The Covid-19 outbreak was an unprecedented negative shock to Canada’s economy and threw financial markets into turmoil, but early indications suggest the investment business is holding up remarkably well.

The economy took a massive hit — estimates put the annualized plunge in GDP for the second quarter at about 40%, and 3 million Canadians lost their jobs in March and April as governments imposed lockdowns — but the effects have varied wildly by sector. Tech is flourishing, grocery sales are up and online commerce is going gangbusters, whereas airlines, restaurants and live entertainment are being hammered.

So far, the investment business is among the winners: the vast majority of firms are still profitable, industry revenue is resilient and investment dealer employment has never been higher.

According to the latest data from the Investment Industry Association of Canada (IIAC), almost 80% of firms were profitable in the first five months of 2020. The industry’s shift to remote working is proving successful and employment is continuing to rise, reaching a record level (43,746) at the end of May, despite the pandemic.

Firms are maintaining profitability by keeping a lid on operating expenses amid a relatively modest decline in overall revenue. Preliminary data from the IIAC indicate that revenue dropped by slightly more than 10% in March, when the pandemic was declared. In April, at the height of the lockdown, revenue rebounded strongly — thanks to temporary spikes in fixed-income trading, debt underwriting and fee-based revenue — before easing again in May.

Click chart to view full size.

Beneath these relatively healthy headline trends, the industry is doubtless feeling the effects of the pandemic. For example, the revenue mix is shifting significantly: certain segments of the business — such as trading and debt underwriting activity — have risen in response to a surge in market volatility and economic disruption, while others — such as interest-driven revenue — are suffering.

At the beginning of the year, the investment industry was generating about $1 billion per month in interest-related revenue. That dropped to about $800 million in March before plunging to $480.0 million in April and to just $425.9 million in May. The IIAC attributes the drop to the Bank of Canada slashing interest rates in March to 0.25% from 1.75% in response to the crisis, which forced investment dealers’ spreads to tighten significantly.

Fortunately, much of the drop in interest-driven revenue was offset by gains in other areas.

The arrival of rock-bottom interest rates, coupled with an urgent need for financing in an array of industries due to lockdowns, sparked record debt underwriting activity in the second quarter of this year.

Debt underwriting revenue more than doubled in April, jumping to $176.8 million from $69.3 million in March. Activity has since eased, but revenue remained elevated in May ($132.2 million).

Equity underwriting revenue dropped amid the April spike in debt activity, but overall investment banking revenue was still above average for each of March, April and May, the IIAC reports.

Alongside the robust financing activity, trading volumes also are hitting record levels this year in response to the surge in market volatility.

In the first half of this year, trading volume in TMX Group Ltd.’s equities markets rose by 39.2%; activity was up by about 50% in the TSX and TSX Alpha, TMX’s main markets; and volume rose by a much more modest 13.5% in its venture market.

Thanks to the surge in trading, commission revenue jumped by 58% in March (from the previous month) to $462.5 million, the IIAC reports. Since then, commissions declined to more typical levels, but remain above average.

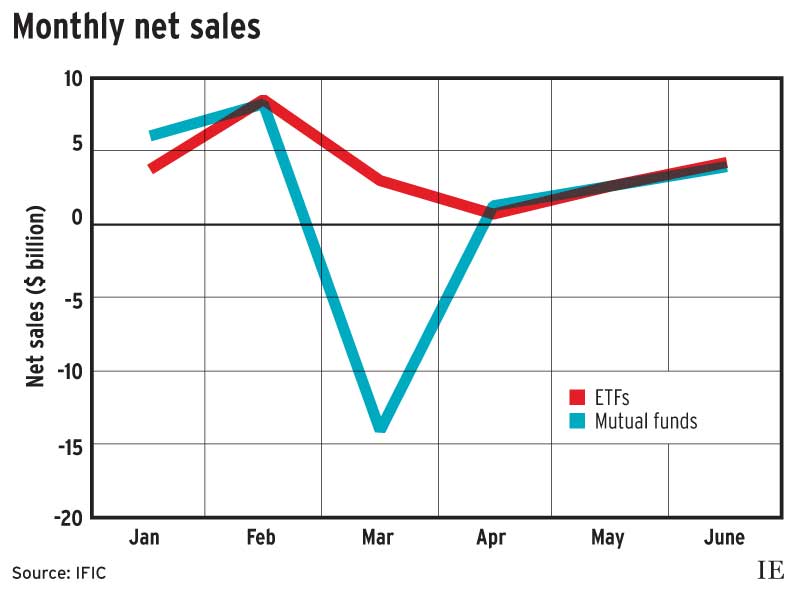

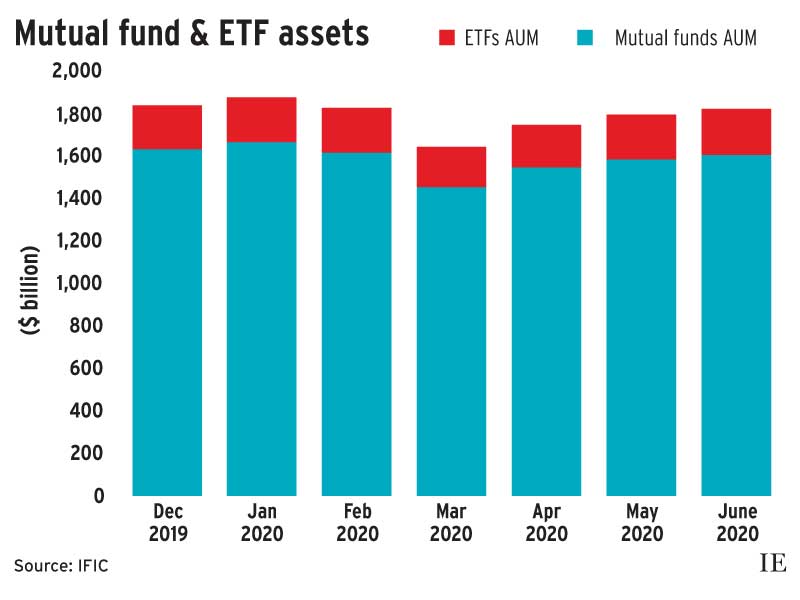

While the data on commissions don’t include mutual fund commissions, that segment of the business is demonstrating remarkable resilience. Mutual fund assets under management (AUM) have almost recovered to their pre-pandemic levels, and fund sales through the first half of 2020 are up from levels in the corresponding period last year.

As of June 30, 2020, total mutual fund AUM reached $1.6 trillion, just shy of the level at the beginning of the year ($1.63 trillion), according to data from the Investment Funds Institute of Canada. Through the first six months of this year, mutual funds managed $7.8 billion in total net sales, up from $6.0 billion in the same period last year. However, this year’s total is propped up by almost $5 billion in money market fund sales, compared with just $143 million during the same period last year.

Balanced funds remain the largest mutual fund asset class, even as they’ve suffered $6.7 billion in net redemptions as of June 30. Equity funds have net sales of $1.9 billion this year after seeing $5.8 billion in net redemptions in the first half of 2019.

Bond fund sales are in positive territory for this year too, despite hefty redemptions in March that wiped out the segment’s RRSP season sales.

Click chart for full size.

Sales figures could have been far worse for bond funds. Researchers at the Bank of Canada found that Canadian bond fund sales held up better than expected in March, given the scale of the economic and financial market disruption inflicted by the pandemic. The BoC’s study of 188 Canadian bond funds found that the segment’s record $14.4 billion in March redemptions should have been more than double that amount; modelling the historical relationship between sales and fund performance indicated redemptions should have topped $30 billion in the month.

The better-than-projected result is attributable to several factors, including the BoC’s emergency measures to boost market liquidity, and to securities regulators easing borrowing limits on bond funds to ensure the funds could meet redemptions without selling significant amounts of AUM. The efforts by investment dealers to soothe clients and firms charging higher exit fees to reflect the elevated cost of liquidity also helped to limit bond fund redemptions and prevent calamity in that segment of the market.

ETFs have performed even better than the resilient mutual fund segment. While long-term mutual fund sales are down from last year, that’s not the case for ETFs: net sales of long-term ETFs doubled this year, jumping from $10.4 billion in the first half of 2019 to $20.9 billion for the first six months of this year.

As with mutual funds, equity ETFs lead the way, with $15.4 billion in first-half net sales, up from $3.3 billion for the first six months of 2019. Both long-term and money market ETF net sales are up this year, pushing total net sales to $22.7 billion in the first half of 2020, compared with $10.8 billion last year.

The wealth-management business’s overall strength is also reflected in IIAC data on industry fee revenue, which reached almost $2.5 billion for the March-to-May period. April set an all-time monthly record, with $910 million in total fee revenue — probably a reflection of the record heights markets hit before the pandemic.

The investment industry’s early results are encouraging, but whether this strong performance can be sustained amid a prolonged period of ultra-low rates and intense economic uncertainty remains to be seen.