Having strong banking systems in place got the four Scandinavian countries through the global financial crisis more easily than the rest of Europe. In turn, the stock prices of companies based in this region have held up relatively well. Still, portfolio managers and analysts believe that good investment opportunities remain. Although many recommendations are for firms that export their products globally, there also are some plays on domestic growth.

Norway is particularly strong – and rich – because of oil and gas production in the North Sea; the country also has successful forest products, mining, fishing and shipbuilding industries.

Sweden’s strength comes from its many global industrial firms.

Both countries’ real gross domestic product (GDP) is expected to grow by 2%-2.5% in 2014 and 2015, according to Copenhagen-based Danske Bank A/S.

Although Denmark’s economy is the most high-tech among the four countries with major pharmaceutical and medical equipment companies, that economy is recovering from a drop in real estate prices in 2013. The country expected to have real GDP growth of only 0.8% in 2014 and 1.8% in 2015.

As for Finland, it also has many successful global industrial companies, but its economy is being dragged down because of the country’s ties to Russia. Thus, Danske Bank expects Finland’s real GDP to drop by 0.4% in 2014 and rise by only 0.8% in 2015.

All four nations are major exporters and were affected by the economic recession in Europe and sluggish growth elsewhere. From 2009-13, exports of goods and services averaged 55% of GDP for Denmark, 46% for Sweden, 40% for Finland and 39% for Norway, according to the World Bank.

Three of the four countries have no public debt; in fact, they have large net assets. Norway’s net assets were 205.1% of GDP in 2013, according to the Organization for Economic Co-operation & Development. (Norway puts a certain percentage of oil royalties into a sovereign wealth fund that invests globally.) Finland’s net assets were 59.6% of GDP and Sweden’s were 24.1% of GDP. Denmark had net debt of only 5.9% of GDP.

The banking systems are “very strong” in all four countries, says Stephen Oler, portfolio manager with Pyramis Global Advisors in Smithfield, R.I., a unit of Boston-based FMR LLC (a.k.a. Fidelity Investments), and co-manager of Fidelity Europe Fund.

This wasn’t always the case. The Scandinavian banks had a banking crisis in the early 1990s that was caused by a real estate collapse and, as a result, stringent regulations were brought in.

“Regulators have been vigilant in making sure the banks have very strong capital positions,” Oler explains. “The banks demand collateral for consumer loans, very high down payments on mortgages and only lend to people who are financially strong.”

These regulations got those banks through the global credit crisis relatively easily – even though Sweden’s banks were hit by loan losses in the Baltic states of Estonia, Latvia and Lithuania.

All four Scandinavian countries have strong social safety nets. Norway, for example, has a guaranteed pension plan for everyone. Denmark provides living allowances for its post-secondary students.

These nations use different currencies. Finland uses the euro but the other three use their own currencies – the Danish krone, the Norwegian krone (NK) and the Swedish krona (SK).

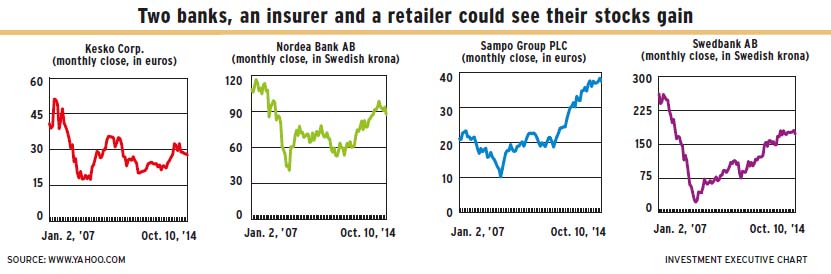

The recommended stocks discussed below primarily depend upon domestic demand: Finland-based retailer Kesko Corp., Finland-based insurance company Sampo Group PLC and two banks based in Sweden, Nordea Bank AB and Swedbank AB:

– Kesko corp. is the largest retailer in Finland, with a variety of outlets selling groceries, building and home-improvement products, sporting goods, furniture, shoes and automobiles. The vast majority of Kesko’s sales (83%) come from Finland, with the rest from Norway, Sweden, the Baltics and Russia.

Kesko is debt-free and its stock provides a dividend yield of 5%, says Wendell Perkins, senior portfolio manager with Manulife Asset Management (U.S.) LLC in Chicago. Kesko owns most of its real estate, worth about 1.5 billion euros-two billion euros ($2.1 billion-$2.8 billion). Perkins points out that with market capitalization of 2.8 billion euros ($4 billion), investors aren’t paying much for Kesko’s operations.

Perkins considers the price for Kesko’s 100 million outstanding shares, which has fallen by 15% since June and closed at 27.7 euros ($39.12) on Oct. 10, to be “relatively cheap.” He believes average annual growth in earnings per share will be in the low teens in the next three to five years.

– Nordea Bank Ab. has significant retail and wholesale banking operations in most Scandinavian countries and the Baltics.

Don Reed, president and CEO of Franklin Templeton Investments Corp. in Toronto, considers Nordea to be a “good solid bank.” However, he adds, Nordea’s share price, which has risen by 86% since November 2011, is getting a little expensive.

An analysts’ report from J.P. Morgan Securities LLC (JPM) in London, U.K., has an “overweight” rating on Nordea’s stock, foreseeing upside potential from improving profitability because of better pricing and product mix, enhanced efficiency and improving asset quality, particularly in Denmark, which accounted for 33% of operating income in 2013.

This should lead to dividend increases of 21% this year and another 3% in 2015, according to the report, which offers a Dec. 31, 2015, price target of SK102 ($15.82) a share, well above the SK87.25 ($13.50) the four billion outstanding shares closed at on Oct. 10.

– SAMPO GROUP PLC is a Finland-based insurer, with both property and casualty (P&C) and life insurance subsidiaries that operate in Scandinavia, the Baltics and Russia. In addition, Sampo holds a 20% interest in Nordea Bank and will benefit if that bank does well.

Charles Burbeck, co-head of global equity portfolios with UBS Global Asset Management (U.K.) Ltd. in London, says Sampo is very well managed and has a proven track record in achieving good underwriting results. However, growth is likely to be modest and the share price isn’t very cheap, as it has risen by 107% since June 2012. Nevertheless, Burbeck still recommends Sampo as a core holding in insurance.

A JPM report lauds Sampo for the scale and geographic diversity of its P&C business. Sampo can continue to grow its dividend, according to the report, due to increased cash returns from its stake in Nordea.

The JPM report gives the stock an “overweight” rating, with a Dec. 15, 2015, target price of 41.10 euros ($58.45) a share, well above the 37.31 euros ($52.69) the 560 million outstanding shares closed at on Oct. 10.

– SWEDBANK AB is the leading bank in Sweden and the Baltics. The firm is a very high-quality bank, Oler says, and “probably the best capitalized bank in Europe.” It’s a traditional retail bank, without exposure to investment banking and trading risks. Its growth in Sweden will be modest, but its Baltics business is expanding.

Oler expects Swedbank’s earnings to grow by about 5% a year, which will be matched by equivalent increases in the dividend as management has committed to paying out 75% of earnings.

However, a JPM report rates the stock as only “neutral.” While Swedbank’s highly profitable mortgage business, improving top-line revenue growth in the Baltics, cost management and capital position are strong, the report states that the stock has reached “fair value” and slower growth is anticipated.

The price target for Dec. 31, 2014, is SK160 ($24.75) a share, much lower than the SK171.7 ($26.56) that the 1.1 billion outstanding shares closed at on Oct. 10.

© 2014 Investment Executive. All rights reserved.