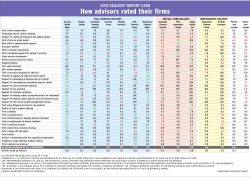

How advisors rated their firms

Pablo Fuchs, senior editor of Investment Executive, and Clare O’Hara, reporter, discuss the results of the 2012 Dealers’ Report Card and why “firms feel just right to advisors”. They outline the key finding’s of this year’s survey. They spoke at the TSX Broadcast Centre in Toronto.

How advisors rated their firms

Dealers that keep advisors in the loop and make themselves available received top ratings from reps

When it comes to support for wealth-management services, advisors want a comprehensive mix

When dealer firms have solid staff in place in their back office and compliance departments to provide support in an accurate, timely and helpful manner - and they do it all free of errors - this pleases advisors to no end

There has been a shift in the expectations advisors have about their firm's promotional tactics in this post-financial crisis environment now, firms' branding strategies are becoming more important, as is marketing support for advisors' practices

Firms that haven't restored their grid and bonus payouts to pre-recessionary levels garnered the most displeasure from their advisors. In contrast, advisors were most pleased at dealers that offer a balance among support, independence and payouts

When it comes to providing support for financial planning, some firms' ratings rose because of technological improvements to their financial planning software, better education and training, as well as increased flexibility

Some dealers still have a lot of work to do when it comes to making their tech tools and advisor desktop accessible to advisors. Other firms, however, are starting to step up their game