Goldpoint investors may claim compensation

Ontario Attorney General says $580,000 has been recovered under civil forfeiture law

- By: James Langton

- November 17, 2014 December 19, 2017

- 13:40

Ontario Attorney General says $580,000 has been recovered under civil forfeiture law

New rules aim to help investors better understand and compare packaged retail and insurance-based investment products

The current default to printed disclosure may be detrimental to consumers

UK watchdog finds small firms fail to manage financial crime risk

Firms are expected to implement the new guidance by May 1

OSC approves no-contest settlement

Comments due Jan. 12

Proposed changes step up supervisory requirements and aim to ensure consistent regulatory oversight

The alleged high-yield investment scheme used social media pitches on Facebook, YouTube, and Twitter

All countries have now implemented risk-based capital regulations

U.S., UK regulators imposes fines totalling more than US$3 billion

Many of the top threats facing investors involve new products in classic schemes

The regulator invites insurers to participate in a sixth quantitative impact study

CPMI issues report on cyber resilience in financial markets

IIROC partners with BBB to distribute quiz across Canada

Court of Appeal of Alberta dismisses leave application

Systemically important banks should hold double the capital of smaller banks

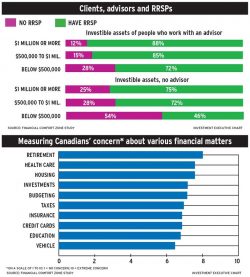

Regulators are seeking to answer questions about the possible influence of fee structures on fund sales

Former Assante rep used discount brokerage accounts to make up for client losses

Compliance deficiencies led to clients paying excess fees

Report examines progress on cross-border issues

IIROC suspends Winnipeg rep for KYC failings, unauthorized trades

The goal is to bolster confidence in residential mortgage insurance underwriting

30 banks considered the most systemically important globally

Raising the threshold from 20% to 50% would make it easier for dealers to raise capital from one another