SPECIAL SPONSORED CONTENT

Defining the Future of Private Wealth

While the needs of private wealth clients grow increasingly more complex, their patience for dealing with silos is quickly fading. They’re looking for integrated solutions that help them grow, protect, and transition their wealth across multiple generations, businesses, and borders. In other words, they’re looking for a partner that makes things easier and more seamless, not more complicated.

As firms scramble to address this need, BMO is setting the standard for what’s possible.

After several years of increasingly stronger collaboration, BMO’s private banking business and full-service brokerage, BMO Nesbitt Burns, came together earlier this year to form the unified brand BMO Private Wealth. Their business and segment leaders recently held a roundtable on the future of the industry. They explored what it takes to win: put clients and their families at the centre, deliver best-in-class service with an integrated team of local experts, and leverage BMO’s full suite of capabilities. The discussions revealed how private wealth professionals can make a meaningful difference in the lives of their clients.

Click below to see each relevant section

Click here to see related articles

Making Sense of Complexity

What do private wealth clients want? The right products and services, of course, but they need something more.

“Client lives today are more complex, and they’re looking for professionals to help them make sense of it,” says Sandra Henderson, Chief Operating Officer with BMO Private Wealth.

During the roundtable, the leaders identified six layers of complexity and discussed ways to fully understand and address them to help clients and wealth professionals prosper.

1. Business, individual, and family interests

Each part of a client’s life has its own financial needs, often quite intricate, and usually interconnected. Wealth planning, investments, banking, taxes, business succession, estate planning, and more—how do all the pieces fit? Those needs can also cross geographies.

At BMO Private Wealth, financial professionals bring their expertise and insight to the conversation when it can add the most value for the client.

“Having the client at the centre is how we organize, but it’s how we actually work together that sets us apart,” says Henderson, who heads the group’s Client Solutions team.

2. Choice

Add to that the number of options and advice, available from all corners. The challenge is to navigate it in order to take smart action.

“It’s a lot more overwhelming today for most people,” says Bruce Ferman, Head of Investment Management at BMO Private Wealth. “There are more products and solutions with more information available about them. You need help to sift through it. People are looking for personalized advice from advisors who know and understand them.”

3. Transfer of wealth

If overall requirements and choice make things more complex in private wealth, so does a third factor: the sizable and ongoing transfer of wealth.

“We’re dealing with different generations, needs, and wants,” says Elizabeth Dorsch, Head of Trust and Estate Services at BMO Private Wealth. “In some situations, people are also skipping a generation and giving their wealth to their grandchildren.”

Preparing families and multiple generations for the next stage—as well as dealing with family dynamics—fills an invaluable role.

4. Relevance

What all clients want, beyond sound advice and a plan, is a grasp of what it all means. Advisors have to cut through all the noise, a fourth layer of complexity.

Picture a giant funnel, says Ferman, with all sorts of information flowing through it. What’s the professional’s job? “Present the information so it’s uniquely relevant to the client,” he says. “Communicate it in a way that they’re going to understand and that’s going to resonate with them—so they remember why they made the choices,” Ferman says.

5. Communication

Clients also want information and ideas in a manner that suits them best. That, too, is part of distilling clarity from complexity.

The way wealth advisors deliver information and communicate can be varied. It can entail monthly meetings, other check-ins, written statements, digital advice, and more.

“We need to be doing all of it and tailoring our communication plan to how the client wants to hear from us,” says Henderson.

6. Time

Lastly, in a fast-paced world, “time is the most valuable commodity,” says Lina Stinnes, Head of Business Banking Strategy and Wealth Integration at BMO Private Wealth.

It has become a more urgent task to make things less confusing for clients, by providing ideas in a co-ordinated and timely approach.

Stinnes also looks at time another way. The value of advice comes from what’s applicable today and what sets people up for continued success. “Sometimes we’re planting ideas,” she says. “When we’re talking to clients who eventually plan to transition their business, we help them plan it five or 10 years in advance. That helps them maximize the value of the transaction while ensuring the transition is smooth.”

What could be more complex than seeing the future? For BMO Private Wealth, helping clients visualize it can maximize their outcomes for years and generations to come.

back to top ↑BMO Private Wealth at a Glance

- Created in January 2019 by bringing together BMO Private Banking and BMO Nesbitt Burns, to form one united brand.

- A team of BMO Private Wealth professionals provides planning services on topics related to investment management, wealth planning, banking, tax planning, philanthropy planning, estate and trust, and insurance products, services, and advice.

- Experts are located in markets across Canada.

- Part of BMO Financial Group, which has two centuries of experience putting clients first.

- Culture of collaboration enables professionals to work on integrated teams and bring the best of BMO to every private wealth client.

- Develops customized and integrated investment, banking, and estate planning solutions.

- Partners across the U.S. and Asia help deliver a smooth cross-border experience.

- Applies innovative approaches that leverage assets and insurance to solve complex needs.

- Commitment to increase women in leadership and client-facing roles. Half the members of the leadership team are women.

The Go-to Qualities for Private Wealth Professionals

It takes more than technical skills and industry experience for wealth professionals to succeed. For BMO Private Wealth, six qualities are critical:

Probing: Do a deep discovery to draw out what clients, their families, and their businesses are all about. Knowing what’s important to them helps establish a trusting relationship. “By taking the time to understand a client’s goals and motivations, we often uncover unarticulated needs,” Charlton says. “That’s where we really shine—by providing a holistic solution, tailored to the individual.”

Good listening skills: Every client is different, so pick up on what matters. “I once dealt with an individual whose four-year-old grandson was the centre of his universe. If you didn’t know that, you would have missed everything,” says Dorsch.

Empathy: Put yourself in the client’s shoes. Peel back the needs on the surface to grasp the client’s feeling about crucial times in their lives—their challenges and desires.

Perspective: Start with the client first, then work the solutions back. “Teams across BMO put the client at the centre, which helps them come together when multiple businesses or geographies are part of a client solution,” says Stinnes.

Collaboration: Team with partners, across businesses and borders, to revolve around the client. “Use the depth and breadth of the platform to take new ideas to clients,” says Neil Herschcovitch, Head, Ultra High Net Worth Segment.

Entrepreneurial spirit: Be willing to challenge the status quo and do what’s right for clients.

On a Journey

This may be the first year for BMO Private Wealth, but unification was a long time coming.

BMO Private Banking and BMO Nesbitt Burns were already working in partnership. They referred billions in business to each other annually. Members of those respective groups often went to market and approached clients as a team. More than 50 Private Bankers and Investment Advisors were working together at the same branch.

“This didn’t happen overnight. It was a journey,” says Henderson. “Over the years, the businesses have increasingly worked together on the best solutions for clients.”

How natural has the evolution been? After the announcement in January, employees from both businesses said they wanted the transition to a united brand to happen even faster than leaders expected.

“Success breeds success,” says Laura Charlton, Head of Banking. As both sides saw how coming together would benefit clients, “we were ready to take collaboration to the next level.”

Another reason why the time was right: the industry is changing.

“It’s not just about cash flow and retirement anymore —it’s much more personal,” says Sebastien Souligny, Head of Wealth Planning Canada. “Families have a lot of important decisions to make. They need a team that will take the time to understand their needs, make sense of it all, and guide them through the right process to make those decisions.”

The structure helps clients and wealth professionals alike.

“Through the formation of Private Wealth, we’re developing more resources, breaking down barriers, and really focusing on our clients—which is where it needs to be,” says Ferman. “We’ve empowered our advisors to really build an amazing business.”

It’s the client who ultimately benefits. “Putting Private Wealth together and encouraging multidisciplinary teams, the experience feels better, more seamless,” says Ferman.

Another thing that differentiates BMO Private Wealth is that experts are in local markets. Clients meet the people they’ll work with. Local credit adjudication also means the people making approval decisions understand the dynamics of the market. Being local and personal helps to bring a boutique feel to a large organization.

Bringing the businesses together to form a united brand offers efficiencies around operations. That frees up capital to put one solution into place for everything—from technology to services.

“We can come up with new products and solutions that are going to be unique in the marketplace,” says Henderson. “So we’re reinvesting in things that will help our advisors and teams to be out there with clients in a different way.”

back to top ↑Ask the Tough Questions

Some client conversations are straightforward and some solutions are obvious—but hardly all. For wealth professionals, a big part of the job is helping clients consider things they hadn’t contemplated, or have avoided talking about.

“We have a responsibility to have the courage to ask the difficult questions, because, quite often, members of the family don’t want to raise them in a meeting,” says Ferman.

Every situation is unique. How much leverage makes sense? How much debt can you borrow? How can you protect assets? Who will have power of attorney? Often, there’s no single answer to questions like these. But it’s vital to push back, raise issues, and uncover ways to mitigate them.

It’s the same when business transitions come up. Who’s going to lead the family business? How will decisions be made? How will disagreements be resolved? What ownership makes sense if children have unequal roles, or if some have no role?

Even a seemingly simple question can raise complex issues to sort out. Questions like “Who’s going to pay the bills?” or “Can my daughter who just graduated start working in the family business I own with my sister? In doing so, “our role is to challenge and help clients go further in their reflection process,” says Souligny.

back to top ↑The Right Solutions at the Right Time

In meeting any client need, it’s important to keep one thing in mind.

“To clients, their money is a lifetime of work, and sometimes several lifetimes of work,” says Ferman. “So how they see their money, spend their money, and wish to gift their money is all very personal.”

So is the service that BMO Private Wealth provides. There is no one-size-fits-all approach. Everything is highly customized. It’s about one team coming together to make a meaningful difference for the client and their family.

BMO Private Wealth’s leaders discussed seven real-life scenarios to illustrate how their overall capabilities come to life and what they ultimately achieve for clients.

1. Instill confidence in times of uncertainty

Serving the client:

A client worked with his BMO Nesbitt Burns advisor and the Trust team to establish a power of attorney (POA) for his property, which included a business. A few years later, he suffered a medical condition, which required BMO to execute on the POA to manage his personal property and keep the operating company going. Fortunately, the client recovered and he expressed an interest in selling the company. Trust arranged to have it valuated and introduced BMO Business Banking. The client intended to invest a portion of the proceeds with BMO Nesbitt Burns.

Lesson learned:

“Our Trust professionals worked with our partners to simplify things for the client and keep things running at a time when it could have been quite chaotic,” says Dorsch.

2. Make it easy for clients to capitalize on an opportunity

Serving the client:

A family business wanted to make a time-sensitive investment in a company. Many clients in this situation would think about how they had to shop the street to get financing. That adds stress. BMO helped avoid this, providing some borrowing power on the client’s investment portfolio, with more long-term financing arranged for down the road. The advisor was able to assemble a multidisciplinary team and make it happen with no bureaucracy.

Lesson learned:

“The opportunity for this client was right then and there, and we were able to act quickly,” says Ferman. “It felt smooth. The client was able to do what they wanted without feeling a level of stress.” He adds that this all came about because of the advisor’s regular contact with the client. “A routine portfolio review became a larger conversation. It’s back to the basics of just knowing your client, knowing your client’s business, and having the wherewithal to pull people together.”

3. Open a conversation to open possibilities

Serving the client:

A BMO Nesbitt Burns client wanted to expand the relationship. They went through a will planning and appointed BMO Trust as their executor and POA for property. The discussion revealed that the client had a family trust with another institution. BMO eventually got appointed as trustee and won over all their banking as well. These clients are snowbirds, and BMO was able to pull in their U.S. capabilities to help on that banking end. The Investment Advisor remained at the centre of the client relationship.

Lesson learned:

“This has just blossomed,” Dorsch says. “It’s a classic example of opening that conversation, having the strength of BMO behind us, pulling in partners, and really adding value to the client experience.”

4. Provide a range of options

Serving the client:

A client with considerable real estate holdings, not a very liquid asset, faced a significant tax liability. What the client needed, though, was viable choices. If you don’t want to have a yard sale, what are the alternatives? One alternative presented itself: life insurance against the real estate, with an ability to finance payment of the premiums. That helps with cash flow as well.

Lesson learned:

If answers are obvious, anybody can provide them. What clients appreciate are wealth professionals who can step back, understand the issue, and return with different possibilities. “We’re really good at leveraging life insurance policies, and not many can. So that’s a differentiator. The client here was really looking for options, and knowing we could deliver,” says Souligny.

5. Help clients create a new chapter in their stories

Serving the client:

BMO is committed to women, including female entrepreneurs. Historically, they’ve had challenges accessing funding. Since 2014, BMO has pledged $5 billion in capital to support this segment. One client came to BMO after her marriage dissolved. The breakdown left her with some means, but she had a passion to start a business that would involve her daughters. She had a great proposal. The team brought Business Banking to the table to help her get it off the ground. Later, BMO’s franchise group supported her efforts to expand the enterprise, which has since spread to dozens of other female entrepreneurs.

Lesson learned:

“She had an idea, but she didn’t know how to access capital,” Henderson says. “Now she’s advocating for other women to take this on. Her success has bred into entrepreneurs who are also developing wealth and creating new stories on their own.”

6. Navigate complex scenarios across jurisdictions

Serving the client:

For clients based in Hong Kong, one of the parents was moving to Canada and one of the children was going to live in the U.S. Making the financial arrangements, and dealing with all of the cross-border considerations, involved professionals from all three jurisdictions.

Lesson learned:

The global aspect, combined with family dynamics, meant this engagement had many dimensions. Dorsch says BMO experts brainstormed to design a plan with several options. In a way, families sometimes have their own jurisdictions, in terms of each individual’s interests, authority, and say. Navigating that can be just as tricky as dealing with geographies—especially when you’re dealing with emotions. “Clients see us as an unbiased party,” says Dorsch. “We come to the table with solutions.”

7. Reveal ways to expand the relationship

Serving the client:

BMO started a relationship with a commercial client as a single-bank lender. Over a number of years, BMO became the lead bank in their syndicated credit. As a substantial part of the client’s wealth was tied up in the company, the family members wanted to consider diversifying their risk. With demonstrated expertise in this industry segment, Commercial Banking was engaged to help explore strategic options, including a potential sale of the company. Thinking about the practicalities of monetization, the client welcomed the chance to talk to the wealth business and opened personal accounts for the whole family. That also sparked conversations around family governance of the business, decision-making, and philanthropy.

Lesson learned:

“The client was involved with every pillar of our company: wealth, commercial, and capital markets. That’s a great platform to be able to provide access to,” says Herschcovitch. “Advisors are able to drive new business by unlocking opportunities from extremely deep relationships across the rest of our firm. That’s unique, the way we are connected across the bank.”

back to top ↑The Pillars of a Practice

Wealth professionals are focused on what their clients want and need. But what fulfills those same professionals?

“We have a culture of helping advisors, and all of our frontline relationship management people, to build successful businesses,” says Ferman.

Professionals want to work with a brand that supports their entrepreneurship and provides the tools to help them serve their clients. That’s a strong foundation for a practice.

One of the things BMO Private Wealth does best is help professionals to broaden their impact. That happens in a few ways.

Nobody can know everything. When professionals have the ability to collaborate widely with other subject matter experts—whether with colleagues in co-locations or across the organization—they can offer that much more to clients.

“Breaking down the barriers is really an example of freeing capacity, helping them deliver, and taking it to the next level,” says Ferman.

Souligny adds that potential hires often want to meet with other members of the team in the organization to understand the expertise they can leverage. “They understand the value proposition here,” he says.

More efficient processes behind the scenes also free up time for wealth professionals to spend more time with clients. That’s more capacity, too, to dig deeper and provide valuable advice.

By increasingly incorporating technology, teams can also make an even more meaningful difference with clients. BMO continues to innovate through tools like digital onboarding, an integrated view of accounts across the bank, and WealthPath (an interactive financial planning platform to explore complex scenarios in real time).

Henderson mentions a wealth of resources to bolster an advisory practice. That includes a best-in-class training and mentoring program, data and analytics that provide leads, and marketing support.

“We have great insights into what clients are thinking about and some of the ways we can help advisors be proactive with them,” says Henderson.

The culture of collaboration extends to feedback, all of which helps BMO Private Wealth and its people to continually improve. Dorsch describes the flat leadership, which encourages informal feedback. “Especially if there’s a client need in the middle—in which case, it’s all hands on deck,” she says.

An idea exchange is a more formal feedback mechanism. Dorsch says that suggestions get compiled and team members vote on the priorities, from technology improvements to policy changes.

“All of this is about how we make their day-to-day interactions easier,” says Dorsch, “and how we make it easier for clients.”

Consider the Culture

A big part of what helps serve clients and attract the best talent comes down to the same thing: the culture.

“What comes through is a deep-rooted advocacy for clients,” says Ferman. He says wealth professionals challenge the four corners of the organization to deliver what each client needs and wants in a manner that’s suitable for them.

In part, the BMO Private Wealth culture meshes an entrepreneurial spirit with a team approach. It’s about bringing in different expertise to surround the client. “There’s a feeling of one team,” says Ferman, “rather than a web of referrals.”

It’s enticing to work together in an unprecedented way and give clients access to the best solutions. “People who we hire say they feel the energy in our organization and the desire to grow,” says Charlton.

There’s also a culture of trust, between colleagues and with clients. Both are crucial in generating the best solutions and plans.

Clients want to deal with wealth professionals in whom they have deep confidence. After all, they’re bringing you into their circle. This is all about the most important asset clients have: their families. Wealth has to be preserved and protected for them.

Gaining insight into and establishing bonds with the entire family—spouse, children, or grandchildren—is a priority. That deepens (and can help retain) relationships, and it’s a foundation for better advice.

“We want to be seen as an extension of their family, as a true financial partner,” says Herschcovitch. “It has to feel like a trusted and value-add experience.”

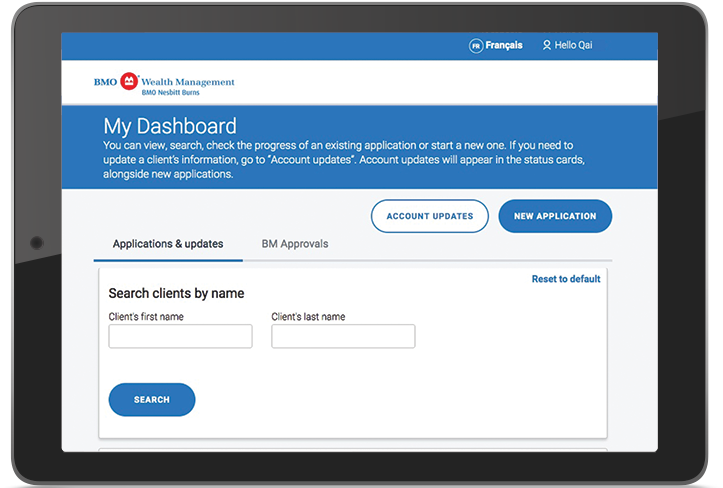

Onboarding.

Advisors can spend less time on paperwork and more with clients thanks to a fully digitized client onboarding application that opens accounts quicker and eliminates most paper forms. The tablet-friendly platform has reduced error rates and freed up even more time for great conversations.

Digitized onboarding

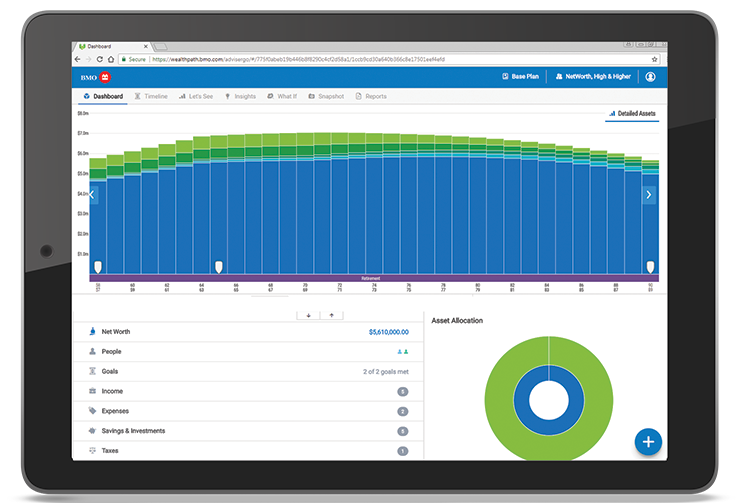

back to top ↑Planning.

WealthPath simplifies the process to identify and achieve clear financial goals. The tablet- and smartphone-friendly application lets advisors explore complex scenarios in real time, using instructive charts and graphs. Once a plan is set, clients can review it online and test other scenarios.

WealthPath

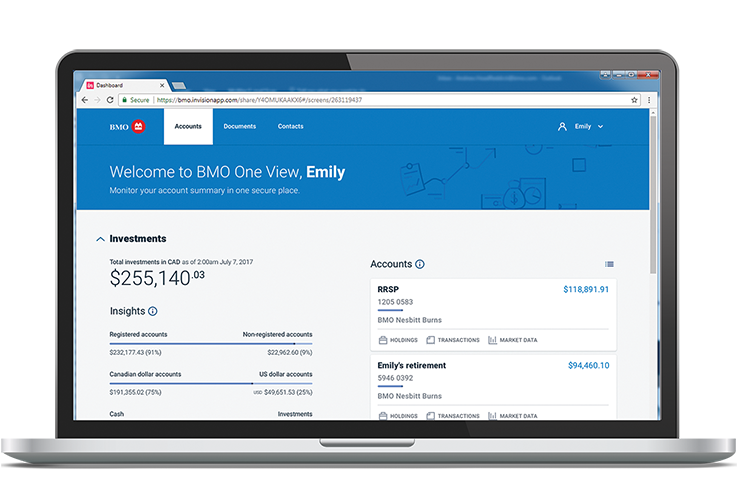

Banking.

Private Wealth clients can access a secure and consolidated view of their relationships across BMO via One View. It delivers a complete financial picture, with accounts from BMO Bank of Montreal, BMO Nesbitt Burns, BMO Private Banking, BMO InvestorLine, and BMO SmartFolio.

One View

BMO Private Wealth is a brand name for a business group consisting of Bank of Montreal and certain of its affiliates in providing private wealth management products and services. Not all products and services are offered by all legal entities within BMO Private Wealth. Banking services are offered through Bank of Montreal. Investment management, wealth planning, tax planning, and philanthropy planning services are offered through BMO Nesbitt Burns Inc. and BMO Private Investment Counsel Inc. Estate, trust, and custodial services are offered through BMO Trust Company. Insurance services and products are offered through BMO Estate Insurance Advisory Services Inc., a wholly-owned subsidiary of BMO Nesbitt Burns Inc. BMO Private Wealth legal entities do not offer tax advice. BMO Nesbitt Burns Inc. is a member of the Canadian Investor Protection Fund and the Investment Industry Regulatory Organization of Canada. BMO Trust Company and BMO Bank of Montreal are Members of CDIC. ® Registered trademark of Bank of Montreal, used under licence.