Scandinavian countries have mature economies with affluent and highly educated populations. This has led to the creation of strong companies that portfolio managers and analysts currently consider to be undervalued and worth a good look.

The economies of Denmark, Finland, Norway and Sweden are small but nevertheless successful. Although these countries didn’t escape the effects of the global financial crisis entirely, having strong banking systems in place got them through it relatively easily.

In addition, these economies have high-quality global companies that sell their products around the world and are, therefore, less dependent on domestic or regional European growth than many other European countries.

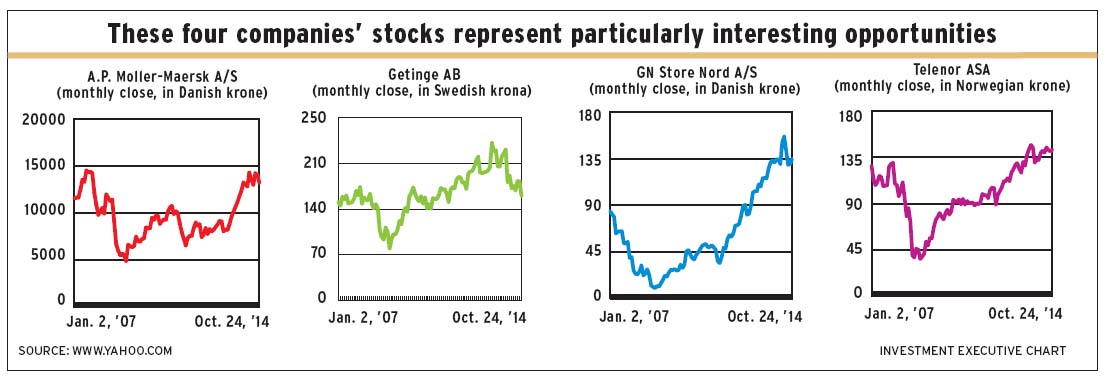

Portfolio managers and analysts recommend nine such companies, including Denmark-based shipping firm A.P. Moller-Maersk A/S (a.k.a. Maersk) and brewer Carlsberg A/S, and Sweden-based clothing retailer Hennes & Mauritz AB (H&M) and telecommunications firm Telenor ASA. Lesser known names include: Aker Solutions ASA, a Norway-based oil services firm; Assa Abloy AB (a.k.a. Abloy) of Sweden, the world’s largest lock manufacturer; Getinge AB, a medical technology company also based in Sweden; Denmark-based GN Store Nord A/S, which makes hearing aids and audiological diagnostic equipment; and Sweden-based Swedish Orphan Biovitrum AB, a drug company focused on rare diseases.

Here’s a closer look at these nine companies:

– A.P. Moller-maersk a/s is one of the top three shipping companies in the world. Maersk is both a restructuring story and a play on growth in global gross domestic product (GDP), says Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London, U.K.

Like for many companies based in Denmark, the founding family still has a high ownership stake, about 40%; but with the death of the previous patriarch, the firm “has been more focused on cost-cutting, its core business of container shipping and managing the business for shareholders,” says Burbeck.

For example, Maersk sold its interest in a Danish supermarket chain in January 2014 – although Maersk still has an oil and gas subsidiary and a 20% interest in Denmark-based Danske Bank A/S.

There also is the possibility of Maersk entering into a joint venture (JV) with one of the other major shippers to improve efficiency. One proposal for such a JV among the three top shipping lines – Maersk, Switzerland-based Mediterranean Shipping Co. SA and CMA CGM Group of France – was approved by the European and U.S. authorities, but turned down by China. Burbeck thinks a JV involving just two of these companies could get approval.

A report from J.P. Morgan Securities LLC (JPM) in London has an “overweight” rating on Maersk’s shares, with a Dec. 31, 2015, price target of 16,700 Danish krone (DK; $3,188), well above the DK13,230 ($2,526) level that the 22 million shares outstanding closed at on Oct. 24.

– Aker Solutions asa provides deep-water drilling services in the North Sea and other deep basins.

According to Don Reed, president and CEO of Franklin Templeton Investments Corp. in Toronto: “No other company in the sector has better long-term prospects [than Aker].” It’s not only a leader in deep-water drilling, a business with high barriers to entry, but the firm now is focused solely on this business, having spun off its other operations into a separate publicly traded firm, Akastor ASA, this past September.

The 272 million shares outstanding closed at 23.70 Norwegian krone (NK; $4.03) on Oct. 24.

– Assa Abloy ab is a play on growth in global housing, says Stephen Oler, portfolio manager with Pyramis Global Advisors in Smithfield, R.I., a unit of Boston-based FMR LLC (a.k.a. Fidelity Investments) and portfolio co-manager of Fidelity Europe Fund.

Abloy has become the world’s largest maker of locks through a series of acquisitions over many years – and Oler expects the firm to continue to do well through a combination of organic growth, market share gains, pricing power and continued accretive acquisitions. Prospects are best in North America, which has what Oler calls the “healthiest” housing market. Meanwhile, the housing market in Europe is sluggish, China’s is slow and Japan’s is a question mark.

A recent JPM report is less enthusiastic about Abloy, rating the stock “neutral,” with a Dec. 31, 2015, price target of 390 Swedish krona (SK; $60.26). The 371 million shares outstanding closed at SK378.10 ($58.42) on Oct. 24.

However, the report adds: “We continue to like the organic- and acquisition-driven growth outlook for Abloy and prefer it to other high-quality, construction-exposed names.”

– Carlsberg a/s. In 2013, western Europe accounted for 41% of this brewer’s sales volume, with eastern Europe accounting for 35% and Asia for 24%. Carlsberg’s market share of beer consumption is more than 50% in Denmark, Norway, Finland, Azerbaijan, Cambodia, China, Laos and Nepal, 39% in Russia and 33% in Sweden.

Carlsberg’s stock price plunged when Russia’s ban on selling alcohol in kiosks and train stations, which had accounted for a third of beer sales in that country, was announced in August 2011. This ban went into effect on Jan. 1, 2013. Carlsberg’s stock price has mostly recovered, but still is below previous highs.

Peter Hadden, portfolio manager with Pyramis Global Advisors and Oler’s partner in managing Fidelity Europe Fund’s portfolio, expects further improvement in Carlsberg’s stock price, but a JPM report rates the stock as “underweight,” with a price target of DK500 ($95.45) for Aug. 31, 2015, because of the firm’s significant exposure to Russia.

Carlsberg’s 152 million shares outstanding closed at DK512.5 ($97.84) on Oct. 24.

– Getinge ab makes medical products, including operating room, disinfection and sterilization, and elder-care equipment that are purchased mainly by hospitals. In fact, Getinge sells both the equipment and the replacement parts, ensuring a stream of recurring revenue, says Wendell Perkins, senior portfolio manager with Manulife Asset Management (U.S.) LLC in Chicago.

Getinge’s stock price has dropped because of issues the firm has had with the U.S. Food and Drug Administration (FDA) concerning Getinge’s quality control systems at its manufacturing facilities in the U.S. Perkins thinks the price drop has been overdone and that the company probably can resolve the issues “without too much damage” and continue to deliver on its excellent long-term prospects.

However, a recent JPM report has an “underweight” rating on Getinge stock because of the uncertainty involving what the FDA will require, including associated fines, and also raises concerns about sales prospects, given current hospital and nursing-home capital-investment constraints.

The JPM report’s Dec. 31, 2015, price target of SK152 ($23.48) a share is below the SK161 ($24.87) that the 238 million shares outstanding closed at on Oct. 24.

– GN Store Nord a/s makes hearing aids and related devices and is particularly good at wireless technology for the premium market for these devices. But premium products are not covered by many medical health benefits, so sales have been less robust than investors expected, says Hadden. However, he expects good growth as global growth picks up, particularly in Europe.

A recent JPM report has an “overweight” rating on GN’s stock, with a Sept. 30, 2015, price target of DK143 ($27.30) for the 166 million shares outstanding that closed at DK134.50 ($25.68) on Oct. 24.

That report suggests GN will exceed expectations on both revenue and margins and also foresees “scope” for enhanced share buybacks.

– Hennes & Mauritz ab. Although consumer markets have been relatively tough this past summer, particularly in Europe and Russia, H&M continues to grow – and, indeed, to surprise with its strength. Hadden expects this performance to continue, explaining that the company isn’t very good at communicating with investors, so the share price doesn’t go up in anticipation of good sales, but only after the sales have occurred. He also notes that H&M is expanding in Asia and North America.

However, a recent JPM report rates H&M stock as “neutral,” with an Aug. 30, 2015, price target of SK310 ($47.90). The 1.7 billion shares outstanding closed at SK281 ($43.41) on Oct. 24.

That report cites concerns about the increase in H&M’s gross margin between 2010 and 2013 and the “fierce and increasing competition” it faces.

– Swedish Orphan Biovitrum ab is a specialty health-care company focused on inflammation and genetic diseases. The firm also markets a variety of products for partner companies. Hadden expects Swedish Orphan’s earnings to be boosted by a new hemophiliac drug that has to be taken only 100 times a year vs 150 times for previous treatments. This drug has approval in the U.S. and is awaiting approval in Europe.

The firm is good at finding opportunities like this and is small enough that such breakthroughs make a big difference to its earnings, Hadden adds. Swedish Orphan’s 270 million shares outstanding closed at SK75.35 ($11.64) on Oct. 24.

– Telenor asa offers landlines and mobile telecom services in Norway, Denmark and Sweden, but these are mature markets. The big excitement, says Burbeck, is the mobile market in underpenetrated economies in Southeast Asia, which are generating 40% of Telenor’s profits and which Burbeck thinks investors are undervaluing. Telenor’s 33% interest in Netherlands-based VimpleCom Ltd., the No. 2 mobile service provider in Russia, also is being undervalued, Burbeck says.

Reed also is enthusiastic about Telenor’s stock – as is a JPM report, which rates the stock as a “buy,” with a Dec. 31, 2015, price target of NK160 ($27.20). This target is below the NK142.70 ($24.26) at which the 1.6 million shares outstanding closed at on Oct. 24.

© 2014 Investment Executive. All rights reserved.