Attention turns to financial planning

The percentage of advisors who create financial plans for clients and the percentage of clients with a financial plan are rising

- By: Rudy Mezzetta

- August 26, 2016 November 9, 2019

- 00:00

The percentage of advisors who create financial plans for clients and the percentage of clients with a financial plan are rising

As the regulatory environment in the financial services sector continues to evolve, keeping up with a steadily growing list of compliance responsibilities is a major…

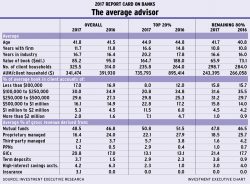

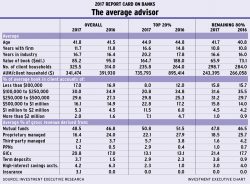

The average age of the financial advisors surveyed for Investment Executive's annual Report Card series has been rising over the course of this decade

CRM2, with its focus on enhancing the investment costs to clients, is transforming advisors' traditional revenue model

Most advisors say they already have transformed their businesses in anticipation of CRM2, but others say the new regulatory regime is bound to be disruptive

Although advisors are continuing to see significant growth in their books of business, their practices are undergoing a seismic transformation as a result of new…

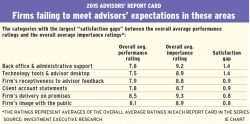

Work remains to be done to improve firms' communication efforts with their advisors

A significant percentage of advisors recommended their firm, but a close look reveals that this usually comes with stipulations

Technology is often a source of dissatisfaction, but some firms have found the right formula

Despite multiple complaints across the board, advisors with certain firms say that having strong relationships and competent and proactive staff are key to success with…

Advisors hope the new CRM2 reporting requirements will end their pervasive - and persistent - dissatisfaction with client account statements

Advisors are focusing on building their businesses and growing their assets under management at a time when not only has recent economic and financial performance…

Powered by surging stock markets, advisors see gains in key metrics

Advisors across all channels of the financial services sector are adamant that their firms are providing independence, a positive work environment and stability. Yet, these…

Advisors expect their branch managers to be supportive, knowledgeable and resourceful leaders who can be relied upon

Financial advisors across all channels of the financial services sector look to their firms to provide the necessary training to keep advisors’ knowledge and skills…

Support for mobile technology and for using social media rose in importance - and it's the younger advisors driving this trend

Not only is recognition a poor substitute for better pay, many advisors say, but it's just the top advisors who are rewarded

As the glut of baby-boomer advisors continues to get older, succession programs are becoming more and more important

For the most part, firms are on the ball in helping their advisors deal with the major regulatory changes that are taking place in the…

It's been a great year for advisors, as they are enjoying an all-time high in the average book of business while their firms continue to…

Once considered pariahs within financial services firms, compliance officers are now viewed as “partners” in doing business, who are “eager to help” and respond “immediately”

Advisors of all stripes say that even though their firms are open to receiving advisors' feedback, their suggestions are seldom put into place - nor…

Firms are performing strongly in their approaches to diversity in the workplace

Firms and their advisors have embraced financial planning, but it appears clients have not. Advisors cite the time and the complexity involved in preparing a…