Large Canadian life insurance companies (lifecos) continue to face the fallout of extended low interest rates. And while these firms have taken defensive action since the global financial crisis of 2008-09, challenges to profitability remain.

However, several analysts belive lifecos’ share prices may present opportunities for investors willing to wait for the key shift that will improve lifeco earnings: higher interest rates.

Sustained low rates have hobbled the big Canadian lifecos, in part because of the way that Canadian accounting rules treat product liabilities – the return on assets required to pay benefits over the life of the products the lifecos have underwritten. In Canada, the return needed for liabilities of up to 20 years is based on current interest rates and is recalculated every quarter. The required return for liabilities of 60 or more years is based on historical returns. A combination of these two returns is used for 40- to 60-year liabilities.

Thus, while the Canadian rules offer long-term stability, profitability suffers when rates are low, and increases when rates rise.

The lifecos have adapted in a variety of ways, including expanding their wealth-management divisions and using interest rate hedging. But current low rates still “create a fairly sizable headwind,” says Dave Britton, portfolio manager at Sionna Investment Managers Inc. in Toronto. “Lifecos have to continually fight to maintain current profitability.”

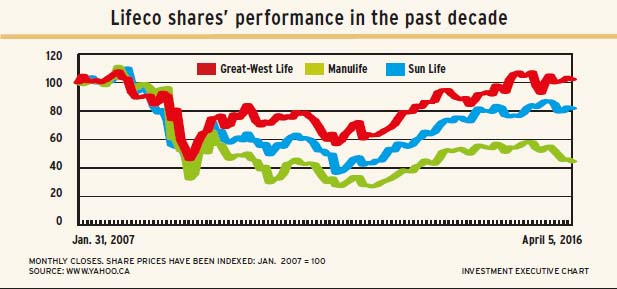

Nevertheless, there’s enthusiasm about at least one large Canadian lifeco: Manulife Financial Corp. John Hadwen, portfolio manager with Signature Global Asset Management, a unit of CI Financial Inc., says its share price “has been a bit more beaten up,” than those of Sun Life Financial Inc. and Winnipeg-based Great-West Lifeco Inc. (GWL). (All companies are based in Toronto unless otherwise indicated.)

More recent events are also depressing lifecos’ share prices. For example, many investors focused on Manulife’s $876 million in 2015 losses on its oil and gas investments and, fearing more bleeding, sold the stock.

What they missed, says Peter Routledge, analyst at National Bank Financial Ltd., was the increase in Manulife’s book value due to $5.3 billion in gains from the lower value of the Canadian dollar (C$) when the insurer’s foreign operations were translated into C$.

Analysts also think Sun Life and GWL are worth considering. They particularly like Sun Life’s investment-management businesses, but they are also impressed with GWL’s very conservative approach to actuarial assumptions.They also like GWL’s 2013 purchase of Irish Life Group Ltd., the largest life, pensions and investment manager in Ireland.

Here’s a look at the three lifecos in more detail:

– GREAT-WEST LIFECO INC. GWL is a favourite of Britton’s. As a conservative investor, Britton says, he has “a natural affinity for its prudent approach, particularly to risk management.”

Routledge takes the same approach: GWL “makes very conservative actuarial assumptions, and this conservatism permeates management’s thinking about risk and return.”

Since the early 2000s, GWL has, more than any other Canadian life insurer, consistently resisted the temptation to take on risk in order to gain market share in “hot” product categories, Routledge notes. The result is less volatility, in both earnings and share prices, compared with Manulife and Sun Life.

The main negative for GWL is its subsidiary, Boston-based Putnam Investments LLC. Its recurring losses, Routledge says, have constrained GWL’s valuation for some time. He doesn’t expect Putnam to “sustainably break even until 2017, with meaningful contributions to earnings an even more distant outcome.”

Routledge’s target price for the stock is $35 a share. That’s below the $35.28 the 993 million outstanding shares closed at on April 5. The target in a recent report from Royal Bank of Canada’s (RBC) capital markets unit was $38 a share.

GWL’s net income in 2015 was $2.9 billion (excluding acquisition and integration charges), up from $2.7 billion in 2014. Revenue in 2015 was $33.8 billion, down from $39.2 billion, due to declines in the fair market value of investments. This factor was even more negative for Manulife and Sun Life.

– MANULIFE FINANCIAL CORP. Manulife had big losses on its large U.S. variable annuity business following the financial crisis. Unlike GWL and Sun Life, Manulife didn’t hedge its financial markets exposure and had to increase reserves by more than $5 billion by Dec. 31, 2008.

Since then, Manulife has implemented hedging and other programs. This strategy has been costly and resulted in lower earnings, but the firm’s exposure to declines in equities markets and interest rates is reduced substantially.

Other Manulife operations are doing well. Its asset-management business is solid, with $550 billion in assets under management (AUM) as of Dec. 31, 2015. Manulife is expanding this business in Asia.

Hadwen says Manulife’s Asian operations are already “a very good franchise,” accounting for 30%-35% of the company’s valuation. Asian acquisitions aren’t cheap because many global lifecos are trying to establish themselves in Asia, he says, but adds that Manulife’s investments should pay off in the long term.

Manulife’s two billion outstanding shares closed at $17.80 on Apr. 5. Hadwen predicts a share price of $21 by the end of this year, as does Routledge. The RBC report’s target is $24.

Manulife’s net income was $2.4 billion in 2015 (excluding acquisition and integration charges), down from $3.6 billion in 2014. Revenue was 34.4 billion vs $54.4 billion.

– SUN LIFE FINANCIAL INC. Sun Life is a well-regarded global asset manager with US$413 billion in AUM. The firm has seen some outflow of AUM recently, which, Routledge says, is due to a general shift in investor preferences to passive vs active management investing styles and not due to weak investment performance. Asset management remains a highly profitable business for Sun Life.

The company has separate Canadian and Asian wealth-management businesses and also sells its expertise in reducing the risk of very long-dated liabilities to institutional investors such as pension plans. Although the latter business currently is small, it “has the potential for very fast growth,” says Routledge.

He also believes that Sun life’s investment-management businesses and insurance operations give the firm “built-in share price momentum for the next two years.”

One possible negative, says Routledge, is Sun Life’s exposure to the oil and gas industry, which accounts for 43% of its common equities holdings. (That figure compares to 46% for Manulife.) Losses on these holdings could pull down net income.

The 612 million shares closed at $41.44 on Apr. 5. Routledge’s target is $43. RBC’s is $45.

Net income for Sun Life was $2.4 billion in 2015 (excluding acquisition, integration and restructuring charges), up from $1.9 billion in 2014.

© 2016 Investment Executive. All rights reserved.