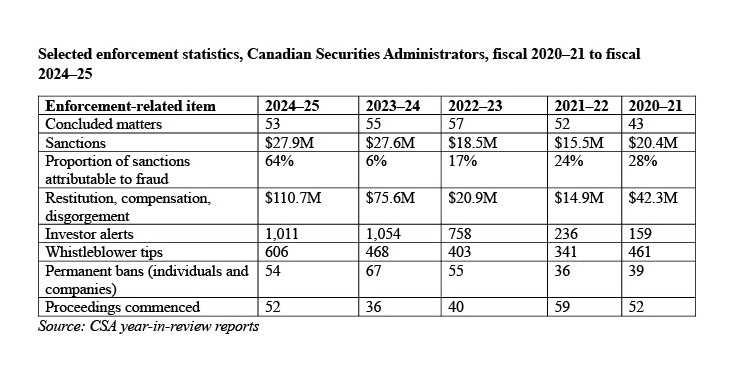

The proportion of sanctions attributable to fraud in 2024–25 was the largest in five years, based on enforcement statistics from the Canadian Securities Administrators (CSA), the umbrella group of provincial regulators.

The regulators imposed or obtained nearly $28 million in sanctions during the year ended March 31, the CSA’s latest year-in-review report, released on Thursday, says. While sanctions were flat year over year, fraud accounted for $17.9 million, or 64%, of the amount — the largest proportion in the past five years.

A spokesperson for the CSA said in an email that enforcement actions “vary considerably” each year, and depend on such things as the complexity and number of cases.

Still, the regulators are seeing “a substantial increase in all types of fraud, including online investment fraud” as bad actors exploit digital and social platforms. “CSA members take action to educate Canadians, disrupt misconduct and seek sanctions where possible,” the spokesperson said.

The year-in-review report said that in specific circumstances, some regulators or courts have restitution, compensation and disgorgement powers or can make financial orders to return money to investors. These amounts were up 46% year over year in 2024–25 to $110.7 million — $89.9 million of which was attributable to fraud.

“It’s important to emphasize that once money is fraudulently obtained, it can be nearly impossible for an investor to recover their money,” the CSA spokesperson said. Further, perpetrators are often based outside Canada, which is a complicating factor.

While the regulators’ investor alerts were relatively flat year over year at 1,011, alerts in the past two years increased significantly, in line with a surge in fraud.

A growing proportion of alerts relate to crypto assets — 75% of alerts in 2024–25 compared to about 50% the year before. The rise in digital assets and online investment fraud has resulted in more intelligence-sharing efforts with police, and with other enforcement agencies in Canada and abroad, the report said.

In 2024–25, CSA members took enforcement action in 20 crypto-related matters, the report said. Among them, an operation in March helped identify compromised ethereum wallets and warned potentially affected crypto investors.

The report also noted that in the past three years, many global crypto asset trading platforms were registered as restricted dealers. That registration allows the platforms to operate in a regulated environment for a limited period while working toward obtaining membership with the Canadian Investment Regulatory Organization (CIRO). CIRO membership became a requirement for the platforms beginning in August 2024.

Regulators respond to U.S. policy stance, launch testing environment

The CSA’s year in review also detailed the regulators’ paused, completed and ongoing initiatives over the past year, to the end of June, as the regulators completed a three-year business plan.

Work on a mandatory climate-related disclosure rule for issuers was paused earlier this year “to support Canadian markets and issuers as they adapt to the changing economic and geopolitical landscape,” the report said. The regulator also paused work on amendments to diversity-related disclosure requirements.

Completed initiatives include implementation of the regulatory regime for over-the-counter derivatives, helping with the implementation of total cost reporting and conducting sweeps (over the past three years) to ensure compliance with the client-focused reforms (CFRs).

Results of 2024 sweeps on know-your-client, know-your-product and suitability CFR requirements will be published later this year, the report said.

Also in 2024–25, the regulators proposed a modernization of the continuous disclosure regime for investment funds, and introduced blanket orders to support capital raising.

Rule changes in support of the T+1 settlement cycle were implemented, and amendments to accommodate a range of settlement cycles for mutual funds, including those switching to T+1, came into force in August 2024.

Through the CSA Collaboratory, a regulatory testing environment to foster innovation, the regulators published a consultation on client data portability and electronic KYC. Future projects may include tokenization, decentralized finance and AI in the capital markets, the report said.

To streamline regulation, most of the provincial regulators handed off the dealer registration function to CIRO in 2025.

Binding authority for OBSI and more

Providing the Ombudsman for Banking Services and Investments (OBSI) with authority to make binding compensation decisions remains an ongoing regulatory initiative, with a consultation running on the CSA’s proposed approach to oversight of OBSI and a mechanism to review larger compensation decisions before they become final. Provinces and territories will have to make legislative amendments to enable investors in their jurisdictions to pursue claims under the proposed framework.

Modernizing mutual fund practices is also ongoing, with proposed amendments to the principal distributor model used in fund distribution and amendments to ban chargebacks. The regulators also published for a second comment period proposed amendments for an access model for corporate issuers and funds.

Reviewing client-facing advisor titles and proficiency requirements are also ongoing. The CSA conducted research related to the proficiency regime for registrants to “help assess potential enhancements” to the framework, the report said. However, proficiency isn’t mentioned in the regulators’ 2025–28 business plan.

Editorial note: This story was updated on Aug. 15 to clarify financial orders as restitution, compensation and disgorgement.