But a resurgence in mega-deals led to a growth in capital invested to US$26.8 billion from US$25.5 billion in the corresponding quarter a year earlier

The new Venture Capital Catalyst Initiative could also generate as much as $1.5 billion in total new funding, depending on the extent of private sector participation

The federal budget is expected to include several measures aimed at improving the performance of the so-called innovation economy

The VC industry hopes the federal budget will preserve a program designed to boost investment, yet argues VC firms already up and running struggle to reach the next level due to lack of capital

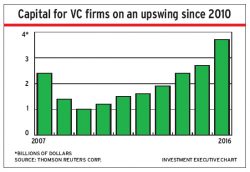

There was $3.2 billion in total venture capital investments in 2016, up by 41% from 2015 and reaching their highest level since 2001, according to a new report from the CVCA

Canadian companies wait longer before they start raising funds, they raise less money less often and they raise less money, a new report finds

However, buyout and related private equity activity saw significant declines both in terms of deal volume and value last year

The government is hoping to attract 1.5 times its investment in the new, clean technology fund from other private sector investors

The total number of deals rose by 7% while total investments dropped by 0.3% in Canada while, globally, total deals dropped by 10% and total dollars invested dropped by 23%

Portag3 Ventures LP, another VC fund, is one of the backers in the project and Paul Desmarais III of Power Financial serves as both VC funds’ chairman