Despite all the headlines stemming from this year’s stock market volatility, the ups and downs essentially cancelled each other out. The U.S. stock market finished the first four months of the year flat, as measured by the bellwether Standard & Poor’s 500 composite index.

Rumblings of trade wars between the U.S. and China, continued rhetoric about the North American Free Trade Agreement and uncertainty surrounding U.S. relations with Iran and North Korea haven’t derailed the economic optimism and other positive factors bolstering U.S. stocks.

Even the sell-off earlier this year in high-profile technology stocks, including the famous FANG group – Facebook Inc., Amazon.com Inc., Netflix Inc. and Google (now Alphabet Inc.) – imposed no serious long-term damage to the sector.

Apple Inc. reported stronger than expected financial results for its fiscal second quarter and fears that iPhone orders were slowing proved to be unfounded when demand surged for the iPhone X. Other tech giants, such as Netflix, Amazon and Facebook, reported solid earnings, thus beating the analysts’ expectations in general and calming the market.

Economic growth in the U.S. in the first three months of this year was 2.3%, according to the U.S. Department of Commerce, down from the annualized 2.9% pace of the last three months of 2017, but still solid. However, economic growth is expected to strengthen over the balance of the year as the effects of rising employment and lower taxes for both individuals and corporations kick in.

The U.S. Department of Labor, for its part, recently reported that the unemployment rate fell to 3.9% in April, the lowest rate since 2000 and a sign of a competitive job market.

“Macro factors, such as economic growth, and favourable policy measures are creating a tailwind for U.S. companies,” says Tony Genua, senior vice president and research director of North American equities with Toronto-based AGF Investments Inc. and lead portfolio manager of the $1.2-billion AGF American Growth Class fund since May 2005.

“U.S. domestic activity is picking up due to lower consumer tax rates, and corporations are benefiting from tax cuts and deregulation,” Genua says. “At the same time, there is synchronized global growth. And to the extent that U.S. companies are global in nature, they are benefiting from a pickup in economic activity in Europe, Asia and other regions. We’re almost nine years into this economic cycle, but I expect it could last into 2019 or 2020.”

Strong job growth and accompanying wage gains often fuel inflation and lead to higher interest rates. Fund portfolio managers say that if rates rise too much or too quickly, the effect on stocks could be harmful due to the dampening effects of higher borrowing costs on economic activity and the attraction of safe, fixed-income investments.

The U.S. Federal Reserve Board is expected to jack up its trend-setting federal funds rate – currently at 1.75% – twice more this year. Meanwhile, the yield on the U.S. 10-year treasury bill temporarily pushed past 3% in April for the first time since 2014, luring some investors back into bonds and suppressing demand for some of the classic dividend-paying stocks that have acted in recent years as bond surrogates in the low interest rate environment.

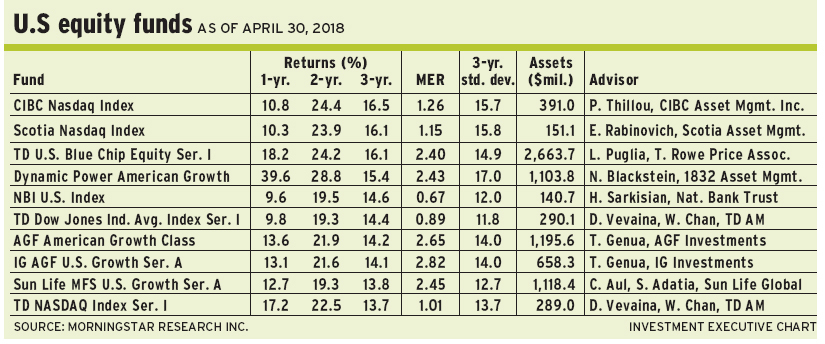

Under Genua’s management, the AGF fund achieved a 14.2% average annual return for the three years ended April 30, which puts it near the top of Morningstar Canada’s U.S. equity category. Genua employs a “growth style,” focusing on market leaders that are experiencing above-average growth in sales and earnings. He also seeks innovation in products or services and strong management teams.

Genua runs a focused portfolio of 30 to 50 stocks. He believes in a “high-conviction portfolio,” but lowers risk by diversifying. The AGF fund had holdings in 10 business sectors at the time of writing, with no exposure to utilities due to weak growth potential. Every day, Genua reviews the fund’s portfolio with a fresh eye, and anything that is not a “buy” is a “sell.”

“If a stock is reaching a fully valued state,” Genua says, “we book our profits and move on.”

In late 2017, Genua took profits in some of the FANG stocks as they rose to expensive levels, and essentially “defanged” the AGF fund. The move took the portfolio from an overweighted position of 36% in technology to a weighting of 25%, close to the benchmark index’s weighting for the sector.

The AGF fund’s largest holding is in Amazon, which, Genua says, will benefit as online shopping grows in North America. Only 10% of U.S. retail sales are transacted online now, he says, so there is huge potential for growth.

Altaba Inc., created from Verizon Communications Inc.’s acquisition of Yahoo! Inc.’s Internet business last year, is another holding in the AGF fund. Altaba owns a 15% stake in Alibaba Group Holding Ltd., the largest online retailer in China and the potential of this investment has not been fully recognized, Genua says.

Other technology stocks held in the AGF fund include NVIDIA Corp., Netflix and Adobe Systems Inc. NVIDIA designs semiconductor products such as graphics processing units for the gaming and professional markets, and chips for mobile computing. The company is moving into artificial intelligence and cloud-based technologies and, Genua says, it’s “on the doorstep of emerging trends” such as self-driving cars.

The AGF fund is overweighted in U.S. financial services, although Genua has avoided banks since the 2008-09 global financial crisis. He prefers wealth-management and brokerage firms, so the AGF fund holdings in that sector include Raymond James Financial Inc., TD Ameritrade Holding Corp. and Charles Schwab Corp.

In health care, Genua is leery of pharmaceutical companies, which may be facing pricing pressures. Still, the AGF fund holds shares in Illumina Inc., a biotech firm that develops systems for the analysis of DNA; and Idexx Laboratories Inc., a global provider of products for pets and livestock.

Noah Blackstein, vice president with Toronto-based 1832 Asset Management LP and portfolio manager of the $1.1-billion Dynamic Power American Growth Fund, has achieved superior performance in Morningstar Canada’s U.S. equity category for both short and long periods through a focus on bottom-up stock-picking methods.

“I look at how much bigger a company can get and the opportunities ahead of it to earn more,” Blackstein says. “I’m asking how long growth [will be] sustainable, and whether a $1-billion company can become a $5-billion or a $10-billion company.”

Blackstein is less concerned about big-picture forecasts and says too many forecasters get “macro” calls wrong. Even if the calls are right, he says, often markets’ reaction can’t be predicted.

For example, Blackstein points out, many investors anticipated that Brexit and the election of Donald Trump would be negative for stock markets. However, reactions to these events were bullish.

Blackstein ignores benchmark indices, and the Dynamic fund could be either heavily weighted in or completely out of certain industry sectors. More than half of the fund is invested in tech stocks, but, he says, index categorization is merely a label and doesn’t necessarily reflect the business focus of companies.

For example, Netflix, a provider of online content with a wide subscriber base, is listed as part of the technology sector but the firm’s business activities make it more like a communications/media company. And a tech company such as Amazon could be considered a retailer.

“I want to own 20 or 25 of the best companies with high sustainable growth rates and a long runway for expansion,” Blackstein says. “I don’t care where they reside in the index.”

Top holdings in the Dynamic fund include Abiomed Inc., a manufacturer of medical implant devices, including artificial hearts; and ServiceNow Inc., which provides software for cloud-based data management.

Also in health care, the Dynamic fund holds a significant position in Vertex Pharmaceuticals Inc., which focuses on drugs for viral infections, inflammatory conditions, autoimmune conditions and cancer. As well, Vertex developed a revolutionary drug to improve quality of life and longevity for cystic fibrosis patients.

Blackstein seeks companies capable of innovation and disruption, and with few competitors.

Whatever the Dynamic fund’s sector weightings, Blackstein ensures the portfolio includes a diverse mix of business models and revenue streams. On common ground with AGF American Growth, the Dynamic fund holds shares in NVIDIA, Amazon and Netflix.

Blackstein also foresees opportunities in online payment transactions and point-of-sale services and, thus, the Dynamic fund holds shares in PayPal Holdings Inc. and Square Inc. He steers clear of tech companies with advertising-based models that could face regulatory scrutiny regarding client privacy issues, including Facebook and Google (i.e., Alphabet).