THE TRANS-PACIFIC PARTNERSHIP (TPP) still has hurdles to clear, and most of its details have yet to be revealed, but the deal represents a potentially historic trade pact that could help to define the balance of global economic power in the years ahead.

Given what is known so far, the TPP appears to be good news for the Canadian financial services sector.

On Oct. 5, the 12 countries participating in the TPP negotiations – including Canada, the U.S., Japan and Mexico – finalized a new trade deal that has been in the works for much of the past decade. In short, the agreement aims to promote freer trade among the participating countries by reducing trade barriers – including both tariffs and other obstacles – thereby bolstering market access and driving economic growth.

Assuming the deal is approved eventually, it would create a new free-trade bloc that includes almost 40% of world gross domestic product (GDP) – about US$25.7 trillion.

Although precisely what the impact of the TPP will be is too early to assess – given that the detailed text of the agreement has yet to be released, and that the impact of trade agreements typically emerges over time – the TPP is expected to add about US$220 billion to the global economy by 2025, or 1% of global GDP.

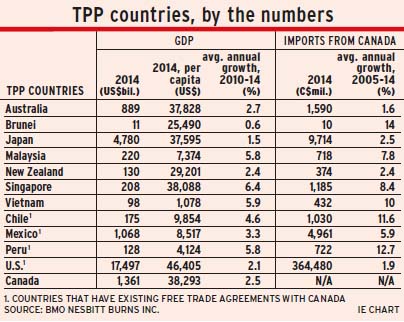

The TPP’s text should be released in the next couple of months, once it has been reviewed, legally vetted and translated. After that, the TPP must be ratified in each of the countries that has signed on. (See accompanying table.) Then, assuming that the deal is ratified, its implementation and indications of its impact on trade and economic growth would take a couple of years.

If that happens, Canada’s financial services sector is expected to be one of the beneficiaries of the deal. Although foreign trade traditionally has been less important to service industries, cross-border business has become increasingly significant in the financial services sector in recent years.

According to a report published jointly in December 2014 by the Conference Board of Canada and the Toronto Financial Services Alliance, global financial services exports have tripled since 2000. Further, Canadian financial services exports have almost quadrupled (in U.S.-dollar terms) over that same period. About half of Canada’s exports are to the U.S., and 39% of foreign direct investment by Canadian financial services firms is in the U.S., the report notes.

The U.S. market will always be attractive to Canadian firms, given its size, geographical proximity and similar culture. But emerging markets also represent a big growth opportunity for Canadian financial services firms, particularly in markets without dominant domestic companies but with favourable demographics. And that’s where the TPP comes in.

“The TPP should be particularly beneficial for the Canadian financial services sector, as it will improve access to high-growth markets such as Malaysia, Vietnam and Singapore,” according to a research note from BMO Nesbitt Burns Inc. “Importantly, the agreement also includes provisions to temper the dominance of state-owned-enterprises in banking and insurance, lessen limitations on ownership and expansion by foreign financial institutions, and encourage communication and co- ordination among financial regulators.”

According to a summary of the agreement released by Canada’s federal trade officials, the financial services component of the deal aims to provide firms with greater cross-border and investment market access, while also preserving local regulatory authority.

Among other things, the deal will allow financial services firms to sell certain financial services across borders without requiring those firms to set up shop in the other country. The agreement gives foreign firms the ability to sell new services if domestic firms are allowed to provide those services. And the TPP will curb limitations on ownership and expansion by foreign financial institutions. The deal also sets out specific commitments regarding portfolio management, electronic payments and data processing.

In addition, the TPP will establish a dispute-resolution mechanism, including specific provisions dealing with the financial services sector. Collectively, these measures will open foreign markets to Canadian firms, and provide some assurance that their investments in these markets will be protected from the threat of expropriation or limitations on firms’ ability to transfer funds outside a country.

Notwithstanding these efforts to break down trade barriers, the TPP includes exceptions that will ensure that financial services regulators have broad discretion to act to preserve financial stability and ensure consumer protection.

The impact is seen as positive for the services sector, and financial services in particular. Canada’s large financial services institutions – the big banks and insurers – have expressed approval. Both the Canadian Bankers Association and the Canadian Life and Health Insurance Association Inc. (CLHIA) immediately expressed support for the agreement.

Brian Porter, president and CEO of Canada’s most international bank, Bank of Nova Scotia, issued a statement regarding the deal: “The TPP will enhance our ability to help Canadian and international customers take advantage of this new marketplace to grow their businesses and create jobs.”

Porter’s statement also pointed out that Scotiabank already has operations in 10 of the 12 countries that have signed on to the TPP, and that Scotiabank expects the deal to help the bank’s growth in those international markets.

The hope for the big banks generally is that any policy that stimulates trade and economic growth ultimately will benefit the banking business, as banks will play a role in financing that activity.

For the big insurers, the opportunity is more likely to come from exporting their services, particularly to less developed markets with greater growth potential than can be found in the domestic market. A statement from the CLHIA notes that the life insurance industry is particularly keen on growing its business in Asia.

Yet, while the big banks and insurers are the most visible players in foreign markets, the provision of other sorts of financial services have been the faster-growing component of international trade in financial services in recent years. According to the Conference Board/Financial Services Alliance report, the portion of financial-related exports accounted for by services other than banking and insurance, such as securities trading and asset management, now represents half of the sector’s exports; that’s up from less than one-third in 2000.

And all sorts of Canadian financial exports are poised to grow in the years ahead. “Financial services is the greatest export that Canada will have in the future, bar anything,” said Bruce Flatt, CEO of Toronto-based Brookfield Asset Management Inc., at the Ontario Securities Commission’s annual conference in mid-October. “And that’s from banking to pension plan investing, asset managers, life insurance and all of the financial services that go along with [those].”

Added Flatt: “We shouldn’t just think of exports as manufactured products. Financial services are incredibly valuable.”

Apart from the economic impact of the TPP, there also is a significant strategic aspect to the deal.

“For the U.S., this deal is as much, if not more about geopolitics than it is about trade,” according to a report on the TPP by National Bank Financial Ltd. (NBF). “It would allow the U.S. to take the lead in setting the rules of commerce for about 40% of the global economy without having to negotiate with China.”

There is some hope that China will join the pact one day, the Scotiabank report notes, and that several other countries are likely to be interested in joining the TPP in the years ahead – including the Philippines, Taiwan, Colombia, Thailand, Indonesia and Cambodia.

Upholding regulatory authority is always a key issue with these sorts of deals, given concerns that the provisions of the trade agreement may be used to subvert regulatory policy. Indeed, the TPP deal faces its share of opposition from critics such as Canada’s largest private-sector union, Unifor (formerly the Canadian Auto Workers union), which worries about the TPP’s impact on jobs, the environment, intellectual property rights and regulatory sovereignty.

A statement from Unifor calls upon Canada’s federal government to release the actual text of the agreement as soon as possible, so that its detailed terms can be fully analyzed before the TPP proceeds to ratification.

Canada’s auto sector, in which Unifor represents thousands of workers, is likely to be one of the industries that will face increased competitive pressure under the TPP. Canada’s autoparts industry will see tougher competition, as tariffs on imported vehicles are phased out and local content rules are loosened.

In addition, certain agricultural sectors – namely, the dairy, egg and poultry industries – will come under increasing competitive pressure.

“The Canadian dairy industry is likely most at risk,” according to a report on the deal from Raymond James Ltd., “as the agreement will reduce the tariffs on imported milk products, which will significantly erode the 90% market share of domestic producers.”

On the upside, according to the report from NBF, the list of industries that are expected to benefit from the agreement includes agricultural producers and food processors that currently face hefty foreign tariffs, particularly in Asian markets.

And, according to the NBF report, the mining and forestry sectors also stand to benefit from the deal.

Getting the TPP deal ratified is the next big hurdle. While all of the participants in the deal must sign off, the NBF report points to the U.S. as the linchpin of the process: “The fate of the TPP rests largely with the U.S. Congress. If the deal is passed in the U.S., the approval phase will be a foregone conclusion in most other countries. If [the deal] fails to pass Congress, then it most likely will fall apart.” The report predicts that the deal will face a tough fight in Congress, but ultimately will be approved.

Canada also will have to approve the deal, according to the NBF report: “Given Canada’s small internal market, it has little choice but to approve this agreement in order to ensure that [Canada] is on a level playing field with nations with which it competes for access to global export markets.”

© 2015 Investment Executive. All rights reserved.