If your clients’ portfolios need a dose of strong medicine, consider prescribing stocks of pharmacy benefit managers (PBMs), which are key players in the U.S. health-care sector and have excellent growth prospects.

Prescription drug usage will increase as Americans continue to age and more Americans become insured through Obamacare. Use of very expensive specialty drugs also is expected to rise and be a key driver.

PBMs process and pay claims for their insurance company and other health-care provider clients. PBMs also help to design health-related benefit plans; create a network of retail pharmacies at which drugs can be picked up; handle mail orders; and negotiate with suppliers to get the lowest price for the prescription drugs provided.

Volume is key for PBMs because they are paid a fee for each drug provided and claim processed. Thus, competitor acquisition is a frequent strategy and there have been some very big deals in this subsector. For example, St. Louis-based Express Scripts Holding Co. acquired Medco Health Solutions Inc. of Franklin Lakes, N.J., in 2012 for $29.1 billion, which resulted in the approximately 33% market share Express Scripts has. (All figures are in U.S. dollars.)

Schaumburg, Ill.-based SXC Health Solutions Corp.’s purchase of Rockville, Md.-based Catalyst Health Solutions Inc. that same year was much smaller, at $4.4 billion, but still doubled the newly blended and renamed Catamaran Corp.’s market share to around 3%. This gave Catamaran enough size to win a 10-year contract in 2013 to manage the prescription drugs benefits business for clients of Bloomfield, Conn.-based Cigna Corp., which again doubled Catamaran’s market share to 6%.

Although Express Scripts has reached a size that precludes further major acquisitions, Catamaran is expected to continue making acquisitions. Many money managers like both stocks: Express Scripts for its high volumes and attractive margins; Catamaran for its growth potential.

The two companies are “pure” plays in the PBM space. There are three major competitors:

– CVS Health Corp. of Woonsocket, R.I., runs major drugstore chain CVS Pharmacy as well as CVS/Caremark PBM, which has a 26% market share.

– Prime Therapeutics LLC of Eagan, Minn., is a private firm owned by groups representing 13 Blue Cross and Blue Shield health-care plans. Prime Therapeutics has a market share of 5%.

– UnitedHealth Group Inc. (UHG) of Minnetonka, Minn., owns the largest health-care insurer in the U.S. UHG’s information-technology (IT)-enabled business includes the PBM OptumRx, which has a 12% market share.

Specialty drugs are a major growth opportunity for these firms. These drugs include biologics, which are manufactured in or extracted from biological sources rather than created chemically. Biologics are particularly appropriate to treat rheumatoid arthritis, cancer and heart and skin disorders, as well as stomach and neurological conditions.

Specialty drugs often have to be administered and monitored by health-care professionals, and several PBMs have created divisions to provide support. Catamaran’s is BriovaRx and Express Script’s is CuraScript. Both ship specialty drugs to homes or physicians’ offices and provide detailed instructions as well as 24/7 telephone support.

Although biologics are used by only about 1% of Americans, these drugs are so expensive that they account for about one-third of U.S. drug spending and, thus, contribute greatly to PBMs’ earnings.

John Lumbers, portfolio manager with Mackenzie Financial Corp. in Toronto, expects this percentage to rise to around 45% of total drug expenditures in the U.S. within the next three years.

Troy Crandall, analyst with MacDougall MacDougall & MacTier Inc. in Montreal, thinks biologics’ share will be 50% by 2020.

A major factor behind this anticipated rapid rise in specialty drugs is Solvaldi, a hepatitis C treatment that was approved by the U.S. Federal Drug Administration at the end of 2013. Crandall says Solvaldi is the only “real” cure for hepatitis C, so there is pent-up demand from patients.

As a result, PBMs that provide this drug will get a good revenue stream, given the $84,000 cost for the 12-week treatment. But, because Solvaldi won’t have the market to itself for long – Crandall expects there will be alternatives by the end of 2015 – PBMs will negotiate better prices for their clients.

Another growth driver is a wave of branded drugs, accounting for about $30 billion in U.S. drug spending, that will be coming off patent within the next two to three years, Lumbers says. This list includes Celebrex, Crestor and Glevec. Once these drugs are off patent, PBMs can negotiate with suppliers of generic drugs to lower costs for their clients.

Then there’s Obamacare, which is expected to add 30 million people to the insured health-care network in the next five years.

Here’s a look at Catamaran and Express Scripts in greater detail:

– Catamaran Corp. started in Canada in 1993 and is still officially a Canadian firm, although its head office is in Schaumburg, Ill. Initially, the firm created technology for PBMs to manage their businesses. Catamaran then became a PBM itself through several major acquisitions, although the firm retained its IT business, whose customers include about a third of the many small PBMs.

Catamaran has made eight major acquisitions in the past six years, Crandall notes, including three specialty pharmacies. Catamaran is likely to continue making acquisitions. One possibility is Louisville, Ky.-based health-care plan provider Humana Inc., which is rumoured to be considering the sale of its PBM business. This would almost double Catamaran’s size and cost the firm $4 billion-$6 billion, Crandall says.

Given Catamaran’s 6% market share, the firm now is in the big leagues and able to win major contracts, yet still is small enough to be flexible to meet its customers’ needs. In fact, Catamaran management prides itself on listening and customizing services to what its clients want rather than trying to fit the client into a standard service model.

A recent report from J.P. Morgan Securities LLC (JPM) in New York says: “New business [including Cigna] and recent acquisitions should provide a tailwind to earnings for Catamaran over the next several years, allowing the company to grow earnings faster than the overall market.”

In addition, the JPM report says, Catamaran’s increased scale should result in more invitations to bid on contracts (especially from larger clients) and the firm’s flexible business model and focus on unique markets – such as Medicaid, hospice prescriptions and long-term care – should lead to incremental business.

The JPM report also foresees opportunities for Catamaran in mail-order and specialty pharmacy, and notes that the firm has a nice IT pipeline and that additional accretive acquisitions are anticipated.

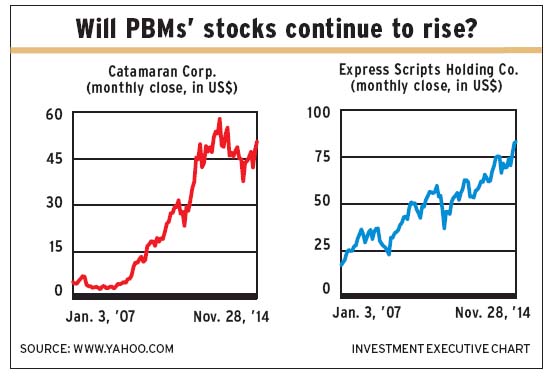

The JPM report gave an “overweight” rating on the stock and a Dec. 31, 2015, target of $54 a share.

A report from Credit Suisse Securities (USA) LLC’s research and analytics department in New York gave an “outperform” rating and the same price target. The 208 million shares outstanding closed at $50.94 on Nov. 28.

Net income was $260 million on revenue of $15.8 billion in the nine months ended Sept. 30, 2014, vs net income of $211.1 million on revenue of $10.3 billion in the corresponding period in 2013.

– Express Scripts inc. was created as a PBM in 1986; it was a joint venture between two retail drug chains. New York Life Insurance Co. then acquired Express Scripts in 1989 and took it public in 1992; Express Scripts began to build through acquisitions thereafter. The firm tried to purchase Caremark Rx Inc. in 2006 but lost out to CVS. However, Express Scripts’ 2012 Medco purchase secured the firm’s position as the biggest PBM.

Express Scripts has huge market share, giving the firm significant power in negotiating with suppliers, says Crandall, who expects the firm to post 10%-20% growth in earnings per share over the next 10 years. This earnings growth will come from organic growth and synergies from the Medco merger that raise margins and cut costs.

Express Scripts doesn’t pay dividends, but Crandall expects share buybacks to add to growth.

A JPM report points to Express Scripts’ clear leadership position and opportunities in specialty pharmacy and restrictive plan design (whereby patients are restricted in what drugs they get and how they get them). The report also says Express Scripts’ strong free cash flow gives the firm flexibility to pursue opportunities.

Both the JPM report and a Credit Suisse report say there could be opportunities following the recent news that drugstore chain Walgreen Co. will be a preferred pharmacy in a couple of the plans that Express Scripts manages. Although this doesn’t affect Express Scripts “materially,” it opens the door for more collaboration between the two firms.

However, Lumbers thinks there could be challenges for Express Scripts. He says it’s relying on its mail-order business and he thinks the future will be about “the human touch” as the population ages.

As a result, he says, the firm needs to be able to adapt to changing conditions but the CEO lacks the vision to do so. In contrast, CVS and Catamaran both are “pretty clever, adaptable and able to differentiate themselves.”

Reports from JPM and Credit Suisse both have an “outperform” rating on the stock, with Dec. 31, 2015, targets of $89 and $83 a share, respectively. The 746 million shares outstanding closed at $83.15 on Nov. 28.

Net income was $985.4 million on revenue of $34 billion in the nine months ended Sept. 30, 2014, vs net income of $851.6 million on revenue of $33.7 billion in the nine months ended Sept. 30, 2013.

© 2015 Investment Executive. All rights reserved.