At the 2nd Annual ETF Summit 2019, we caught up with Trevor Cummings, Director and ETF Leader for BlackRock Canada

Trevor Cummings

Director and ETF Leader

BlackRock Canada

The ETF industry in Canada has grown rapidly over the last year – as of the end of September 2019, total assets under management grew to $188 billion.1

In early 2019, RBC Global Asset Management (“RBC GAM”) and BlackRock Canada’s iShares business2 came together to form RBC iShares, a strategic alliance that delivers Canada’s most comprehensive ETF offering. At the 2nd Annual ETF Summit 2019, we caught up with Trevor Cummings, Director and ETF Leader for BlackRock Canada, to discuss how asset allocation and factor investing, together with passive and active strategies, can help build effective portfolios in a modern advisor practice.

Let’s talk about visibility of returns, which is a common theme in BlackRock’s research. What’s the significance of asset allocation to an investor’s portfolio?

Asset allocation policy is crucial. We’ve seen numerous studies which suggest that over 90% of historical variance of portfolio returns over time is due to asset allocation, versus security selection or market timing.3 Therefore, sound asset allocation is really the most important thing you can do as a first step to con-structing an efficient portfolio.

Why is asset allocation particularly important in today’s investment environment?

I think there are newer risks that advisors need to be cognizant of, risks that place an even greater emphasis on getting asset allocation right. Some of these are linked to portfolio construction, but others are more demographically based. One example is longevity risk, the risk of clients outliving their savings. This is a risk that perhaps wasn’t as common 15–25 years ago. However, our current low-yield envi-ronment calls for more careful portfolio construction to help manage that risk.

Another risk is sequence of returns risk. We’re in a late-cycle environment, with fairly good equity returns on balance for the better part of a decade now, admittedly with some bumps along the way. So, now we need to think carefully about risks. Where do we take them? Should we be taking risks on the equity side, or on the fixed income side of portfolios? What kinds of risks? What about factors? The risk now is that someone retiring very soon and starting to decumulate from their portfolio could face a correction or a bear market early on in their retirement. That isn’t to say that we’re forecasting a recession, but every day that we continue in this current expansionary phase potentially brings us closer to an eventual slowdown or a period of diminished returns across many asset classes.

What is a broad assumption about portfolio construction that needs to be challenged?

The major assumption that we want to challenge is that active versus passive strategies are mutually exclusive. What we say often at BlackRock is that almost every investment decision is active. The decision you make on your asset allocation is active, the decision on which economies around the world to invest in is active, and even in the realm of index ETFs, the decision on which index to use, or which ETF to use for an exposure; these are all active decisions. There are far more numerous active choices than people realize.

How do factors contribute to portfolio performance?

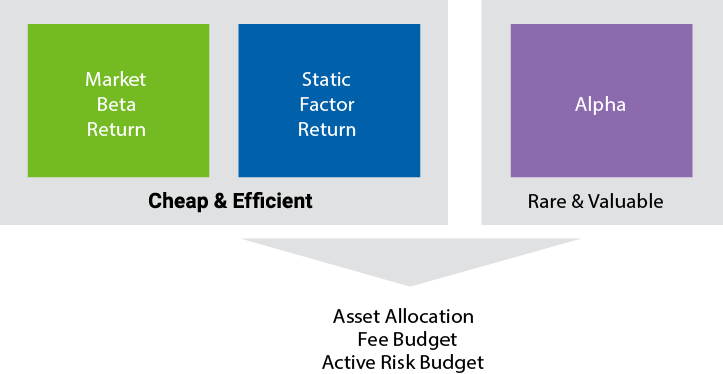

In thinking about portfolio performance, beta and alpha are two key elements. A separate third element would be invest-ment factors: the systematic, repeatable sources of excess return, or outperfor-mance. The five commonly cited factors are value, quality, momentum, size and minimum volatility. When BlackRock researched alpha-seeking strategies in the United States, we found that a lot of the active risk from these strategies ended up coming from a static or per-sistent tilt to one factor or another. This is different than what we would consider “pure alpha,” which comes from highly concentrated portfolios with high active share and built upon high conviction research. It may be possible to enhance returns through low-cost factor expo-sures, in addition to investments in beta and alpha-seeking strategies.4

Characteristics of five common investment factors

| Seek outperformance | Factor | Objective | Screens |

|---|---|---|---|

| Value | Invests in stocks that are inexpensive relative to fundamentals |

|

|

| Quality | Invests in companies with strong fundamentals |

|

|

| Momentum | Invests in stocks on an upswing |

|

|

| Size | Invests in smaller, more nimble companies |

|

|

| Reduce risk | Minimum Volatility | Invests in stocks that have collectively exhibited lower volatility |

|

Constructing a portfolio with inexpensive solutions plus pure alpha

Can factor investing contribute to outperformance over the long term?

Our analysis indicates that over a long period of time, all five factors add incre-mental return to beta, to varying degrees, depending on different markets and/or data sets. For example, if you were to look at the past 20 years using data from the MSCI USA Index, the value and momentum factors have added more excess returns than the others. That’s very interesting when you consider the oft-repeated nar-rative of recent years that value is dead or passé. If you have the discipline and wherewithal to hold a factor exposure for the long run, you have greater odds of it being accretive to your total returns.

All of this represents a significant enhancement in the way we think about alpha and constructing portfolios. What does this mean for advisors when it comes to building client solutions?

Portfolio construction can include con-sideration of index, factor and actively managed solutions that offer pure alpha. One approach is to build an indexed core, which can be broadly and inexpensively exposed to the beta returns of various economies and regions. Around that core, you can build a careful selection of low-cost factor investments and good active management solutions, depending on your risk and fee budget.

Could you explain in greater detail the role of models in an advisor’s business?

One great way to introduce scalability to a practice is to create model portfolios that can apply to individual investors across multiple scenarios and profiles. That could mean moving from dozens, hundreds or even thousands of individual investments within an advisor’s practice to a more reasonable five to seven dif-ferent models – narrowing your shelf to around 30 securities, mutual funds and ETFs – that can apply to different inves-tor archetypes. If we look at studies by Cerulli Associates, which is U.S.-focused but can be considered analogous to the Canadian market, they have shown that spending less time on investment management through model portfolios can free up time for higher value client activities such as having deeper and more robust conversations around finan-cial planning, and more time to gather assets. Cerulli Associates estimates a savings of about 450 hours a year.5

How does RBC iShares help advisors build model portfolios?

Our family of core asset allocation ETF portfolios can address the need for an indexed core in model portfolios. The five auto-rebalancing asset allocation ETFs are among the lowest cost strategies available in the Canadian marketplace.

The expansion of Canada’s ETF industry has given advisors ease and flexibility to deliver investment strategies, such as factor investing solutions and model portfolios, that work as both client and practice-optimization solutions.

The RBC iShares alliance, bringing together Canada’s largest asset manager and the world’s largest ETF manager6, is committed to delivering not only these innovative products, but also industry leadership and support to help advisors grow their business in today’s market environment.

Managed Money, Model Portfolios and the Opportunity for Advisors

Jonathan Hartman

Head of Advisor Channel Sales RBC GAM

Markets are constantly evolving, and information is coming at us all faster than it ever has before. Whether you’re looking at fixed income, factors or ESG, managed money and model portfolios are tools to help advisors execute their investment game plan, according to Jonathan Hartman, Head of Advisor Channel Sales at RBC GAM.

“For many advisors their biggest challenge today is time. Managing model portfolios can represent a significant time-saver for advisors, as a scalable solution for their business,” says Hartman. “We are hearing from more and more advisors that they are looking for a solution for managing fixed income. Managing fixed income is incredibly time-consuming and offers little value unless you can effectively build in credit and global exposure. Using managed money enables advisors to spend more time on client service and business building activities.” In fact, Hartman notes that RBC GAM and BlackRock Asset Management Canada came together in a strategic alliance in part to ensure advisors had the broadest range of solutions available for their clients. “The RBC iShares alliance was formed to bring advisors the broadest suite of ETF solutions all in one place. Paired with the cross-country presence of our Advisor Channel team, we have a great value proposition for advisors,” Hartman adds. “We curate the resources of BlackRock and RBC GAM, sharing investment insights, offering portfolio reviews and product expertise, in-person or over the phone. Our service team is here to support advisors whether choosing individual solutions or incorporating model portfolios into their practice.”1. CETFA MCETFA Monthly Report ($ billions), as of September 30, 2019, Canadian ETF Association.

2. BlackRock Asset Management Canada Limited (BlackRock Canada).

3. Robert Farrington, “The only thing that matters in investing: asset allocation”, The College Investor, March 2019.

4. Blending alpha-seeking, factor and indexing strategies: a new framework, BlackRock Investment Institute, July 2018.

5. “U.S. Advisor Metrics 2016: Combatting Fee and Margin Pressure,” Cerulli Associates.onthly Report ($ billions), as of September 30, 2019, Canadian ETF Association.

6. As of 6/30/19, RBC Global Asset Management Inc. is Canada’s largest fund company by assets under management (Source: IFIC) and BlackRock, Inc., together with its worldwide affiliates, is the world’s largest ETF manager by assets under management (Source: BlackRock, Inc.).

For more information about RBC iShares,

visit www.rbcishares.com.

RBC iShares ETFs are comprised of RBC ETFs managed by RBC Global Asset Management Inc. and iShares ETFs managed by BlackRock Asset Management Canada Limited (“BlackRock Canada”). Commissions, trailing commissions, management fees and expenses all may be associated with investing in exchange-traded funds (ETFs). Please read the relevant prospectus before investing. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. ®/TM Trademark(s) of Royal Bank of Canada. Used under licence. iSHARES is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. Used under licence. ©2019 RBC Global Asset Management Inc. and BlackRock Asset Management Canada Limited. All rights reserved.