The market for initial public offerings (IPOs) in Canada got off to a slow start last year but still managed to attract almost $3.5 billion in investment, beating both expectations and totals for 2013, according to a recent report from PricewaterhouseCoopers LLP (PwC).

Fewer, larger IPOs were the order of the day last year, with just 14 IPOs accounting for the $3.5 billion total, compared with 30 new issues recorded in 2013 that generated $2.7 billion, and 62 IPOs in 2012 for $1.8 billion.

PwC’s national IPO services leader, Dean Braunsteiner, says that 2014 was unpredictable and began (and remains) with few IPOs in the works. Yet, the year was “remarkable,” given that it produced a few jumbo-sized offerings to save the day.

“It was just the right issues coming forward at the right time,” he says. “The markets were quite turbulent and those companies that were well prepared – had planned these IPOs out in advance – certainly took advantage and pulled the trigger when the market had the appetite for these new issues.”

Last year, it was Canadian oil and gas producers that were willing and able to tap public markets, producing the two largest IPOs of the year and accounting for 85% of the total market value for Canadian IPOs.

More than 40% of last year’s IPO dollar total was due to just one new issue: the $1.4-billion monster IPO by PrairieSky Royalty Ltd. on the Toronto Stock Exchange in May. A spinoff of Calgary-based Encana Corp., the PrairieSky IPO also sparked a wave of oil and gas issues over the balance of the year.

The second-largest IPO in 2014 was offered in the fourth quarter by Seven Generations Energy Ltd. of Calgary. Valued at $810 million, that IPO also was the largest IPO of the final quarter of the year.

Given the late 2014 plunge in oil prices, it is unlikely that energy producers will play a leading role in new issues again this year. Braunsteiner says it’s too early to tell just which industries might play a leading role in 2015, but he is hopeful that private companies will step forward.

“I don’t think [the 2015 IPO leader] will be one industry,” he says. “It will be sort of company-specific,” he adds, with favoured companies being those with profitable earnings and the ability to drive expected returns into the market.

Potential players in the IPO market may be large investors, such as pension funds, deciding that the time is right to reap the value of a major holding. “I think you might see some of the private-equity plays that have been invested over the past few years, which are looking to bring those things to their fruition, cashing out.”

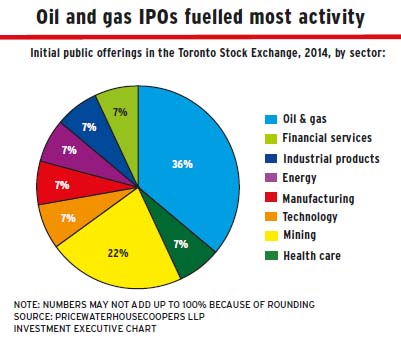

Braunsteiner does not expect any one industry to dominate the IPO scene this year, in the manner that REITs or oil and gas companies have in the recent past. Financial services, technology, manufacturing, energy, industrial products and health care each generated one IPO last year. The mining sector, a traditional area of strength for Canadian markets, generated just three, small-sized IPOs.

Braunsteiner, speaking from Honduras, where he is touring a Canadian company’s gold mine, does not expect a quick turnaround for the mining sector’s fortunes. “I think [mining companies] are going to be stuck for at least another 12 to 18 months,” he says, “given that commodity prices continue to be quite volatile.”

Thomson Reuters Corp. reports that the larger market for Canadian equities issues was stronger in 2014 compared with the prior year, totalling $37.3 billion in 2014, up from $34.1 billion the year prior. That market, which includes equity financing from existing public entities, was aided by a strong second half for oil and gas players and renewed focus on mergers and acquisitions.

Stock market participants are expecting variety in 2015 IPOs. “I think there will be a range of transactions across a range of sectors,” says Kirby Gavelin, head of equity capital markets with RBC Dominion Securities Inc. in Toronto.

Gavelin says 2015 is already off to a good start, pointing to Fairfax Financial Holdings Ltd.’s proposed IPO for a stand-alone public India-based subsidiary from the Toronto-based financial services company that could be a $500-million stock issue.

“That’s a strong sign,” he says. “We’re in a bit of a period of volatility, and stability is always good; we haven’t got that in the energy market currently. We are reasonably confident moving forward that other sectors will be more active than they were last year.”

© 2015 Investment Executive. All rights reserved.