Launch of new investment cycle portends a return to equity growth

Lenny McLoughlin of Irish Life Investment Managers says historical trends point to a return to equity growth in the second half of 2023 and into 2024

- January 31, 2023 February 1, 2023

- 13:01

(Runtime: 5:00. Read the audio transcript.)

**

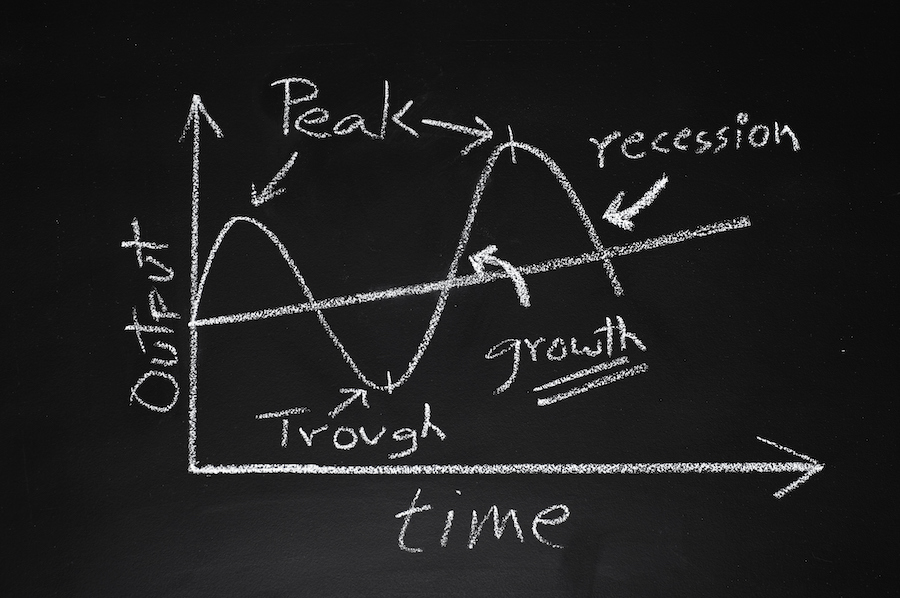

The return of equity growth may not be far off if the world economy is about to start a new investment cycle, says Lenny McLoughlin of Irish Life Investment Managers.

The chief economic strategist for the Dublin-based firm said if the global down cycle is ending, historical trends would point to a bold return to equities growth.

“What you typically see is that, at the early stages of a new investment cycle, equities tend to generate very, very strong returns,” he said. “So, even though there is potential downside in the short term, we think equity markets will begin to discount the economic recovery in the second half of this year and into 2024.”

And while volatility will remain a feature, McLoughlin said equity declines in the early part of 2023 would create even better deals in the second half of the year.

“Equity markets seem to have fully discounted the rising yields of 2022. However, there is a possibility that equity markets haven’t fully factored in the lingering growth and earnings uncertainties,” he said.

Two issues could lead to further short-term downside in equity markets, he said: earnings downgrades and increasing margin pressures.

“We have already seen earnings forecasts for 2023 coming down by about 7% from their peak. But we do think there is risk for further downside to those earnings forecasts, mainly linked to margin pressure,” he said. “At the moment you’re seeing falling goods price inflation … combined with higher wage pressures. Those two issues, we believe, can squeeze margins further over the course of 2023.”

Ultimately, though, he believes there will be double-digit upside in equity markets if consensus economic and earnings forecasts prove to be correct.

Soft landing

McLoughlin said the reopening of the Chinese economy and signs of a European recovery are fuelling hopes for a soft landing for the world economy. Those factors, combined with diminished inflation, could help global economies achieve positive results over the course of 2023, he said.

“With the moderation that we’re seeing in inflation, the squeeze in real incomes that we saw through 2022 is beginning to ease,” he said.

He allowed that the jury is still out as to whether the U.S. economy and the global economy will enter recession this year, but “even if a recession were to occur this year, we think it could be relatively short and shallow,” he said.

According to McLoughlin, four factors drove markets last year: inflation, central bank policy, earnings growth and geopolitics. These risks are significantly reduced this year.

“We think inflation will continue to fall over the course of this year,” he said. “We think it will head down toward the central banks’ 2% targets, but we don’t think it’ll actually quite get down to those low levels. It’ll probably settle somewhere in the low single digits.”

Services inflation, however, is likely to continue. “It remains high,” he said.

Fixed income

While equities adjust to the new cycle, McLoughlin believes investment opportunities can be found in fixed income.

“We believe bond markets, given where yields have got to, are fully discounting that higher inflation backdrop and that tightening of the monetary policy,” he said. “Fixed-income assets will now begin to provide protection again to multi-asset portfolios or balanced portfolios.”

He likes emerging markets local debt as well as hard debt, where yields offer a strong and high yield carry.

Globally, investment grade corporate bonds and sovereign bonds also represent opportunities, he said.

Sovereign debt in particular offers quite attractive levels of yields in absolute terms, offering investors a strong income flow of the course of this year.

“But we also believe there is scope for yields to fall over the course of 2023, which offers you a combination of both income stream but also capital returns,” he said. “We believe there’s scope for those yields to fall over the course of 2023, with inflation continuing to moderate … and the fact that central banks are now quite close to the peak of their tightening cycle.”

As for high-yield corporate bonds, he said it is “probably a little too early” to seek returns there.

“If we do see a lower growth backdrop or even a recession, there’s a risk that spreads could widen significantly in high-yield bonds, just reflecting the risk of rising defaults in that space,” he said.

**

This article is part of the Soundbites program, sponsored by Canada Life. The article was written without sponsor input.