Heading into the next federal budget, Canada’s venture capital (VC) industry is booming. It’s also hopeful the government will keep the largesse flowing by preserving a 2012 program designed to stimulate VC investment. At the same time, a new report from an independent panel convened by the TMX Group Ltd. wants to boost support for companies already past the startup phase to help them keep growing.

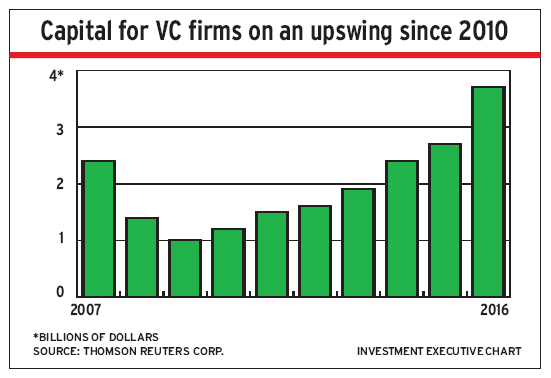

By most measures, 2016 was a banner year for VC investing in Canada. According to data from Thomson Reuters Corp., both VC investment and fundraising reached levels not seen since the “dot-com” boom years.

For that year, VC investment totalled $3.7 billion, which is up by 36% from the previous year and represents the highest level since 2001. At the same time, VC fundraising surged by 81% year-over-year to $2.2 billion. That’s the highest total since 2002.

These Canadian trends are running in defiance of a decline in VC activity globally in 2016. Yet, despite these seemingly strong results for Canada, the VC sector has its share of concerns.

Near the top of the list is the fate of the federal government’s Venture Capital Action Plan (VCAP), which was launched by the previous Conservative government as a way to try to kickstart VC investment in Canada. At the time, annual VC investment was running well below its current level. Following in the wake of the global financial crisis of 2008-09 and the subsequent global recession, VC investment in Canada dropped to just $1 billion in 2009, and struggled to recover after that.

The VCAP concept, proposed in the 2012 federal budget, aimed to invest up to $400 million in VC funds and VC funds-of-funds to help stimulate private investments in these vehicles as well. To date, the feds have invested $340 million into various VC funds, which have raised a total of $1.4 billion, thanks to co-investments from the private sector. Of this total, almost $900 million has been committed to specific VC funds, and more than half of that total has been plowed into “high growth” Canadian companies, such as techs and biotechs.

Although there are still hundreds of millions of dollars to be deployed, the VC industry is concerned that the original VCAP program is set to expire as VC funds become fully committed in the months ahead. The VC industry hopes the next federal budget will include a pledge to keep the VCAP going.

The Canadian Venture Capital and Private Equity Association (CVCA), an industry trade group, is calling on the government to launch VCAP 2.0. The CVCA maintains that the program is not an expense for the government; rather, the VCAP is an investment that will produce a positive return. The CVCA argues that the government shouldn’t let the current strong momentum in the VC industry dissipate before it has become fully sustainable.

This call to rejuvenate the VCAP is being echoed in a new report published in late February by the Advancing Innovation Roundtable – composed of representatives from several large financial services institutions, VC firms and institutional investors – that was convened by TMX Group to explore the challenges facing growth companies and to bring together the investment community to support long-term investment in high-growth sectors.

In the report from the independent roundtable states that although there is a good deal of capital flowing into Canadian startups at the early stages of their life cycle, there remains a real shortage of capital for companies that are trying to scale up their businesses.

According to the report, Canada lags the rest of the developed world in producing companies that reach “significant scale.” The report attributes this result to a lack of capital to fuel the growth of VC-supported companies and estimates that the capital shortfall for companies that are trying to scale up currently sits at about $4 billion – and that the shortfall is continuing to grow.

Of that shortfall, the report says: “$1 billion is needed simply to fund the current wave of companies moving beyond early and startup stages,” and another $3 billion is required by older companies that are growing more slowly than they should be due to a lack of capital.

In particular, the roundtable’s report states that Canada is lagging far behind markets such as the U.S. and the U.K. in terms of large VC deals (specifically, companies raising in excess of $50 million). The report notes that Canadian companies raise less money, and take longer to do it, compared with their counterparts in other markets. As a result, the report notes, VC-backed exits (VC firms that are acquired or go public as a result of their success) also occur far less frequently, and on a much smaller scale, than in the U.S.

The recent growth in VC investing is only going to intensify the problem, the report suggests. As more early-stage companies get financing, the dearth of growth capital will become an even bigger issue as those companies mature and seek additional funding. According to the report: “The funnel is getting increasingly filled at the top while the growth financing pinch point remains in place.”

As a result, the report estimates that the shortfall in VC growth capital is set to increase by at least $250 million per year “due to significantly higher early- and startup stage activity.” This growing shortfall could push the overall funding gap to $5 billion within the next three to five years.

To address the VC industry’s concerns, the roundtable report recommends renewing the federal government’s VCAP program – this time, with a specific focus on companies in the growth stage rather than startups: “[The government’s] continued support of the Canadian venture capital ecosystem at a critical point in the development cycle is crucially important. In short, one cycle is not sufficient to build a sustainably self-funding industry.”

In addition, the report calls on Canadian pension funds to set a target of devoting 0.1% of their assets under management, up to $100 million, to investing in growth-stage companies. This sort of commitment, the report suggests, could help drive participation by other institutional investors, along with banks and insurers, that could generate several billion dollars in “patient” capital for growth companies, which “would have an immediate and material impact on addressing the current capital gap.”

Some of this could be deployed via VCAP 2.0, the roundtable’s report suggests. However, in addition, it calls for the creation of an Innovation Growth Fund (IGF), modelled on an initiative in the U.K., that would give institutional investors a vehicle for contributing capital to high-growth Canadian companies. At the same time, the roundtable envisions a retail version of the IGF.

The report proposes creating a publicly traded VC investment fund that would allow retail investors to participate alongside institutions in an IGF: “With a target of $500 million to $1 billion, such a fund would expand the potential capital pool, while also re-energizing the retail channel and independent dealer sector.”

The report offers a handful of other recommendations for boosting retail interest in the VC market. Among other things, the report suggests that the TSX Venture Exchange seek to expand its listings, both by adopting rules that are better tailored to the needs of growth companies and by becoming more accommodating to different sorts of capital structures. In doing so, VC-funded firms can list on the public market without immediately incurring the expense of converting to a conventional publicly traded structure.

The report also advocates for increasing retail investors’ access to information on VC-funded firms, noting that the lack of analyst coverage for small- and micro-cap companies limits investor interest and market liquidity, and that this issue is growing more acute amid the struggles of the small dealers in recent years.

“While we support a healthy independent dealer sector,” the report states, “additional self-serve and easy-to-use tools and information should be made available to help retail investors better identify and understand investment opportunities on TSXV, thereby generating greater participation in Canada’s public venture market.”

The Canadian VC industry appears much healthier than it has been in a number of years. But, amid strong headline growth, concerns remain for companies and investors alike.

Much depends on whether Ottawa is prepared to renew its commitment to VC investing. Either way, the financial services sector will have to do most of the heavy lifting to drive innovation in Canada’s economy.

© 2017 Investment Executive. All rights reserved.