Even though low interest rates mean returns that lag inflation, many older clients remain extremely averse to taking almost any risks in today's volatile markets. But failure to get back in the game could mean long-term losses for many

Europe still poses greatest risk to financial markets

The outlook is less rosy for the financial and energy sectors

European equities vulnerable to any new downgrades to growth

Craig Fehr, Canadian market strategist for Edward Jones, says the uncertainty surrounding the outcome of the U.S. presidential election has made investors nervous. He explains how advisors can help their clients focus on long-term strategies to navigate through volatile markets and the slow-growing U.S. and world economies. He spoke at the TMX Broadcast Centre in Toronto.

Only emerging markets stocks are expected to underperform

Canadian investment managers split over the impact of events in Europe

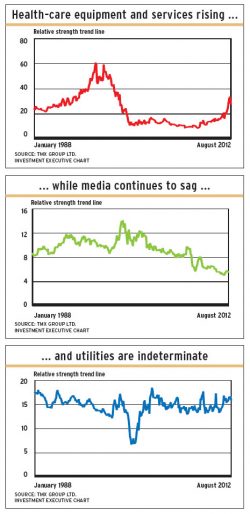

Relying on relative strength analysis can keep your clients out of sectors that look good but are losing their way

Advisors must remind skittish clients there are also risks associated with seemingly safe vehicles

The optimal equities/straddle strategy arises when the return assumption approximates the frequency of the potential for profit