CDS sees need for default fund

Proposed new fund would guard against losses due to participant defaults

- By: James Langton

- November 21, 2014 November 21, 2014

- 16:30

Proposed new fund would guard against losses due to participant defaults

Canada’s banks preparing for slower growth: analyst

The Calgary-based National Exempt Market Association responds to an editorial in the September issue of Investment Executive

Active traders offered research, discounts and preferred interest rates

CPPIB is contributing an additional US$400 million

The organization also recognized Robbie Pryde, Anne Marie O’Donovan and Jennifer Ocampo-King for supporting women in the capital markets business

BMO and RBC are “quality leaders” in equity capital markets

Two-day conference in Quebec City

Bank moves to serve more trade in Asia

IFIC supports next steps in review of financial planning and advice

Panel says regulators should consider imposing fiduciary duty on investment managers

More study of these markets is needed before regulators tinker with the rules, report argues

Clients can get an actively and professionally managed portfolio starting at $2,000

Q3 profit surges 70% to $350 million

Deal unlikely to result in substantial lessening of competition

Net income up 6.4% to $1.1 billion

The CRA’s update of its guidance notes will include several changes

Revenue grows to $53.4 million

The portfolio delivered a gross investment return of 3.4% for the quarter

Sprott intends to assume management contracts of two Royce specialty funds

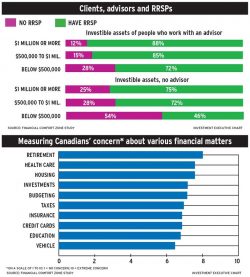

Survey by Financial Planning Standards Council draws attention to the impact of financial stress on Canadians

One victim allegedly defrauded on $25,000

Sun Life is considering allowing annuities to be purchased in installments

Invesco Canada responds to a recent Inside Track column from Neil Gross, executive director of the Canadian Foundation for Advancement of Investor Rights (a.k.a. FAIR…

Bank charter would help grow and diversify deposit base, CEO says