As previously announced, Fidelity Investments Canada ULC has made changes to its capital yield funds following amendments to the Tax Act (Canada) introduced in the 2013 federal budget. Effective January 16, Fidelity completed the merger of its remaining four capital yield funds.

The amendments to the Tax Act were designed to eliminate the tax-related benefits associated with the forward contract transactions, used by capital yield funds, from Dec. 31, 2014.

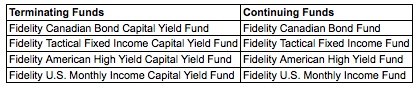

The four terminating funds were merged into their corresponding reference funds, which are existing Fidelity Investments mutual funds. On January 16, securityholders automatically ceased to hold units of the terminating funds and became securityholders in the continuing funds.

Fidelity Investments Canada ULC is part of the Fidelity Investments organization of Boston, one of the world’s largest providers of financial services.