A significant majority of female Canadian investors either control or have an equal stake in handling financial decisions in their household, but just half say they feel confident in their investing abilities, according to the results of a Canadian Imperial Bank of Commerce (CIBC) poll released on Friday.

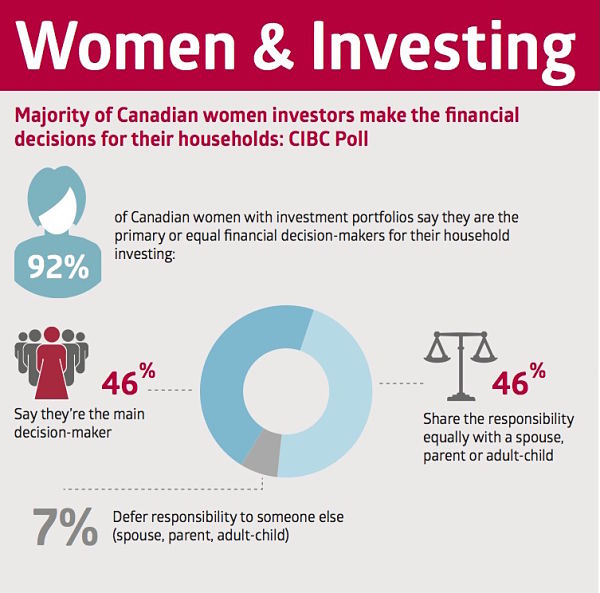

Of the 1,010 female investors surveyed aged 18 or older, 92% reported they assume or share responsibility for making investment decisions in their household. Among these women, there’s an even split of 46% each between those who are the primary decision-maker and those who jointly carry out investment decisions with a spouse, partner, parent or their adult-aged child.

But while most of the women surveyed don’t defer that responsibility to a family member, the poll finds that there’s a sizable “confidence gap” as only 49% of these women believe they are knowledgeable investors.

To help close that gap, financial advisors shouldn’t focus on investment returns alone in their conversations with women, but should discuss strategy in relation to goals, says Sarah Widmeyer, managing director and head of wealth strategies with CIBC, in a statement.

A bulk of the participants also tends to identify with the characteristics associated with conservative investors, in their expressed preference for less risky investment vehicles, the poll suggests.

For example, when women were asked to think about their investment portfolios, “safety” comes in as the most important consideration for 72% of participants, followed by growth, at 58%, and liquidity, at 33%.

The report, which seeks to gauge female investors’ investment preferences, also examines generational differences in their attitudes. The millennial women surveyed, who fall between the ages of 18-34, are almost twice as likely than Gen X women (aged 35-54) to go for a do-it-yourself investment approach, relying on an online service or discount broker.

Among those who have a retirement portfolio, participants were asked about where they’ve invested most of their savings. Just less than half (48%) tended to invest primarily in guaranteed and savings products, followed by 37% who invest in stocks and 14% in mutual funds.

That preference for guaranteed investments appears to hold strong as well for younger generations who were asked about their future retirement plans, the poll suggests. It found that among these participants, 55% intend to invest in guaranteed and savings products over 29% of those who would choose stocks and 17% for bonds.

“Women tend to view wealth in terms of security rather than opportunity,” Widmeyer says. “This can be an issue if you’re saving for a long-term goal like retirement.”

More work needs to be done, she adds, to help women determine and understand how their personal financial goals can work in sync with their investment strategies.

The online survey took place from Feb. 10-17. The pool of participants was sourced through Angus Reid Forum, an online survey panel, on behalf of CIBC.

Photo copyright: CIBC