MGAs deliver in communications

Advisors say MGAs perform better than dedicated sales agencies in sharing information and being receptive to advisor feedback

- By: Johnna Ruocco

- July 25, 2012 October 31, 2019

- 23:06

Advisors say MGAs perform better than dedicated sales agencies in sharing information and being receptive to advisor feedback

Advisors with dedicated sales agencies are not as happy as their independent counterparts

Insurance reps say there is greater pressure to sell in-house products, resulting in greater dissatisfaction

Insurance advisors who work with well-heeled clients are looking for all-encompassing support services and competitive product pricing

The past year has been a time of resurgence, as insurance reps saw their asset bases and client bases grow vs the previous year

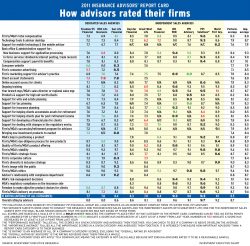

How advisors rated their firms

Some dissatisfaction has entered the fray however, advisors say there's still much to be positive about

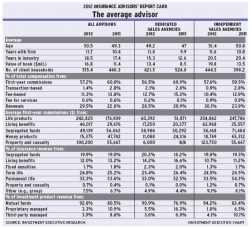

Advisors with dedicated sales agencies and independent sales agencies say there is much to like about their firms (includes main chart and one other)

Independent advisors are seeing rising pay and more satisfaction, while those with dedicated agencies are seeing the opposite (includes chart)

Communication is cited as the key reason for solid back-office support. As for tech tools, internal websites draw advisors’ ire

Many say oversight of agencies would result in more uniformity across the channel and prevent advisor fraud

While there are some key differences between dedicated agents and independents, all are increasing their sales of insurance products (includes chart)

The ratings reveal that advisors consider consumer advertising and marketing support to be more important to their businesses

Advisors are placing far greater importance on topics related to the support they receive for clients’ retirement planning

Advisors’ satisfaction increases because firms’ efforts are more in tune with their needs

Advisors with RBC Life rated their firm much lower this year because its new payout regime will change bonus payouts

Firms have stepped up and helped advisors deal with important regulatory changes

Advisors benefit from value of capital preservation (includes chart)

Major highlights: Departure of one firm, the addition of another, and big increases — and decreases — to some firms’ ratings (includes main chart)

Advisors take notice of their firms’ support as the demand for these services increases (includes chart)

Although some firms have delivered, others still have a way to go

Although the impact of the recession has been somewhat muted at insurance firms, there were still a few bumps in the road for some

Interactive Web tools and ad campaigns that promote the value of advisors’ expertise get kudos

Experienced advisors say they hope to receive the same calibre of training from their firms as newcomers

Advisors were most satisfied with the firms that had knowledgeable staff who provided comprehensive support