Good stock selection and strategies to boost the return on fixed-income securities were the keys to above-average investment performance for segregated (seg) fund families in 2012.

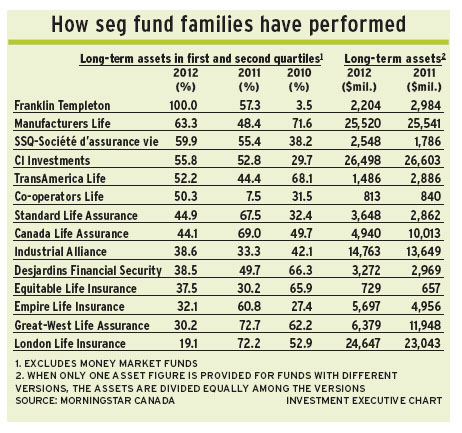

For instance, the large seg fund family of Waterloo, Ont.-based Manufacturers Life Insurance Co. (Manulife) was one of the better performers last year, ranking second in terms of the amount of long-term seg fund assets under management (AUM) in the first or second performance quartiles for the year ended Dec. 31, 2012.

“Our income fund managers select solid companies with strong balance sheets and high quality earnings,” says Michelle Ostermann, assistant vice president, guaranteed investment products, with Manulife. “And [the portfolio managers] have extensive expertise in fixed-income.”

The Manulife seg fund family offers a broad range of products and investment styles.

At the top of the 2012 list is Toronto-based Franklin Templeton Investments Corp., which had 100% of its long-term seg fund AUM in funds in the first or second performance quartiles. However, the firm offers only four seg funds – all of which are based on Templeton equity funds, which are managed in a fairly aggressive value style. That is, portfolio managers of the underlying mutual funds were not afraid to pick undervalued stocks in Europe and Japan – although the biggest contributor to their 2012 returns came from U.S. stocks.

Another small seg fund family, that of SSQ-Société d’assurance vie in Montreal, was the third-best performer among seg fund families last year, with 59.9% of assets in above-average performing funds – and those funds were more broadly representative of 2012 trends.

SSQ’s Astra PIMCO Bond Fund performed particularly well. Its mandate allows up to 30% of its AUM to be held in foreign bonds and the fund invests in some high-yield securities, including emerging-market bonds, says Cedric Pouliot, director, Astra funds. Astra Fiera Capital Bond Fund also had solid results, he adds, primarily because of “good duration management.”

Three of SSQ’s four Canadian equity seg funds did well, although each for different reasons. For instance, Astra JFL Canadian Value Equity Fund was underweighted in the materials sector. In addition, that fund’s stock picks increased its return in the energy sector. And Pouliot describes Astra Triasima Canadian Equity Fund as “quite nimble” in its use of stock rotation, noting its significant underweighting in energy, materials and insurance companies.

Second-place Manulife’s large seg family wasn’t far behind, with 57.9% of its long-term seg fund AUM in the first or second performance quartiles.

Ostermann notes that two of Manulife’s larger funds – Manulife Monthly High Income Fund ($4.6 billion in AUM and managed by Manulife Asset Management Ltd.) and Manulife Fidelity Monthly Income Fund ($1.2 billion in AUM and managed by Fidelity Investments Canada LLC) – had similar sectoral weightings, being overweighted in consumer staples and information technology but underweighted in energy, materials and financials. Strong stock selection within sectors and some emerging-markets exposure in the Manulife Fidelity fund also helped.

On the fixed-income side, Manulife Monthly High Income Fund focused on investment-grade bonds, Ostermann says, while Manulife Fidelity Monthly Income Fund invested in some convertibles and floating-rate bonds.

In contrast, the seg families owned by the three insurance subsidiaries of Winnipeg-based Great-West Lifeco Inc. performed poorly – particularly the large London Life Insurance Co. family, with only 19.1% of its long-term seg fund AUM in above-average performing funds. Great-West Life Assurance Co. and Canada Life Assurance Co. families had 30.2% and 44.1%, respectively, in the top two performance quartiles.

However, George Turpie, senior vice president, investment funds, product pricing and market development, wealth management, with all three insurance subsidiaries in London, Ont., is not discouraged by the 2012 results: “We know there will be short-term fluctuations, and we focus on the longer term. Our three-year returns are quite far north of 50%.”

Turpie points to two factors that negatively affected seg fund performance in 2012: higher average credit quality in fixed-income investments and less foreign content in equity and balanced funds than in competitor funds.

Turpie points out that the strategy of keeping credit quality high in fixed-income investments was a major contributor to the three seg fund families’ success during the credit crisis. And the firms will not change the funds’ mandates because they don’t want unitholders’ credit risk to increase “unknowingly.”

However, the companies may add fixed-income funds with more credit risk to provide options for investors who want a more aggressive approach.

On the equities side, the three companies believe in including “pure” funds, such as Canadian equity funds that are invested entirely in Canadian equities, Turpie explains, because that allows financial advisors to build portfolios “without unintended exposure to foreign markets.”

But ratings of Canadian equity funds are not subdivided by the amount of foreign exposure, which can be as high as 49% of AUM. Last year, Canadian equities lagged most other markets, so funds with little or no foreign exposure tended to underperform.

The seg family of Quebec City-based Industrial Alliance Insurance and Financial Services Inc. (IA) also struggled – and for the second year in a row, with 39.8% of its long-term seg fund AUM in above-average performing funds last year vs 3.3% in 2011.

IA’s biggest fund – IA Bond Fund, with $2.7 billion in AUM – was again in the third performance quartile, even though its return was 60 basis points higher than its benchmark.

François Lalande, IA’s vice president for portfolio management, says that 2012 was “all about corporate bonds”; and although IA’s funds were overweighted in corporate bonds, “it was not to the extent of their peers.” In addition, IA Bond Fund’s mandate does not permit the purchase of high-yield bonds.

IA’s biggest dividend fund also outperformed its benchmark, yet it, too, remained in the third performance quartile.

“This is very frustrating,” says Lalande, “as it’s not easy at any time to beat benchmarks.”

The seg fund family of Standard Life Assurance Co. of Canada, based in Montreal, performed better, with 44.9% of its long-term seg fund AUM in the top two performance quartiles, although that was down from 67.5% in 2011.

Patrick Murray, investment specialist, says Standard Life’s seg funds that are more focused on dividends usually do better in years with weak equities returns, such as 2011. In strong markets, they generally don’t capture all the upside.

© 2013 Investment Executive. All rights reserved.