Businesses filed 160 insolvencies in July — a 28.3% decline compared to June

Finance, insurance, real estate and leasing businesses were least likely to have taken on debt

Overall consumer debt now stands at $2.15 trillion

The drop in the deficit came as spending dropped compared with a year ago

Credit card performance continues to outpace pre-pandemic levels

Outlook for credit demand looks positive despite virus threat, TransUnion says

Research examines where physical risk and financial risk meet in Canada

Mortgage debt, however, rose by a record $99.6 billion

Expected credit losses look low, but tail risks are lurking

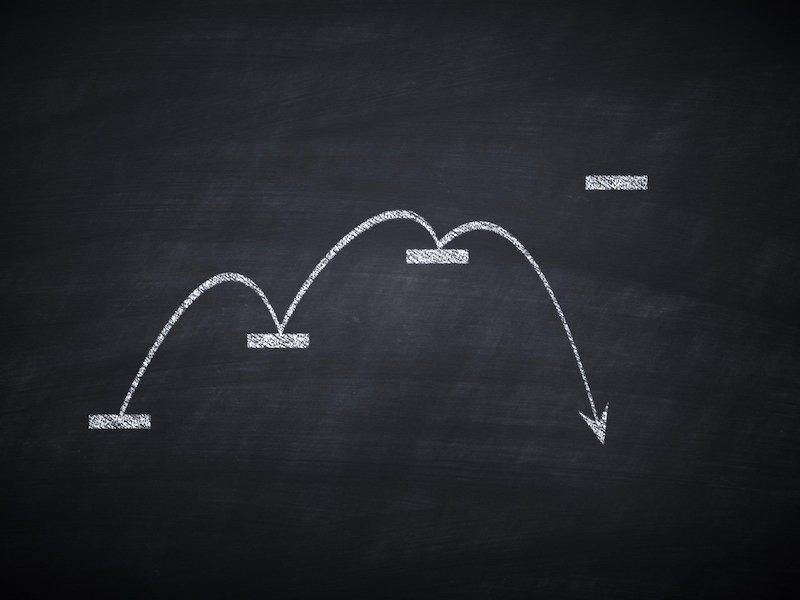

Higher borrowing, overheated housing markets are vulnerabilities