Michael Chan, vice-president and senior portfolio manager at Fiera Capital, says that the initial public offering (IPO) market for Canadian small-cap companies has been active this year as evidenced by the listing of a range of attractive small-cap stocks.

“Both private-equity firms and entrepreneurs have been successfully taking some fairly advanced smaller companies public and we, in turn, have taken advantage of this,” says Chan.

“It is an excellent time to invest in this asset class in general,” the veteran small-cap manager says. “Our analysis shows that there is good upside in well-chosen small-cap stocks, many of which are trading at a considerable discount to our assessment of their fair market value.”

The Canadian small-cap universe has been out of favour for some time, he says. There has been a steady flow of funds out of Canadian small-cap stocks into Canadian bigger-caps, as investors became more risk-averse.

Canadian small-caps have significantly underperformed their big-cap counterparts in the 10 months to the end of October. Over this period, the S&P/TSX SmallCap Index produced a negative total return of 10.4% versus a negative 5.2% for the S&P/TSX Composite Index. Over the past three years to the end of October, this small-cap index had a negative total return of 2.5% on an annualized basis versus a positive 6% for the Composite. “Therein lies the opportunity,” says Chan.

Weakness in Western Canada’s economy as a result of the steep decline in the oil price has, says Chan, created opportunities among those companies in the smaller-cap universe that are perceived to be suffering. “These stocks have come under heavy selling pressure and have fallen below what we consider to be fair market value based on our evaluation of the companies’ prospects.”

The team’s small-cap portfolio currently contains some 60 companies that collectively earn 60% of their revenue from outside Canada, mostly from the United States. But this emphasis on companies with an international focus is changing, at the margin, says Chan. “Our discipline and process is starting to identify attractive opportunities among companies with a domestic emphasis, including those companies that are exposed to Western Canada.”

Chan and senior analyst Jason Miller — who both have degrees in engineering and business administration — are responsible for Fiera’s Canadian small-cap strategy. Chan is also a member of the Canadian equity core team. In all, Chan has spent 21 years in the investment industry, of which the past seven have been with Fiera and its predecessor firm.

Included in Chan’s mandates, totalling some $1-billion, is Fiera Capital Equity Growth, which is benchmarked against the S&P/TSX SmallCap Index.

The minimum market capitalization of the fund’s holdings is $150 million. As a result of bottom-up stock selection, Fiera Capital Equity Growth is substantially overweight in the industrial and financial sectors and underweight in natural resources — both energy and materials.

The team focuses on companies with significant competitive advantages that generate good cash flow and earnings growth. The companies should also produce both high returns on equity and high returns on invested capital. Management must have a proven track record and be aligned with shareholders’ interests, Chan says. “We prefer management to have a significant stake in the company.”

Finally, the potential new investment must trade below the team’s estimated fair value for the business, so as to produce an upside of at least 50% over three years. “The calculation of fair value is based on a three-year internal projection; we build a financial model of the company looking three years out.”

Chan and his team employ a proprietary ranking system for the 300 stocks in their small-cap investable universe “using a blend of both quantitative and qualitative analysis.” As a result of this analysis, the team arrives at a group of 100 stocks, ranked in order of their merit. On a monthly basis, the team tests the actual portfolio against these ranked 100 stocks, which include stocks in the portfolio. “It is a dynamic process. We want to ensure that the best ideas are fully reflected in the portfolio,” says Chan.

This ranking system helps to identify stocks in the portfolio that might be trimmed or sold, he says, as well as identify new ideas. “While it might appear that this would result in a high turnover in the portfolio, this is not the case,” he says. “People do not appreciate how well companies that have dominant franchises can compound their growth.”

Chan and his team have participated in a number of IPOs this year. An example is Spin Master Corp. (TOY). This company, he says, has emerged as a major player in the toy industry globally. “We consider it to be the best of breed in this market and have a large position in this stock.”

Spin Master was listed in July at $18 a share and raised more than $250 million through its IPO. The company designs and makes a diversified range of toys, games and entertainment properties, says Chan. It has a specialty in drone technology. “One of its high-profile products is a Star Wars Remote Control X-Wing Starfighter.”

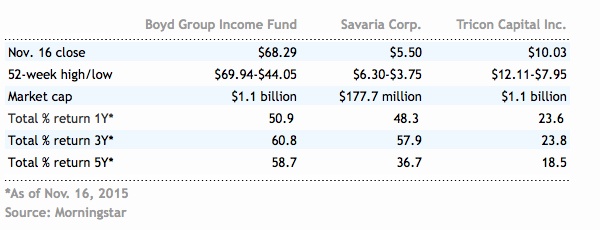

Examples of longer-term holdings in the portfolio that also illustrate the team’s investment criteria and process include Tricon Capital Inc. (TCN), Boyd Group Income Fund (BYD.UN) and Savaria Corp. (SIS).

Tricon Capital is an asset manager focused on the residential real estate industry in North America. Its assets include a portfolio of single-family homes in the United States, says Chan. “Tricon has approximately $2.5 billion in assets under management and is growing these assets by about 20% per annum.”

David Berman, executive chairman and chairman of the investment committee, and his son Gary Berman, president and CEO, are at the helm of Tricon. “This team has a lot of intellectual horsepower,” says Chan. The stock, a top-10 holding, has been in the portfolio since November 2012.

Boyd Group is one of the largest North American operators of collision repair centres. “CEO Brock Bulbuck owns $6 million worth of the units.” The company is growing both internally and through acquisition, says Chan. “Insurance companies prefer to deal with larger, well-established, efficient collision-repair companies,” he notes. The company has a “solid” return on equity of 25%. This stock is also a top-10 holding and has been in the fund since August 2011.

Savaria designs, makes and installs home elevators and stair lifts in residences. “This assists people with mobility issues,” says Chan. “Savaria is a leader in this field in North America and it is a growing market.” The company is increasing its revenue by 15% per annum and has a return on equity of 19%. Chan notes that Savaria’s president and CEO, Marcel Bourassa and other members of the management team have 40% of the outstanding shares of the company.

Chan and his team sold the portfolio’s holding in auto-parts producer Linamar Corp. (LNR). “The stock hit our value target and has successfully grown into a larger-cap company.” In general, he says, the upper limit for companies in the portfolio is a market float of $3 billion. “We’re not forced to sell the stock if it goes over that limit, but we like to lock in our gains and then focus on the next generation of small-caps that are capable of growing into large-cap companies.”