Plus, CI GAM, Dynamic, Mackenzie expand their product lineups and more

Flows into low-cost vehicles far outpaced mutual funds over the past decade: Morningstar

Plus, a new ETF from Invesco, Franklin Templeton terminates funds and Interactive Brokers launches forecast contracts in Canada

Target-date funds are a hit in the group retirement business — why not in the ETF market?

The 2018 corporate bond ETF will mature Nov. 16

Four new Franklin LifeSmart Portfolios launched

The company now offers 12 target-date funds in Canada, ranging in retirement years from 2015 to 2065

Equity level of 2050 target-date fund rises, levels off, then declines

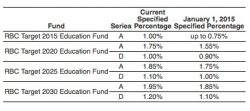

Reduction in specified percentages for Target Date Funds 2015, 2020, 2025 and 2030

There may be suitability issues with these securities