With a growing segment of consumers going online to purchase life insurance, Quebec’s insurance regulator has released a new set of guidelines pertaining to this growing distribution channel.

Although many of the guidelines reflect current industry practice, some industry participants are concerned that the new rules will lead to more consumers buying insurance with out adequate advice.

In April, the Autorité des marchés financiers (AMF) released a report entitled Internet Insurance Offerings in Québec, outlining new regulatory guidelines regarding the distribution of insurance products via the Internet. Although the report says consumers having access to advice is “essential” regardless of which channel they use to purchase insurance, the report also indicates that insurance products can be sold online without the involvement of a licensed insurance agent – a notion that worries advisors operating in the independent distribution channel.

“There’s definitely concern in the advisor world around all of this,” says Arnold Scheerder, chairman of regulatory affairs with the Canadian Association of Independent Life Brokerage Agencies. “Insurance requires a proper needs analysis and discussion. There are too many variables that cannot fit into a cookie-cutter platform via the Internet.”

Quebec’s legislation regarding the distribution of financial products and services prescribes the involvement of an insurance representative when insurance products are distributed, in order to protect consumers and satisfy their need for guidance during the process of buying insurance. In the AMF report, however, that regulator acknowledges that “personal reasons” may lead a consumer to choose not to buy insurance through a licensed rep.

The AMF specifies that insurers can facilitate Internet transactions without the involvement of an advisor, as long as those companies meet a variety of conditions. For example, insurance providers must: provide sufficient tools and information to ensure clients are able to make informed purchasing decisions; facilitate access to licensed representatives for consumers who feel they need advice at any step of the purchasing process; and inform clients before they make a purchase about the importance of obtaining advice from a licensed representative.

“Internet insurance offerings without the intervention of an insurance representative can be envisaged,” says the AMF report, “but only if the online service provider is able to offer the consumer the tools he needs to determine his insurance needs and to determine, from among the various products offered to him, the one that best suits his needs and personal situation.”

Many financial services institutions already sell insurance products directly to consumers via the Internet – and not only in Quebec, but in all Canadian jurisdictions. However, insurance regulations hadn’t previously specified the protocols that insurance providers are expected to follow with respect to these online sales.

The Canadian Council of Insurance Regulators released recommendations for Internet sales practices in 2013, but the AMF is the first provincial regulator that has produced its own guidelines stemming from that initiative.

“It’s sort of codifying the requirements,” says Greg Grant, secretary and chairman of the executive operations committee at the Canadian Association of Financial Institutions in Insurance (CAFII) in Toronto. “I think that, largely, the industry was already following many of the principles that are outlined [in the AMF report] anyway.”

Industry stakeholders admit that it’s important for regulators to update the rules to reflect digital industry practices and changing consumer demands.

“We recognize that there are a lot of people who want to do things over the Internet,” says Susan Allemang, head of regulatory and policy affairs with Independent Financial Brokers of Canada in Mississauga, Ont. “It’s a convenience.”

By giving the insurance industry the green light to conduct transactions with clients who haven’t obtained advice, however, advisor associations warn, consumers could end up buying products that they don’t fully understand and that don’t effectively meet their needs.

“These are fairly sophisticated products,” says Greg Pollock, president and CEO of Toronto-based Financial Advisors Association of Canada (a.k.a. Advocis). “So, to leave individuals making those decisions online with no advice, we think, is not prudent.”

Advisor groups applaud the AMF’s requirements for insurance providers to make advice accessible to consumers and to inform them of the importance of obtaining advice. However, those groups suggest, those measures may not be enough to protect the average consumer.

“We would still prefer that people buy their life and health insurance through a licensed broker,” Allemang says, “because then you have someone sitting with you, face to face, and explaining [a product] to you, and you also have an advocate in the event that something goes wrong.”

Consumers who complete insurance applications without the guidance of a professional insurance agent are at greater risk of making errors, says Richard Gilbert, president of Mississauga, Ont.-based Megacorp Insurance Agencies Inc. He says it’s easy for consumers to misinterpret application questions and unknowingly provide inaccurate answers, which can lead to claims being denied.

“What do the questions really mean? They can be ambiguous,” Gilbert says, noting that advisors play an important role in helping clients navigate the application process. “There are going to be more and more denied claims.”

Financial services institutions, meanwhile, are pleased with the AMF’s guidelines. These firms say consumers should have the option of buying insurance through whatever channel they choose.

“In our view, [the AMF] has found the right balance,” says Brendan Wycks, executive director of CAFII. “It supports consumer choice by allowing a transaction to be completed over the Internet without necessarily involving a certified representative while still requiring appropriate consumer safeguards.”

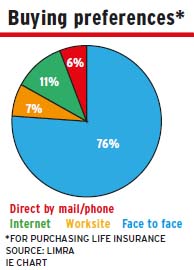

Facilitating online sales without advice doesn’t necessarily mean that the Internet will become the channel of choice for most consumers, Grant notes. In a 2013 survey by Windsor, Conn.-based global insurance association LIMRA International Inc., only 11% of Canadians said they would prefer to buy insurance online, vs 76% who said they would prefer to purchase insurance face to face from an advisor.

Sales patterns in the industry are consistent with these findings, Grant says: “We find that the actual incidence of purchase online is fairly low. The large majority of consumers either use another channel or they might use the Internet as a method of getting information, but then, in the final [step, consumers] would choose to contact a licensed representative.”

Insurance advisors always will be a prominent channel of insurance distribution – especially for products that are more complex in nature, Wycks says. However, he expects consumers to become increasingly comfortable buying simpler products, such as term insurance, online.

“In our view,” he says, “the future of the insurance business in all jurisdictions – including Quebec – will be marked by continued innovation, a continued increase in electronic commerce and increases in consumers’ preference for transacting on their own via the Internet and other alternative channels, including [using] mobile devices.”

Those consumers who choose to buy products online, Wycks adds, typically prefer to serve themselves rather than work with a professional.

© 2015 Investment Executive. All rights reserved.