Europe has staged a Lazarus-like recovery this year after a miserable 2016, thanks in part to more favourable macroeconomics and politics. However, fund managers are also cautious, given strongly rising multiples.

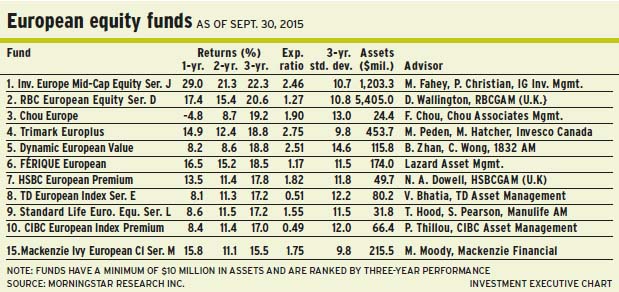

“The earnings recovery in the U.S., post-financial crisis, was stellar and earnings were much higher than the previous peak. But Europe came later. Earnings tracked sideways for a while and have been catching up in the past 18 months,” says David Lambert, senior portfolio manager with London, U.K.-based RBC Global Asset Management (U.K.) Ltd. (RBCGAM/U.K.), who co- manages RBC European Equity Fund with Dominic Wallington, RBCGAM/U.K.’s chief investment officer. “A weaker euro did help exporters, but generally there’s been top-line growth. And [gross domestic product] numbers have been picking up.”

The European Union (EU), as a whole, is expected to experience economic growth of about 2.2% in 2017, says Lambert. Gross domestic product (GDP) for Spain, for example, is expected to grow by 3.2% this year.

“[The EU is] coming off a low base, but [these countries] have fixed a lot of problems. Next year’s GDP forecast in Spain is 2.7%. GDP numbers [in the EU] have been relatively robust,” says Lambert, noting that unemployment dropped to 3.7% in Germany, to 4.4% in the U.K. and to 9.8% in France. “Things are moving in the right direction.”

From a political perspective, Lambert says, the environment has calmed down considerably, and he cites recent election results.

“The political risks seem to have moved away from Europe and toward North America,” says Lambert. “The risk of an [EU] breakup is a lot lower and it would be surprising if we got anything unusual in Germany. Brexit is the one known unknown, and it’s a bit too early to say how it will shake out.” He notes that the hardliners in the U.K. apparently are giving in to those in the “soft” Brexit camp.

From a valuation standpoint, Lambert admits, he’s concerned that the bull market is long in the tooth and that multiples have risen appreciably: “We need to see earnings continue to come through. We need the earnings to do the heavy lifting. That’s what keeps me up at night.”

Lambert is a bottom-up investor, and the RBC fund’s country weightings are a byproduct of stock selection. The U.K. accounts for 28.3% of the fund’s assets under management (AUM); Germany, for 12.9%; the Netherlands, 12%; and Switzerland, 9%; with smaller weightings in countries such as Denmark. From a sectoral perspective, financials account for 19% of AUM, followed by consumer staples (16.3%), industrials (15%) and health care (12.4%), with smaller holdings in sectors such as energy.

A top holding in the 50-name RBC fund is Ryanair Holdings PLC, parent of a leading, low-cost airline based in Ireland. “It’s the highest return-on-capital airline in the world,” says Lambert, adding that the stock’s cash flow return on investment is 14.4%. Ryanair, by being the lowest-cost provider and serving about 125 million passengers a year, has been able to get better terms with airports and boost its parent’s returns. Shares are trading at 17.70 euros ($24.90), or 15.5 times forward earnings. There’s no stated target, although Lambert believes that Ryanair can compound its shareholders’ equity by double digits.

The European Central Bank has continued to be accommodating and unemployment rates also have improved, observes Matt Peden, vice president and portfolio manager on the global equities team of Atlanta-based Invesco Advisers Inc., who is lead manager of Trimark Europlus Fund. But, he adds, markets have been helped by the removal of several key headwinds, such as uncertainty regarding France’s elections and Italy’s banking crisis.

“[Emmanuel] Macron, the pro-EU candidate, had quite a strong majority win and therefore, France will remain in the EU and push for more integration,” says Peden, who shares duties with Michael Hatcher, vice president, global equities, at Toronto-based Trimark Investments Ltd. “There’s hope that Macron will implement some reforms and boost the economy.”

Meanwhile, Italy’s banking system had long been plagued by a large stock of non-performing loans and several banks were experiencing large withdrawals of deposits.

“The turning point was probably in June, when the government bailed out two regional banks with a 17 billion euro fund and acted as a backstop to their non-performing loan book,” Peden says. “We had a resolution of some of the lingering concerns people had about Europe.”

Investor sentiment has swung back to Europe, says Peden: “From what I’ve heard, people are seeing relatively better value in Europe after the strong performance of the U.S. market. The issues around the banking system are starting to fade away, providing investors with more confidence.”

Nevertheless, Peden argues that valuations are excessive: “We are at the upper end of the range. Most global indices, with the exception of the emerging markets index, are nearing historic highs.” The benchmark MSCI Europe index is trading at 20.3 times trailing earnings and 14.7 times forward earnings, while the S&P 500 composite index in the U.S. is trading at 23.6 times trailing earnings and 18 times forward earnings.

However, Peden admits he’s being cautious, based purely on equities valuations. As a result, about 20% of AUM is held in cash.

“We sold a few holdings, which reached full valuations and there was some downside risk,” he says. “Given where the market is and the valuations on the type of quality businesses that we look for, we have not been able to replace those holdings. This cash level is consistent with last year.”

Peden, a bottom-up investor, has allocated about 40% of the Trimark fund’s AUM to the U.K., although many of those firms generate most of their revenue outside the U.K., such as Diageo PLC and Reckitt Benckiser Group PLC. There’s also 12.9% of AUM in France, 5% in Denmark and 4% in the Netherlands, with smaller holdings in countries such as Ireland. The sector allocation is dominated by 39.3% in industrials, followed by 23.1% in consumer staples and 5.7% in information technology, with smaller holdings in sectors such as financials.

One top holding in the 22-name Trimark fund is Unilever NV, the Netherlands-based global consumer staples conglomerate that fought off a takeover bid last winter from Chicago-based Kraft Heinz Co. “[The takeover bid] put pressure on Unilever’s management team to run the business more efficiently. Shareholder returns seemed to be secondary to ESG initiatives that were pushed by its CEO, Paul Polman,” says Peden. (ESG stands for “environmental, social and governance.”)

A strategic review led to plans for Unilever to divest its so-called “spreads” business and concentrate on raising operating margins to 20% (compared with about 15% currently) and a share buyback program. Shares are trading at 50.50 euros ($73.25) or 22.5 times forward earnings. There’s no stated target.

“We are long-term buy-and-hold investors,” Peden says. “Our expectation is that the shares will compound value at a decent rate.”

Another favourite is France-based Bureau Veritas SA, which is No. 2 in the field of testing, inspection and certification in a variety of industries, ranging from electronics production to mining.

“Banks need an independent third party to verify mine samples, for instance,” says Peden, noting that Veritas is also a world leader in certifying ocean-going vessels. Shares are trading at 21 euros ($29.70).

© 2017 Investment Executive. All rights reserved.