An alluring strategy

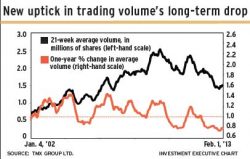

Low-volatility stocks have become the market’s hot sellers. In fact, there are now exchange-traded funds full of stocks with good relative price stability and market…

- By: Carlyle Dunbar

- April 30, 2013 October 31, 2019

- 23:00

Low-volatility stocks have become the market’s hot sellers. In fact, there are now exchange-traded funds full of stocks with good relative price stability and market…

The solution that's been adopted, which dishonours senior bonds and large deposits, is likely to raise red flags

There are many sectors worth exploring in this emerging market, including banking, aviation and consumer durables

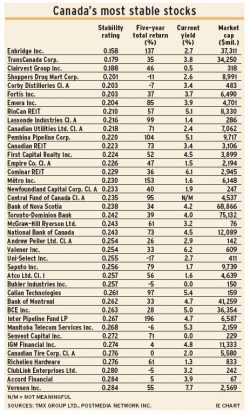

40 stocks with the best price stability in Canada

But issuers paying third-party agencies for credit ratings can't stop, some say, until there is a better model for rating bond issues

Inventories for aluminum, copper, nickel and zinc are relatively high, but are expected to drop in a few years

Clients who want to sustain yield have to accept the credit risk in bond markets in which interest rates are higher

Sectors expected to perform strongly, such as consumer discretionary, IT and telecoms, have not yet delivered this year

BCE, Rogers and Telus all face moderate overall growth - but cost-cutting measures can protect and enhance margins

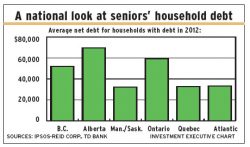

The average debt per Canadian household rose by only 0.3% in 2012, as most Canadians slowed or stopped their borrowing. Seniors were the exception, as…

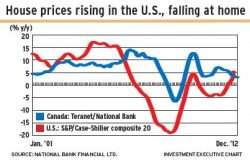

Canadian and U.S. housing markets moving in opposite directions

Stocks of small- and mid-cap companies are rising faster than the large-caps, a clear sign that better times are on the way

Growing middle classes in emerging markets and barriers to entry are good omens for the purveyors of guns and guilty pleasures

More and more forecasts say government bonds should start producing positive real returns soon. That means the prices of existing bonds will tumble

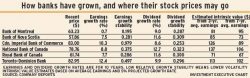

Investing in the stocks of Canada's Big Six banks has much appeal

Political stability is sure to have an impact on interest rates, and thus also affect bond prices and yields

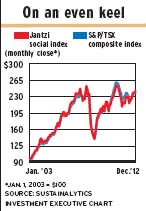

Although SRI excludes sectors and companies with impact that is deemed to be harmful, most stocks pass the eligibility test

Provincial bonds have been overlooked in the past few years, but they offer healthy returns combined with a low risk of default

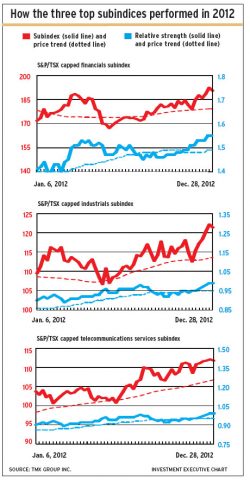

Financials, industrials, telecoms, and consumer discretionary and staples account for 51% of the S&P/TSX composite index

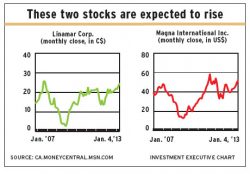

Analysts are bullish on Canadian autoparts manufacturers Linamar and Magna