Following up on the publication of its December 2017 position paper on segregated funds, the Canadian Council of Insurance Regulators (CCIR) on Thursday released the final version of the proposed minimum required content for segfund account statements, along with a prototype of the expected new approach to disclosure.

Both documents are available on the CCIR’s website.

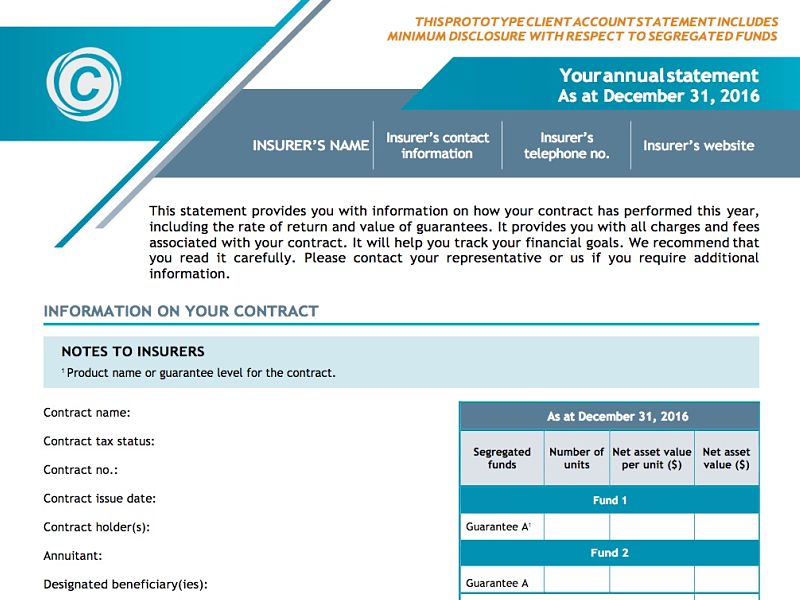

The model disclosure document sets out the minimum content requirements for account statements, but does not prescribe the form or design of client statements.

Insurers will be expected to ensure that their statements include all of the required information, but that they will have flexibility in terms of determining the layout and look of their disclosure documents.

Insurers will also be able to adapt their disclosures to ensure consistency in the language and terminology with the insurance contract and Fund Facts documents.

The new expectations for seg fund disclosure “come at a time of increasing demands and requirements for a greater degree of transparency in the financial services industry, including around the costs of financial products and services,” the CCIR says in a news release.

A prototype account statement provides an example of how the information could be provided to clients.

“The minimum content and the format of the prototype statement were subject to extensive consultation with industry members and comprehensive consumer focus group testing,” the CCIR says.

“The prototype statement provides guidance for insurers with respect to the expectations of the regulators about how the required disclosure is presented,” says Patrick Déry, chairman of the CCIR, in a statement.

“Consumers will be able to see both summary and detailed information on cost and performance of segregated funds, in plain language, and thus will be better able to compare the products that are available to them. This information will better assist advisors in discussing segregated fund performance and costs with their clients.”

“The CCIR will also co-ordinate as much as possible with the Canadian Securities Administrators (CSA) with respect to future developments and consider the implications of the CSA’s work on expanded cost reporting, a best interest standard, embedded commissions and management of incentives,” the regulator says.