PAID CONTENT

The latest report from the Intergovernmental Panel on Climate Change (IPCC)1 shows us once again that the consequences of the climate crisis are being felt around the world and that the only way to address it is to reduce our greenhouse gas (GHG) emissions. This oft-repeated observation reminds us that colossal sums must be invested in the transition economy every year. In order to meet net-zero emissions targets, governments and the private sector must work together and, above all, pool their financial means. Green bonds are an instrument that is increasingly being used to achieve this.

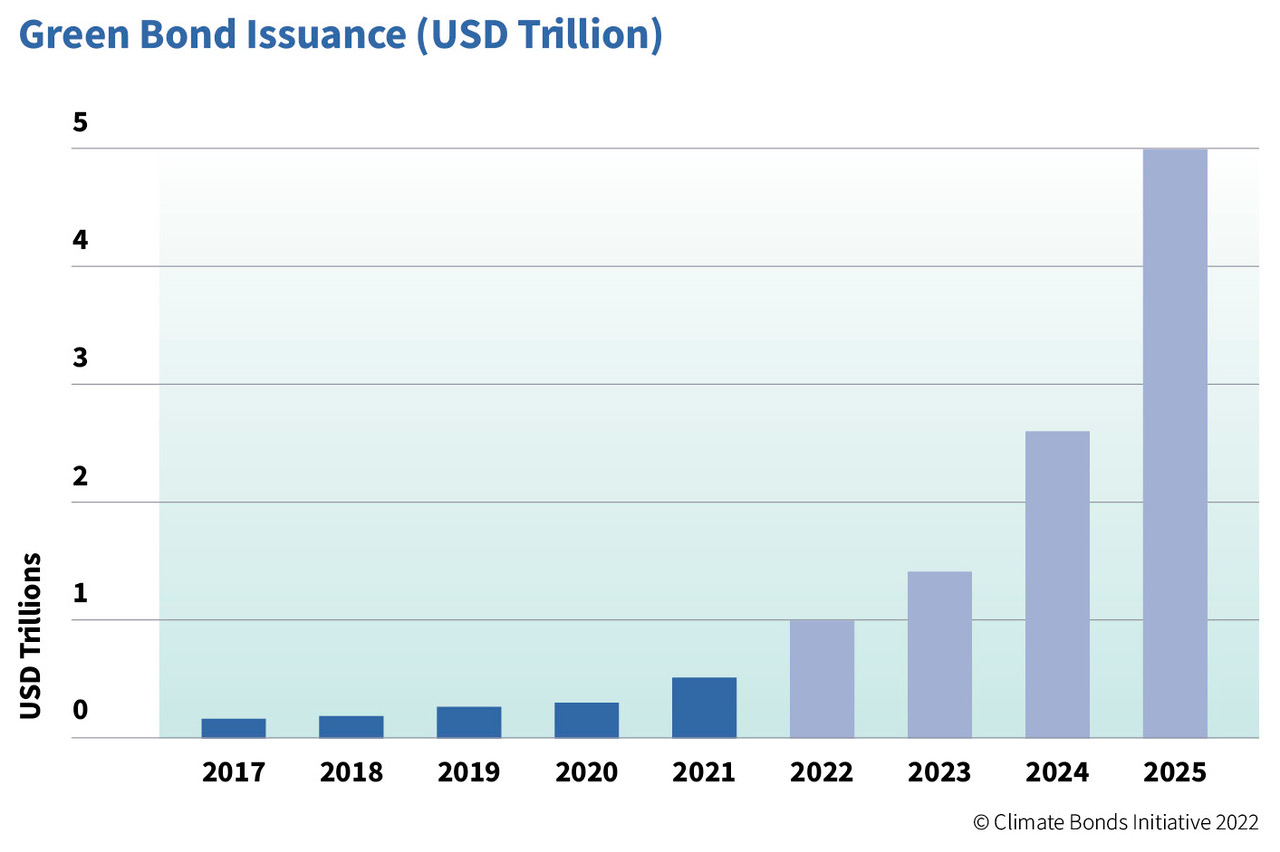

Green bonds have gained popularity in recent years. The Climate Bond Initiative estimates that the green bond market will reach one trillion U.S. dollars in 2022. This is more than double the value of 2020 issues.

Since the first issue of green bonds in 2007, many companies and governments have used them to finance green projects focused on protecting the environment, adapting to climate change, and reducing GHGs. In 2014, in order to regulate the market and limit greenwashing, the International Capital Market Association (ICMA) launched the Green Bond Principles to which most current issuers adhere.

Here are the four key areas on which the Green Bond Principles are based:

- Use of funds

- Project selection and evaluation process

- Fund management

- Reporting

Why hold bonds in a portfolio?

Considering the current economic environment and market volatility, which is expected to continue in 2022, there are advantages to integrating bonds into your portfolio:

- Make use of an instrument that offers a stable source of income

- Preserve your capital

- Enjoy attractive diversification potential

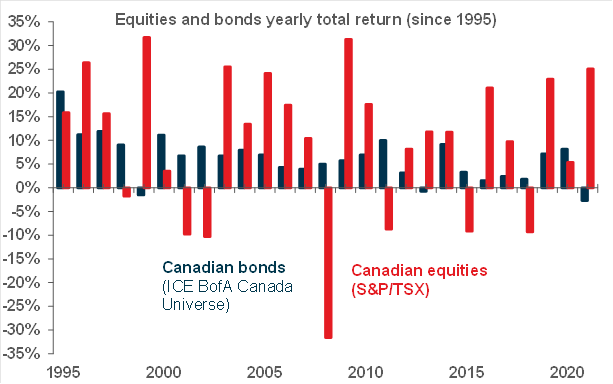

History shows us that bond returns are less volatile than equity returns and positive when equity returns are negative.

Sustainable products at NBI

As part of its drive to offer innovative products, in February 2022, National Bank Investments launched a new Sustainable Canadian Short-Term Bond ETF (TSX: NSSB).

Since 2020, it has already offered the NBI Sustainable Canadian Corporate Bond ETF (TSX: NSCC) and the NBI Sustainable Canadian Bond ETF (TSX: NSCB) (NSSB, NSCC and NSCB, together are the “NBI Sustainable Products”). The latter has also been deployed in the form of a mutual fund.

Why NBI Sustainable Products are a good economic and environmental choice:

- They are primarily intended to finance projects with positive environmental and social impacts

- They can contribute to achieving the UN Sustainable Development Goals

- They are managed by portfolio sub-managers who base their internal analysis on widely recognized sustainability guidelines, principles, and/or objectives.

Please refer to the NBI Sustainable Products prospectus for more information.

Green bonds are a wise choice to balance a portfolio and protect against market volatility, while contributing to projects that are positive for the environment and society.

1 Working Group II Sixth Assessment Report

Legal notes

The information and opinions herein are provided for information purposes only and are subject to change. The opinions are not intended as investment advice nor are they provided to promote any particular investments and should in no way form the basis for your investment decisions. National Bank Investments Inc. has taken the necessary measures to ensure the quality and accuracy of the information contained herein at the time of publication. It does not, however, guarantee that the information is accurate or complete, and this communication creates no legal or contractual obligation on the part of National Bank Investments Inc.

NBI ETFs are offered by National Bank Investments Inc., a wholly owned subsidiary of National Bank of Canada. Management fees, brokerage fees and expenses all may be associated with investments in exchange-traded funds (“ETFs”). Please read the prospectus or ETF Facts document(s) before investing. ETFs are not guaranteed, their values change frequently, and past performance may not be repeated. ETF units are bought and sold at market price on a stock exchange and brokerage commissions will reduce returns. NBI ETFs do not seek to return any predetermined amount at maturity.

© 2022 National Bank Investments Inc. All rights reserved. Any reproduction, in whole or in part, is strictly prohibited without the prior written consent of National Bank Investments Inc.

® NATIONAL BANK INVESTMENTS is a registered trademark of National Bank of Canada, used under license by National Bank Investments Inc.

National Bank Investments is a member of Canada’s Responsible Investment Association and a signatory of the United Nations-supported Principles for Responsible Investment.