Calendar spreads in earnings season

Here's a unique options strategy with a great appeal: The certainty of time value erosion

- By: Richard Croft

- December 14, 2012 October 31, 2019

- 00:00

The Canadian dollar's classification as a "reserve currency" will enhance the visibility of Canada's government bonds

Two of North America's Big Three automakers are selling fewer cars but are benefiting from being more efficient

But the prospects for two major U.S. firms and one prominent Canadian player differ quite significantly

There’s mounting evidence that a portfolio laden with dividend-paying stocks does indeed pay off. Around 2006, indexing portfolios to dividend payments rather than market capitalization…

This short-term forecasting tool can

The prices of solid bond issues can fall precipitously during market downturns, as they did during the recent stock market collapse of 2008

How the U.S. government will cope with its fiscal cliff is speculation. Go with short bonds to be safe

Although four of the big U.S. banks still face significant challenges, there are several reasons to be optimistic about them

There has been an absence of upgraded credit ratings, while defaults and downgraded credit ratings have persisted

Corporate earnings in the U.S. will rise strongly again next year, analysts say. But how likely is it that this will happen? The consensus from…

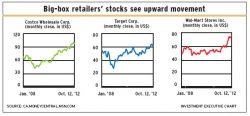

Three major U.S. big-box retailers are expecting to see gradual improvement as more Americans get back to work

Clients may now be receiving insufficient yields, given that dividends have risen by half as much as the S&P/TSX composite index since 2009

In spite of the low yields on bonds, there remains a rationale for holding them: they stabilize portfolios and pay back face value

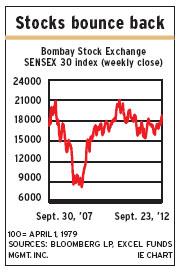

The rise of India as a key emerging economy presents opportunities in banking, IT and automobiles, among other sectors

The prolonged crisis has inverted the assumption that public debt is in the top tier of the bond market

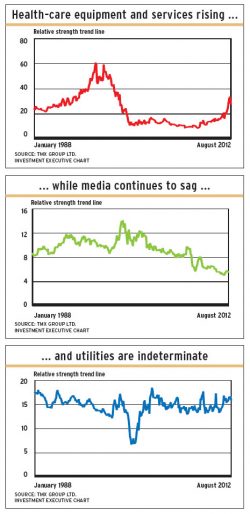

Relying on relative strength analysis can keep your clients out of sectors that look good but are losing their way

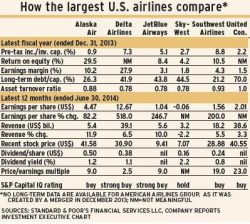

Canada's two major airlines - Air Canada and WestJet - face turbulent times, but their increased discipline should help

The optimal equities/straddle strategy arises when the return assumption approximates the frequency of the potential for profit

Real-return bonds have had a good run over the past five years. But they have become expensive

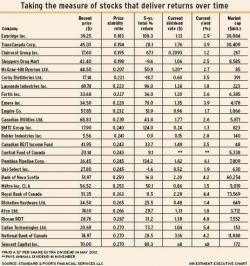

The most stable stocks have provided an average total return of 37% in the past five years. The list is laden with utilities, banks and…

Long-term investment performance track records and a history of increasing dividends make these firms well worth considering