PAID CONTENT

Get clients retirement ready amid a pandemic

Canada Life Risk-Managed Portfolios offer a managed solution for a smoother investor experience.

The global pandemic has caused significant market volatility and impacted many clients’ retirement plans.

In fact, about one-quarter of clients that have less than $500,000 in investable assets are thinking about delaying their retirement due to COVID-19, according to a Canada Life survey. Further, about 15% of clients in that group may downsize their retirement lifestyle expectations.

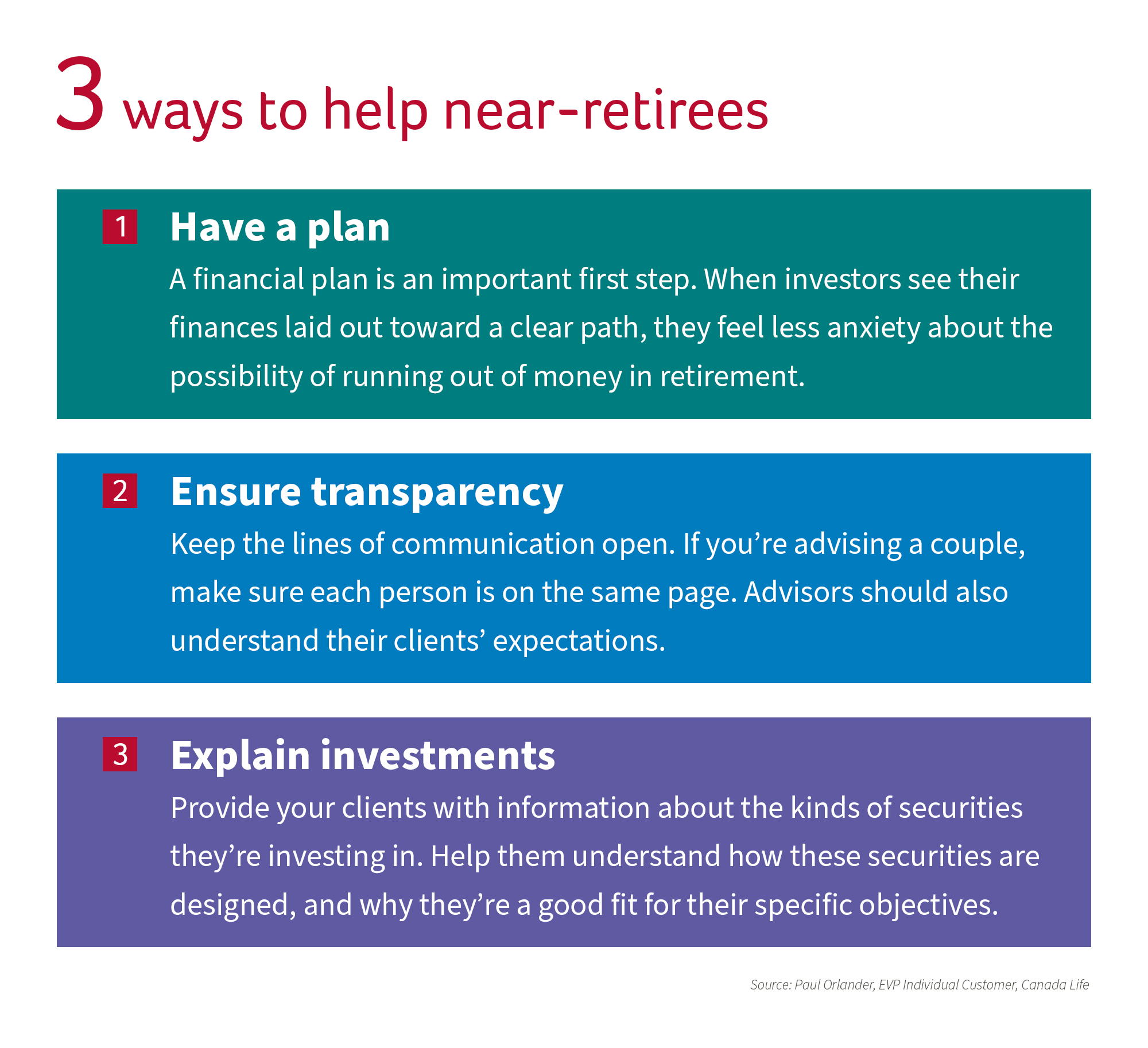

“We’ve all watched the economic uncertainty, tremendous market volatility, and significant rebound,” says Paul Orlander, EVP Individual Customer, Canada Life. Advisors need to help clients with new and different ways of thinking about their portfolios. They need to protect clients from the unexpected while still helping them to reach their goals.”

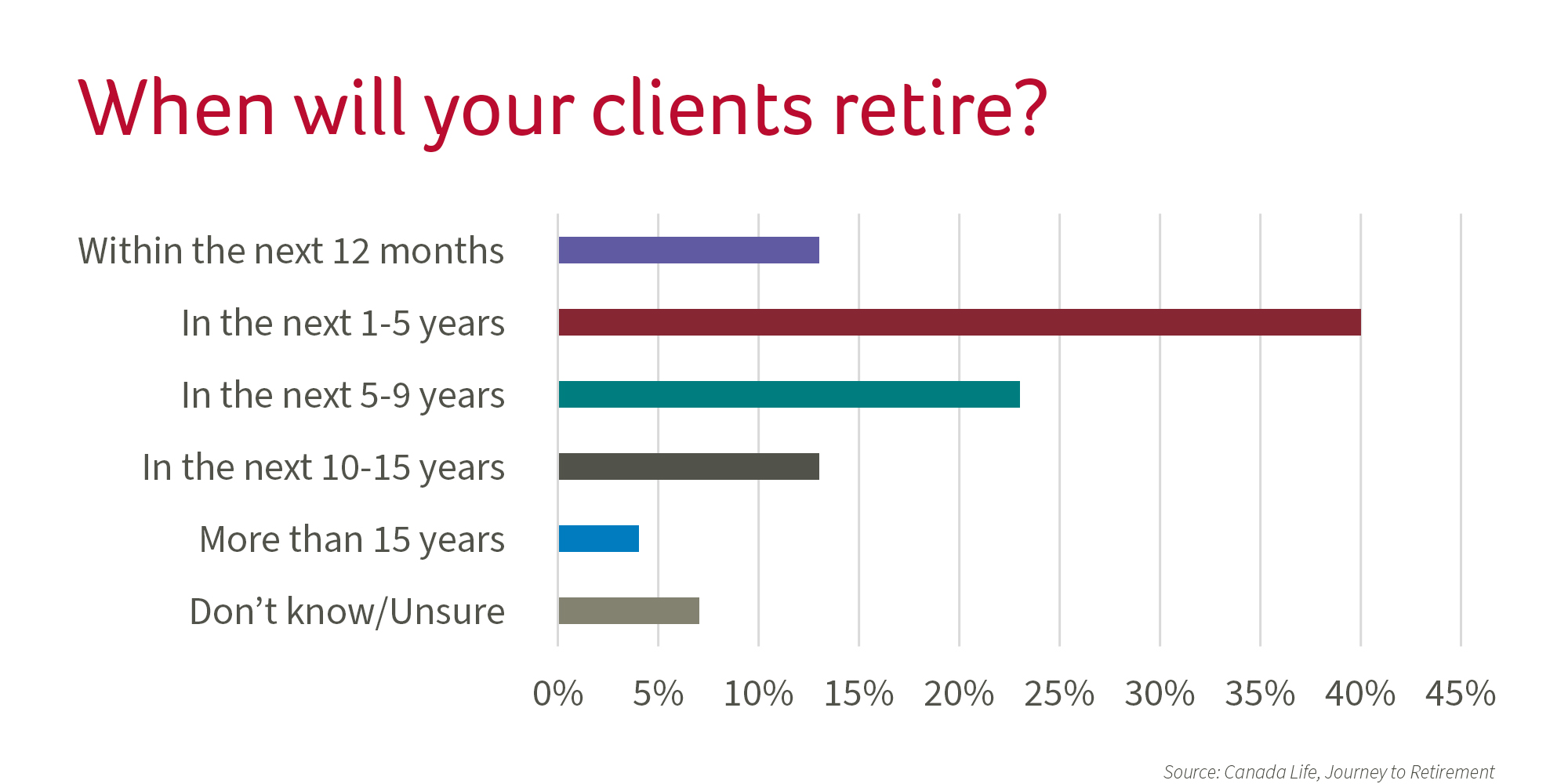

Advisors also need to be prepared to handle a changing retirement landscape.

Some clients, Orlander says, may be late financial bloomers. For instance, they may have purchased a home, gotten married, or had kids later in life. “They’ll likely have to work longer in order to support adult children who are going to be at home longer. That shortens the duration of leisure time they’d have.”

Meanwhile, a growing number of clients over age 60 may have complex families and finances, according to Orlander. For instance, they may have gone through a divorce, or they may be caring for elderly relatives.

There’s also the more traditional type of retiree, he notes. These clients have a comfortable level of wealth, spend time with their families, and enjoy an active lifestyle.

But we expect this financially stress-free group to decrease over time, notes Orlander. “Advisors must be prepared to handle very different retirement-readiness conversations.”

Solution

The pandemic, along with the changing retirement landscape, has also caused an increase in loss aversion, which is the tendency for investors to prefer avoiding losses over acquiring gains.

“One of the challenges of loss aversion is that it can make investors behave in ways that are suboptimal,” says Orlander. “Advisors can help investors focus on the long term and feel confident in their financial plan, regardless of market volatility.”

One option is the Canada Life Risk-Managed Portfolios.

“These are designed to be a single-fund solution that’s thoughtfully designed to balance risk and return, and help manage some of that downside risk,” says Ian Filderman, VP Product Development, Wealth Solutions, Canada Life.

There are four distinct risk management levers used by the portfolio managers to help navigate volatility in these portfolios, he notes.

- Canada Life Risk Reduction Pool: The fund uses an option collar strategy, which uses derivative instruments to reduce equity volatility. This acts as the portfolio’s central defence system. The strategy focuses on buying puts and selling calls, which creates an upper and lower limit to equity returns. Equity returns typically tend to fluctuate within this protected band, reducing the chance of extreme market fluctuations.

- Global equity exposure: The equity exposure is primarily invested in lower-volatility strategies that tend to focus on higher quality companies, which have the potential to offer better risk-adjusted returns than the market.

- Canada Life Global Tactical Equity Fund: This strategy monitors bullish or bearish signals in the market. It adjusts the equity exposure accordingly by reducing the amount invested in equities, and increasing the amount in cash when there is greater likelihood for stock market declines.

- Liquid alternatives: These are accessed through a multi-strategy absolute return fund, which seeks to provide a positive absolute return regardless of market conditions. It can provide additional diversification benefits to the portfolio through uncorrelated sources of return.

There are three different offerings within the Canada Life Risk-Managed Portfolios. Each portfolio is designed to provide a different level of growth and risk management, so advisors can offer a solution based on their clients’ unique risk tolerance, according to Filderman.

- Conservative Income Portfolio: 60% fixed income; 35% equities; 5% alternatives. This portfolio may be suited for clients that want downside protection and more modest growth potential.

- Balanced Portfolio: 40% fixed income; 55% equities; 5% alternatives. This portfolio may be suited for clients that want a balance of risk and return.

- Growth Portfolio: 20% fixed income; 75% equities; 5% alternatives. This portfolio may be suited for clients that want more growth potential and are willing to take on more risk while still maintaining some downside protection.

“These portfolios bring together risk-management strategies, traditional and non-traditional investments, and an award-winning team of knowledgeable, experienced professionals that take care of day-to-day investment management, and monitor and adjust the portfolio into a single-portfolio solution,” says Filderman.

“The Canada Life Risk-Managed Portfolios go beyond the traditional diversification typically found within most balanced funds The risk-management techniques used are designed to help deliver a smoother investment experience.”

Orlander adds, “Clients are looking to simplify their lives by putting more of their financial holdings in one spot. You’re either going to be the lead advisor who is helping a client with their consolidated assets or one of the advisors that clients depart from. So it’s an important opportunity for advisors to step forward and actively support clients in retirement readiness.”

Canada Life Risk-Managed Portfolios are available through a segregated funds policy issued by Canada Life or as a mutual fund managed by Canada Life Investment Management Ltd. offered exclusively through Quadrus Investment Services Ltd. Make your investment decisions wisely. Important information about mutual funds is found in the Fund Facts document. Please read this carefully before investing. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated. A description of the key features of the segregated fund policy is contained in the information folder. Any amount allocated to a segregated fund is invested at the risk of the policyowner and may increase or decrease in value.

Canada Life and design are trademarks of The Canada Life Assurance Company.