Solo living increasingly is becoming the norm in Canada, yet singles still face greater barriers to financial security than common-law or married couples do.

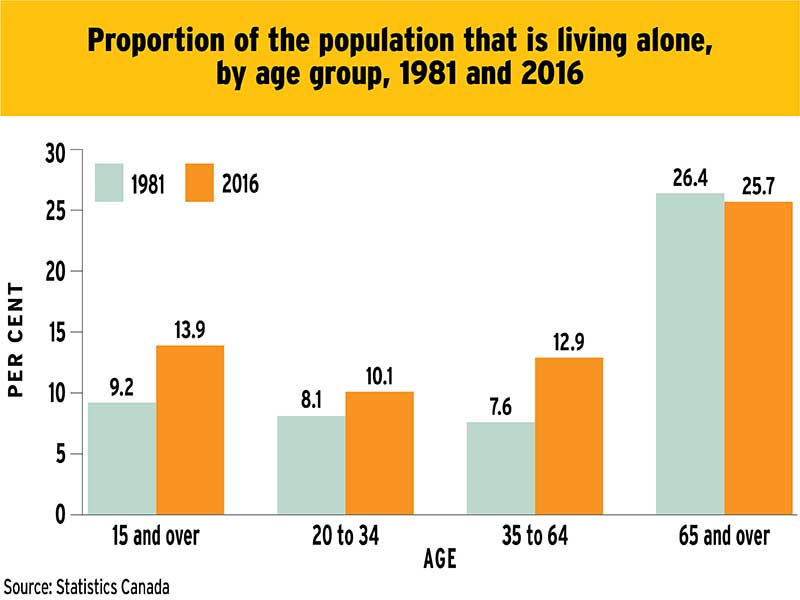

For the first time in Canada’s history, one-person households are more common than all other types of living situations: 28.2% of households consist of Canadians living alone, which is more than the percentage of couples with or without children (26% for each demographic), according to 2016 census data from Statistics Canada.

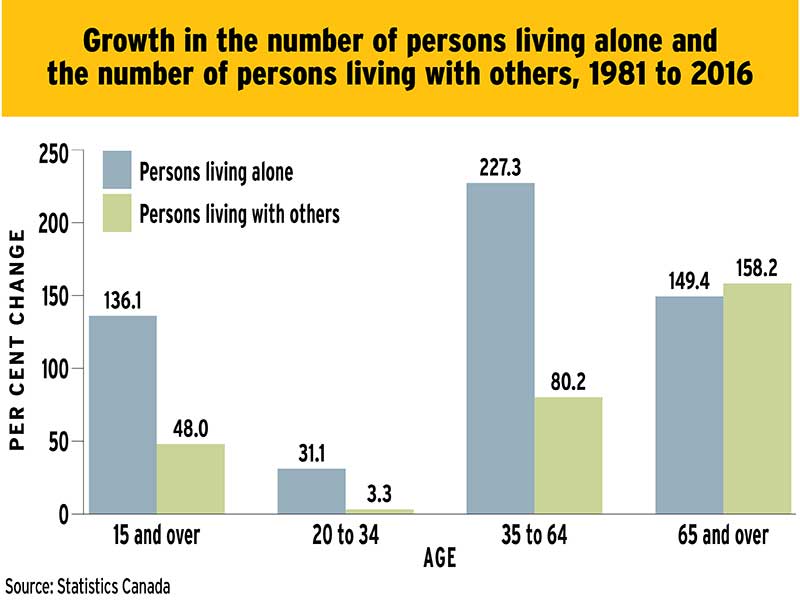

Another study by Statistics Canada, the “2017 General Social Survey on Family,” found that the rate of living alone has climbed fastest among adults aged 35 to 64 – typically, the wealth accumulation years. Yet singlehood can cause serious financial strain – in part, because these people do not share the costs of large expenses such as home ownership.

Furthermore, members of this group increasingly are supporting other family members, such as children or parents. “The demand on their budget is a little more intense,” says Amy Dietz-Graham, portfolio manager and investment advisor with BMO Nesbitt Burns Inc. in Toronto. Sometimes, these clients don’t share the additional costs of a child with a partner, costs that often include huge expenses such as saving for post-secondary education.

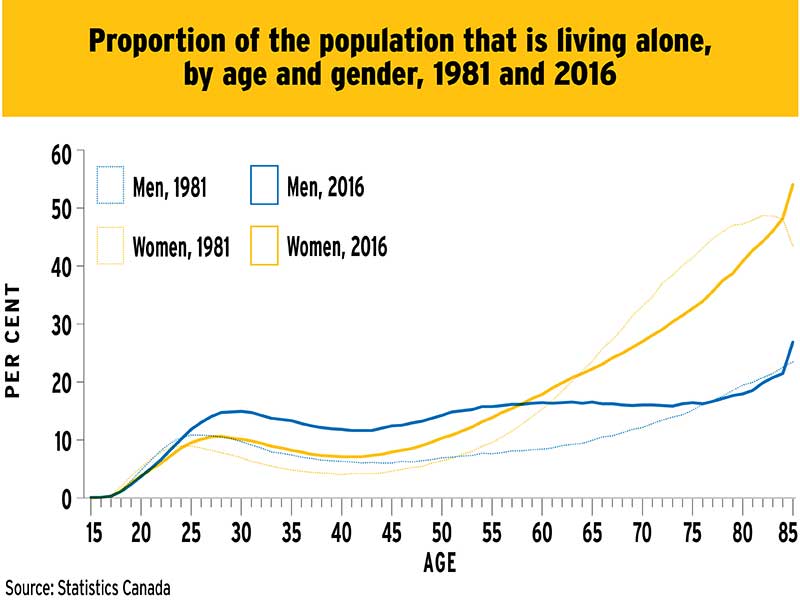

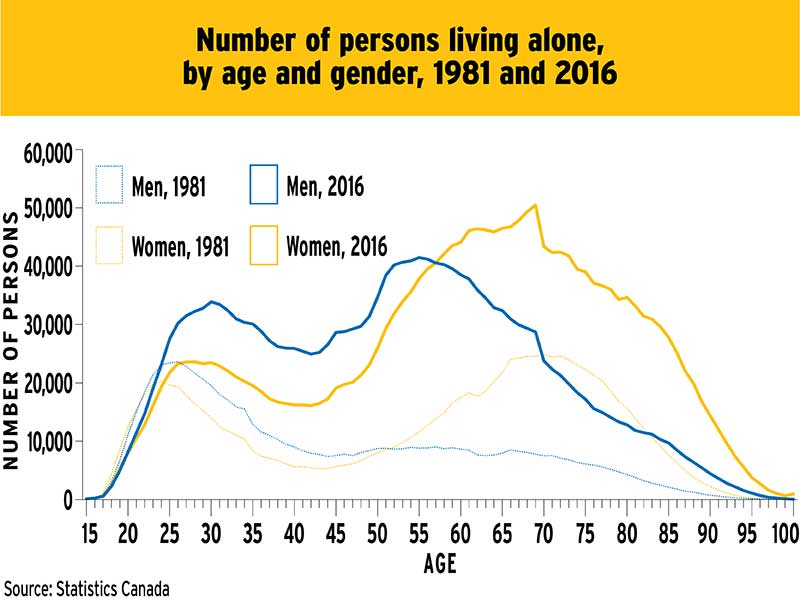

These demands can be even more pressing for women. Financial advisors must understand the financial implications of a single woman with a child who is living on her own, says Jackie Porter, partner and financial planner at Mississauga, Ont.-based Carte Wealth Management Inc. For example, taking a couple of years off work to have a child is likely to affect a woman’s ability to accumulate wealth.

The costs of caregiving, whether through financial support or time off work, doesn’t apply only to children. “If mom and dad are aging and need help, the person who gets called on is the single person,” Porter says. Again, women often take on this caregiving role more than men, she adds.

Single women need to be especially careful of their finances because women typically live longer than men do (which means women need to save more for retirement than men may need to) and women still make less money than men do. According to Statistics Canada, women now earn 87¢ for every dollar earned by men.

Single people, regardless of gender, also cannot take advantage of the tax breaks available to common-law and married couples. For example, pension income splitting – the ability to split all eligible pension income with a spouse or common-law partner – can lead to significant tax savings for someone who earns a high income.

“Single people don’t have that ability and, in some cases, are actually paying a lot more in taxes,” says Sophia Ito, financial advisor with Nicola Wealth Management Ltd. in Vancouver.

Ito suggests advisors take a holistic wealth-management approach with single clients to ensure they still can achieve financial security.

Part of this approach includes providing more hands-on support in helping these clients reach their goals. It is common for single clients to want an advisor they can receive meaningful feedback from – perhaps more common than with other clients.

“[Singles] want someone who can quarterback different aspects of [wealth management],” Ito says, “because they don’t necessarily have a second opinion right beside them who is able to clarify some of the issues or push back on some of the concerns they might have.”

If you are looking to be such a quarterback, here are some ways to get started:

Reduce fixed expenses

You can begin by helping your clients think about keeping their fixed expenses, such as housing costs – whether that’s a mortgage or rent – car payments and utility bills, as low as possible.

“If we can keep their fixed expenses in check relative to their income, then they have a better chance of not relying on debt for miscellaneous expenses such as dining out or lifestyle experiences,” says Sara Zollo, a financial planner with Sara Zollo Financial Solutions Inc. in Richmond Hill, Ont.

You can help clients looking to buy a home ensure that they’re not biting off more than they can chew, Zollo adds. Alternatively, clients who have become single through death or divorce, or who have just had a child leave the nest, should consider whether downsizing their home might be useful.

These clients also could consider how to gain secondary income using their property, Porter says, such as taking in a roommate or a tenant.

Develop an emergency plan

You also can help single clients develop contingency plans that cover losing their income stream, such as through job loss. Single clients would have more difficulty maintaining their lifestyle following a significant income change than their married counterparts may.

“Typically, I would say to have three to six months of living expenses in an emergency fund,” Zollo says. “But, for someone who’s single, I might even up that to eight or 12 months just because they only have themselves to rely on.”

Zollo adds that single income earners can get into trouble with debt because they can accumulate debt through circumstances beyond their control.

For example, single clients may be forced to use debt to finance an unexpected expense, such as a car repair. Because these unexpected expenses are harder to pay off on time, Zollo helps her clients consolidate debt, shifting it so it accrues interest charges at the lowest possible rate.

“Also key for these clients, when coming up to a [mortgage] renewal, is to consider if they want to roll any consumer debt or line of credit into the mortgage and just have one payment that will help open up their cash flow,” Zollo says.

Zollo helps her clients reallocate the savings left over from such moves into a TFSA to bulk up an emergency fund.

Long-term planning

One of the biggest concerns among single people is how they’re going to support themselves throughout retirement.

“You want to make sure that your retirement plan is stress-tested against longevity,” Zollo says. This means accounting for inflation and predicting future retirement income streams.

Single clients could consider whether annuities are a good fit for them. “[It’s] a promise of a paycheque for life, so [the annuityholder won’t ever] run out of that fixed amount of money,” Zollo says.

While planning for the future, single people, more so than those living as a couple, also need to examine long-term care insurance, which provides a tax-free monthly payment that could ensure the policyholder receives assistance with the activities of daily living if needed, especially as nursing homes and long-term care facilities are a large monthly expense and those costs are rising rapidly.

“If I do a retirement plan for someone and we see that they’re set for retirement,” Zollo says, “we also want to stress test that plan to ask if, hypothetically, at age 85 they need to go into a care home – which could be an additional $6,000 monthly – do they run out of money?”

Other types of insurance, such as critical illness and disability insurance, also can be important to ensure some financial support if serious health issues arise.

Life insurance

Single people, particularly those without dependents, often disregard life insurance. To help answer the question of whether or not to buy life insurance, Porter tells her clients to research what their final expenses after death would be and determine their last wishes.

For example, a coffin burial is much more expensive than cremation.

“[I tell clients] to talk to a funeral home and then do the math for insurance costs,” Porter says. “[People] have to consider how much a premium over their life expectancy would be to pay for their final expenses versus paying with their own money.”

Estate planning

When discussing a client’s final wishes, you would be remiss to exclude wills and estate planning.

“Canadians are notorious for not having a will – and it’s worse within the single population,” Porter says.

Sometimes, single clients will say they plan to spend all of their money before they die, so a will gets placed on the back burner. However, deciding power of attorney is an essential component of estate planning that clients shouldn’t gloss over.

A power of attorney for care is essential because it gives single people the ability to advocate for themselves if there comes a time when they may not be able to speak for themselves, Porter adds.

An estate plan also can help clients direct their legacy in case they do have money to pass on. Without a will in place, clients will have no control over how their money is distributed. These clients should be intentional about what they want, Porter says, by deciding to leave money to a charity they’re passionate about or to a family member, such as a nephew or niece.