Helping your clients live their

best lives. Without compromise.

How does someone plan to live their best life?

As Canadians begin their financial planning for the year ahead, we conclude our series of case studies by examining the economic concerns on people’s minds—and how Manulife Bank lending solutions can leverage Canadians’ assets in order to realize their dreams.

1

Wealth decumulation into retirement

2

Wealth preservation with an eye to the future

3

How high-net-worth clients can leverage insurance to enhance cash flow

4

Lending solutions in annual financial planning

* Sample cases for illustration purposes only

How to support financial planning

during uncertain economic times

Activate assets to create cash flow solutions

Through Manulife Bank lending solutions and strategies, you can guide your clients through their 2023 financial planning in ways that can help them achieve their future financial goals—despite today’s economic concerns.

By activating their current investment, life insurance, and real estate assets, you can explore opportunities for each asset as a cash flow solution based on your clients’ specific needs. This helps ensure they’ll continue to have the financial flexibility essential in 2023’s economy.

Canadians aren’t confident going into 2023

Canadians are preparing for a recession and its impact on their budgets and cash flow

According to the Manulife Bank 2022 Fall Debt Survey, a recession seems inevitable to nearly three-quarters of Canadians—which doesn’t include those who believe we’re already in one.

Q

Within the next year, how likely would you say that the Canadian economy will enter into a recession?

Once in a recession, more than half don’t see it ending anytime soon.

Q

How long do you expect this recession to last?

Source: Manulife Bank 2022 Fall Debt Survey, page 41

Canadians say life is becoming less affordable than last year

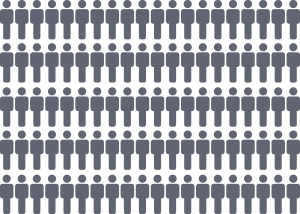

53%

would struggle with unexpected expenses

48%

often feel overwhelmed by their financial situations

35%

say their financial situations have deteriorated over the last year

19%

are saving nothing each month

Source: Manulife Bank 2022 Fall Debt Survey, page 6

Canadians’ 3 key economic concerns in 2023

(Hint: They’re all related to cash flow.)

Nearly one-third of Canadians say financial stresses may be impacting their mental health.

Canadians are more than concerned. They’re actually worried.

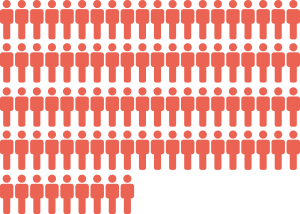

89% worry

about inflation

59% say spending is rising faster than income

85% worry about

interest rates

48% say debt’s impact on them has been negative

67% worry about

mortgage payments

85% of those renewing their mortgages in the next year are concerned

Source: Manulife Bank 2022 Fall Debt Survey, page 6

Right now, it’s all about cash flow.

This combination of inflation, interest rates, and housing costs is making cash flow priority #1, and it’s significantly impacting the following:

Their home equity (and access to cash flow) | Their retirement | Their investing

With day-to-day cash flow their focus, Canadians are seeking alternative solutions that can still fuel their plans two, 10, or 20 years down the road.

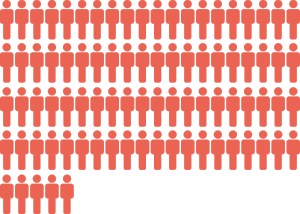

Let’s examine

3

scenarios*

where Manulife Bank lending solutions and strategies can help address short-term cash flow needs and continue to make Canadians’ plans a reality.

Manulife Bank has the solutions and strategies in place to help Canadians live their best lives, whatever they might be.

Insurance Lending

Investment Lending

Commercial Lending