisory and PPI Solutions continue to have among the highest overall ratings for providing strong products and support for high net-worth clients.

“We run into high net-worth clients with oddball situations,” says a PPI Advisory advisor in British Columbia, “and it’s nice to have [this MGA] as a backup – as it probably did that [service] before anyone else in the country.”

Mississauga, Ont.-based IDC Worldsource Insurance Network Inc. (IDC WIN) also was rated highly by its advisors. Above all, IDC WIN advisors were very pleased with the MGA’s focus on independence while still providing access to upper management.

“[The firm] has led the way in what MGAs should be all about,” says an IDC WIN advisor in Ontario. “If they didn’t do something they promised, they will explain to you why they didn’t. I’ve been around a long time, and most MGAs are just here to collect overrides. IDC WIN wants advisors to want [to work with] it.”

Advisors with London, Ont.-based Freedom 55 Financial also were a happy bunch, rating their dedicated sales agency higher by half a point or more in 10 categories, including “quality of firm’s/MGA’s product offering,” “support for helping to deal with changes in the regulatory environment” and “support for tax planning.”

The firm is placing greater emphasis on providing advisors with retirement planning support and enhancing client services. Says Mike Cunneen, senior vice president of Freedom 55’s wealth and estate planning group: “There is a huge opportunity in the retirement income market, as Canadians get older and the concentration of wealth becomes greater, to provide not just the product and tools and processes but the type of services people will need as they come to that unique stage in their lives.”

To obtain the aforementioned ratings, IE researchers Jacob Boon, Alexandra Bosanac and Leah Golob spoke with 380 advisors at three dedicated sales agencies and six independent sales agencies. (Five of latter are MGAs.) In order to complete the survey, an advisor must be either a full-time advisor with one of the dedicated sales agencies or run a minimum of 50% of his or her business through one of the MGAs.

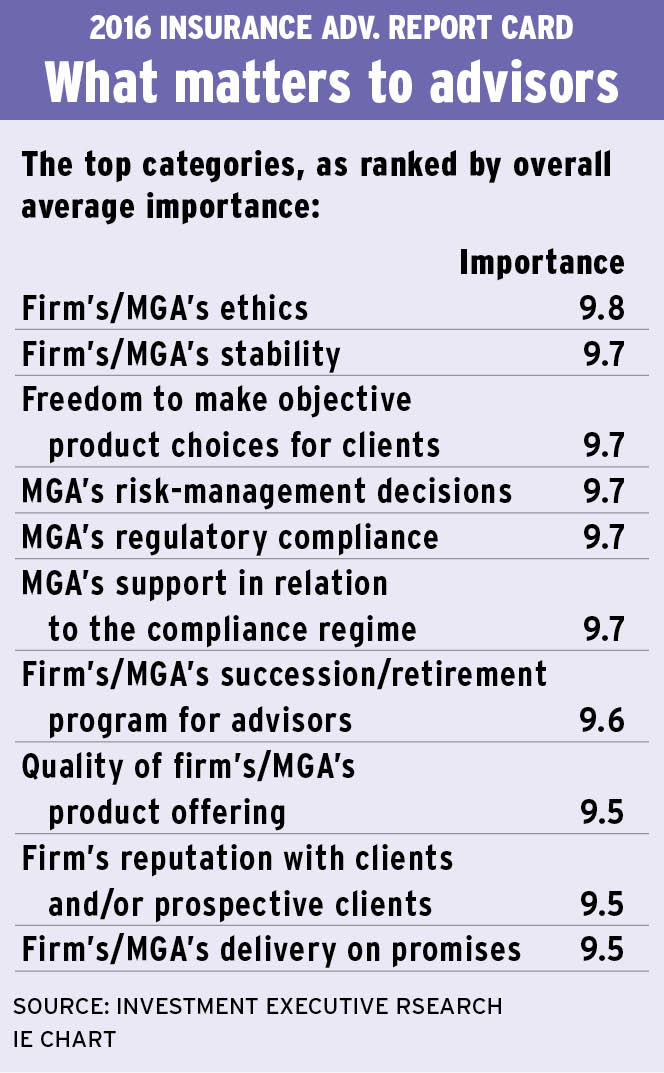

Advisors then were asked to provide two ratings for each category: one on how well their firm or MGA performed in the category and another on how important that category is to their business. Both ratings are based on a scale of zero to 10, with zero meaning “poor” or “unimportant” and 10 meaning “excellent” or “critically important.” The “IE rating” is the average of a firm’s ratings in all the categories; the “overall rating by advisors” is how advisors rated their firm, as a whole, out of 10.

There was a notable change in this year’s Report Card: the removal of Toronto-based World Financial Group Insurance Agency of Canada Inc. (WFG) and Winnipeg-based Daystar Financial Group Inc. – although for very different reasons.

Although WFG continues to be a major player in the insurance industry, its unique marketing-based business model does not make it comparable to the other firms in the Report Card.

As for Daystar, it was acquired by Woodbridge, Ont.-based Hub Financial Inc. in December 2013. As a result, Hub has almost doubled the size of its roster of independent sales agents to 5,000, with 2,000 coming from the Daystar acquisition. Transferring that many advisors to a firm is no easy feat, and Terri DiFlorio, Hub’s president, says the MGA is taking its time to make sure all advisors, as well as their clients, don’t feel the impact.

“We just don’t want to disrupt [advisors’] practices,” DiFlorio says. “We are in this business because we enjoy helping advisors sell insurance and investments to Canadians who need it.”

© 2014 Investment Executive. All rights reserved.