Participating or “par” insurance is so named because policyholders share the underlying risks with the insurance company. This shared risk may also lead to rewards through dividends issued by the par account, which is managed by the insurance company.

Policyholder dividends are based primarily on the returns from investing policy premiums minus associated expenses such as benefit payouts, policy cancellations and taxes. The insurer sets the dividend payout scale and, depending on a year’s net earnings, dividends may increase, decrease or not be paid at all.

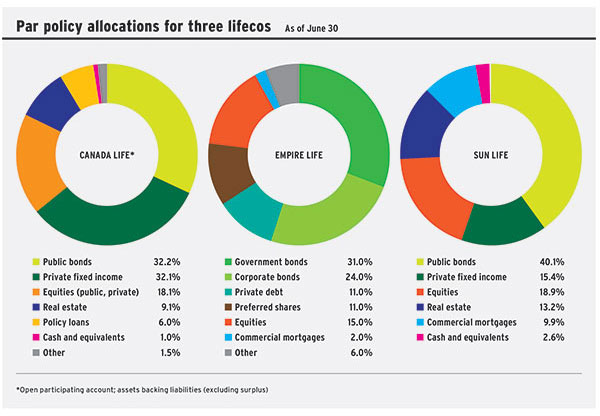

In the current environment of rising inflation, low interest rates and high valuations, how are insurance companies adjusting their par policy investment portfolios?

“From an investment perspective, the par account needs to provide resilient long-term investment performance that meets the insurance promises we’ve made, and deliver robust investment returns that add value to the policyholder across multiple business cycles,” said Ryan Marcy, vice-president, large case services insurance solutions, with Canada Life Assurance Co. “To achieve these objectives, we regularly review the participating account investment strategy with a goal of providing stable, long-term returns.”

Marcy said active management, particularly with regard to diversification, adds “incremental value at both the strategic and asset levels, especially during times of market turbulence.” That said, Canada Life doesn’t try to time the market or make a call on interest rates, he said.

Earlier this year, Canada Life shifted its par account’s target asset mix to 70% fixed income, down from 75%.

“We have increased our allocation to both U.S. and Canadian real estate, leveraging the expertise from our affiliates, and have also increased our account’s target exposure to private equity and U.S. public equities,” Marcy said, adding that these moves increased asset-class diversification while providing greater risk-adjusted return potential.

Mike Stocks, vice-president and chief marketing officer, retail, with Empire Life Insurance Co., said his firm takes a value investment philosophy to managing its par fund holdings, which are diversified across several asset classes.

“Each asset class is managed by experts in their respective fields and we also have a par fund oversight team that regularly adjusts the overall asset mix,” Stocks said. “Given that our par fund is relatively small compared to [those of] some of the bigger lifecos, we believe [that] gives us an advantage in terms of our ability to quickly adjust to changing market conditions and to capitalize on opportunities.”

Empire Life’s par fund has a significant weighting in long-term bonds, which have performed well on a risk-adjusted basis for several years, Stocks said. “However, given that interest rates are now so low, bonds are not expected to do as well going forward.”

As a result, Empire Life has reduced its bond exposure and increased weightings in private debt, preferred shares and common equities. The insurer “also started to move into alternative asset classes such as real estate and infrastructure,” Stocks said.

Vineet Kochhar, senior vice-president, insurance solutions, with Sun Life Financial Inc., said Sun Life’s par portfolio uses a 70/30 mix and is diversified across industries, companies, asset classes and financial instruments. “Our fund mix has remained relatively stable over the past 10 years, with some changes during the past five years in our fixed income assets, where we chose to increase the quality of our public bonds,” he said.

Kochhar stressed his firm’s long-term approach: “The investment guidelines for each asset class within the participating account are designed to satisfy the long-term objectives, liquidity requirements and interest-rate risks for our participating account.”

Sun Life also amortizes gains and losses over time, which mitigates fluctuations in the market. These “smoothing techniques help keep the dividend scale interest rate more stable over time, minimizing short-term volatility,” Kochhar said.

Looking ahead, these three insurance companies do not foresee major risks that might affect the management of their par accounts, but are staying vigilant.

“One of the main risks is the prospect of continued low or even lower interest rates,” Marcy said.

Stocks agreed. “The main risk is that bond yields continue to fall. However, even under that scenario, we still expect our par fund to perform quite well, given that we continue to maintain a fairly large position in bonds,” he said.

Par account yield for the year ended Dec. 31, 2020

Canada Life: 3.2%*

Empire Life: 9.7%

Sun Life: 9.1%

*Does not include unrealized gains/losses on bonds, unlike for competitors. This is a material difference due to the significant weighting in fixed income in par accounts.

Click image for full-size chart