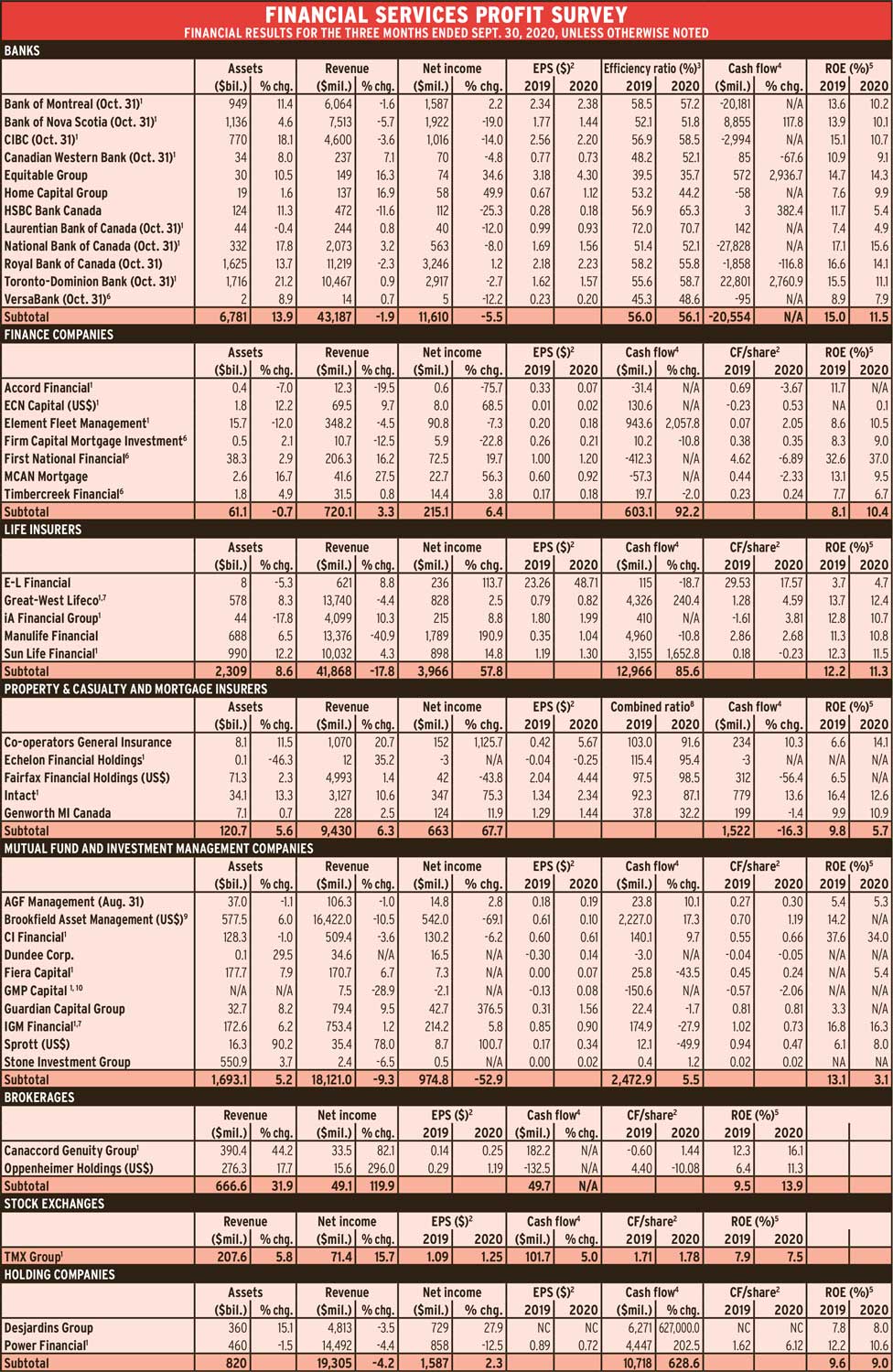

Financial services companies have come through the pandemic relatively unscathed, with many reporting higher net income than a year earlier.

Of the 42 companies analyzed by Investment Executive, 22 had earnings gains and three reported positive net income versus a loss a year earlier. Only 15 firms had lower earnings and just two reported a loss. (These figures are for quarters ending Aug. 31, Sept. 30 and Oct. 31, 2020, and exclude Great West Lifeco [GWL] and IGM Financial Inc., whose results are consolidated with Power Financial Corp.’s.)

Only three firms raised their quarterly dividends. Element Fleet Management Corp. upped its dividend to 6.5¢ from 4.5¢, First National Financial Corp. raised its to 52.50¢ from 48.75¢ and Sprott Inc.’s went to US25¢ from US23¢. First National also paid a special dividend of 50¢.

Most sub-sectors reported higher earnings, except the banks and the mutual fund and investment companies, but the banks were only down an average of 5.5%.

With lockdowns continuing, the spectre of loan defaults remains. Robert Colangelo, senior vice-president with Toronto-based DBRS Morningstar Ltd., called Big Six banks’ results “solid despite the challenging operating environment” in a recent report. Loans covered by payment deferral were “sharply lower” in the quarter. Going forward, “highly diversified franchises and demonstrated abilities to manage expenses should provide an offset” to constrained earnings, he wrote.

Net income dropped 52.9% for the mutual fund and investment companies collectively, but only because Brookfield Asset Management Inc.’s (BAM)earnings fell to US$542 million from US$1.8 billion the year before. Net income increased for six of the other eight firms.

Most insurers had a good quarter while the brokerages benefited from businesses turning to capital markets to raise cash. Strong equities performance increased TMX Group Ltd.’s earnings.

Here’s a look at the sectors in more detail:

Banks. The sector has been impacted by both the need for higher loan-loss provisions and low interest rates, which decrease loan profitability.

Four of the 12 deposit-taking institutions had higher earnings. Housing-focused banks saw big gains: earnings for Equitable Group Inc.and Home Capital Group Inc. were up 34.6% and 49.9% from a year earlier, respectively.

Bank of Montreal and Royal Bank of Canada also had higher net income, but gained less than 3%. Both had lower net income in personal and commercial banking, and profits fell in RBC’s wealth management operations.

CIBC and Bank of Nova Scotia saw double-digit income drops: 14% and 19%, respectively. Scotia’s operations in South America and the Caribbean were hit hard by Covid-19. Similarly, CIBC booked a $220-million impairment charge related to its Caribbean operations.

The 12 firms had a combined $11.7 billion in loan-loss provisions as Covid hit and $7 billion the following quarter. Only $3.3 billion was needed in the latest quarter — not much higher than the $2.9 billion of a year earlier.

Finance companies. Of the four companies with increased earnings, only ECN Capital and First National raised their dividends. The other two with gains were MCAN Mortgage Corp. and Timbercreek Financial Corp.

First National, MCAN and Timbercreek are residential mortgage providers and benefited from a strong housing market. ECN supports U.S.-based financial services companies.

The firms with earnings declines were Accord Financial Corp., Element Fleet Management and Firm Capital Mortgage Investment Corp. The reasons were largely Covid-related. For example, Accord buys other companies’ debts at a discount and collects the money owed, which was difficult during Covid. Firm Capital is involved in short-term real estate loans and other debts related to real estate.

Life insurers. All five lifecos reported higher earnings. E-L Financial Corp. and Manulife Financial Corp. had the biggest increases of 113.7% and 190.9%, respectively. E-L benefited from both an increase in the fair value of assets and lower net claims and benefits. Manulife benefited from investment-related factors. Both Manulife and Sun Life Financial Services Inc. saw sales rise strongly in Asia.

Property and casualty insurers. Fairfax Financial Holdings Ltd., the biggest company in this sector, reported a 43.8% drop in net income, mainly due to taxes payable of US$37.7 million this quarter versus a rebate in 3Q 2019.

Tiny Echelon Holdings Inc. remained in the red to the tune of $2.8 million versus $637,000 a year earlier.The other three insurers had strong increases in net income. Co-operators General Insurance Co. reported a profit gain of 1,125% due to $77.9 million in underwriting profits versus a loss a year earlier.

Intact Financial Corp. and Genworth MI Canada Inc. also saw improved underwriting profits.

Mutual fund and investment management companies. BAM’s big earnings drop was mainly because of lower equity-accounted income and a US$31-million drop in the fair value of assets versus a gain of US$394 million a year earlier.

Of the other nine companies, CI’s net income declined 6.2% and GMP Capital Inc. remained in the red. GMP sold its capital markets business and is focused on Richardson GMP Ltd., for which it acquired all common shares. In November, GMP was renamed RF Capital Group Inc. and Richardson GMP was renamed Richardson Wealth Ltd.

Five of the other seven companies in the sector reported increased earnings. Dundee Corp. and Fiera Capital Corp. posted positive net income versus a loss in 3Q 2019.

AGF Management Ltd. and CI Financial Corp. had net redemptions of $22 million and $2 billion, respectively. IGM reported net sales of $408 million.

- Brokerages. Large increases in investment banking revenue drove strong profits in the quarter.

- Exchanges. TMX had a solid 15.7% earnings gain.

- Holding companies. Desjardins Group’s net income increased 27.9% as all divisions saw higher earnings. Power Financial’s net income was down even though their two main subsidiaries, GWL and IGM, both reported increased earnings. Subsidiary Paragesa Holdings SA had a loss of $15 million versus earnings of $40 million the year before; there were also corporate-level losses.

Click image for full-size chart

N/A = not applicable; NA = not available because company has negative shareholders’ equity; NC = not calculable because Desjardins Group does not have common shares

- Unusual, non-recurring items have been excluded where possible. In some cases, these figures have been estimated

- Per-share data are fully diluted except when there is a loss or negative operating cash flow in either this quarter or the corresponding quarter a year earlier, in which case the number of basic shares are used in the calculation

- Calculated as non-interest expenses excluding amortization as % of revenue (excluding insurance revenue). Unusual expenses (such as for legal settlements) and unusually high revenue items (such as writedowns or large gains or losses from financial instruments) are excluded from the calculation

- Operating cash flow after change in non-cash working balances

- Calculated using net income (excluding unusual, non-recurring items) for the past 12 months as % of average of beginning and ending shareholders’ equity

- VersaBank’s, First National Financial Corp.’s, Firm Capital Mortgage Investment Corp.’s and Timbercreek Financial Corp.’s net income includes comprehensive income

- Great-West Lifeco Inc.’s and IGM Financial Inc.’s results are consolidated with Power Financial Corp.’s results

- Calculated as losses and operating expenses as % of net earned premiums

- Brookfield’s revenues exclude the change In fair market value of assets

- GMP has assets under administration

Sources: Company reports