Helping your clients live their best lives.

Without compromise.

How does someone plan to live their best life?

This series of case studies looks into the lives of four people and couples* who turned to Manulife Bank lending solutions to leverage their assets in order to realize their dreams.

1

Wealth decumulation into retirement

2

Wealth preservation with an eye to the future

3

How high-net-worth clients can leverage insurance to enhance cash flow

4

Lending solutions in annual financial planning

* Sample cases for illustration purposes only

Wealth decumulation into retirement

Preparing clients for their first step into retirement

Manulife Bank solutions and strategies can help your clients use the assets they’ve accumulated over the course of their lives to fund their best lives later on — in this case, transitioning into a confident pre-retirement.

Meet Martha ![]()

| 60 |

| Single, divorced |

| HR executive |

| $100,000 annum |

Martha* is a single empty nester who has built a satisfying career for herself as an HR professional with a large organization.

She’s looking to officially retire at 65, but today, at age 60, she’d like to ease herself into a four-day workweek so that she can spend more time with her grandkids.

What Martha’s looking for is a five-year plan that may allow her to supplement her income while still working part-time – with a longer-term goal of improving her cash flow once she retires.

Martha's reality ![]()

Like many Canadians not far from retirement, Martha does not have a fully fledged plan in place. Fortunately, her accumulated assets to date can help her overcome her concerns.

54%

of non-retirees are not currently prepared for retirement1

72%

not-yet-retired Canadians worry they’ll outlive their savings2

13%

of retirees admit they weren’t prepared for retirement1

48%

of retired Canadians worry they’ll outlive their savings2

Martha's assets ![]()

Martha has been extremely diligent in managing her finances, especially since her divorce. Her home is fully paid for, and she has invested wisely. Contributions to her Whole Life policy have always been a priority.

Real estate

Value

$750,000

Mortgage paid off last year

Investments

Value

$650,000

Sizable portfolio in Registered Accounts / $100K in non-registered investments

Life insurance

Cash Value

$250,000

Whole Life insurance policy

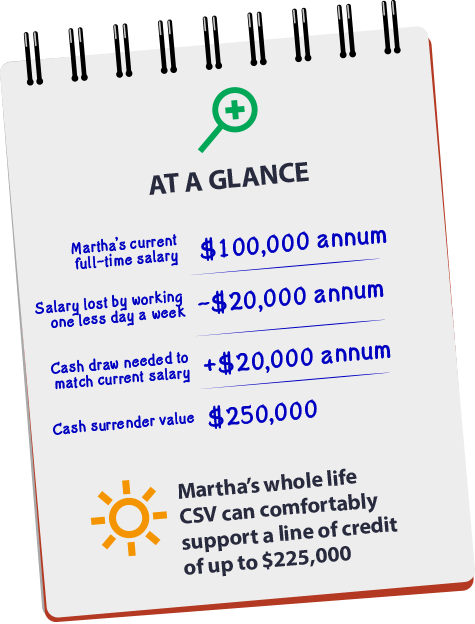

Martha's strategy

An Insurance Line of Credit | Whole life cash surrender value (CSV)

Martha keeps

her policy

Martha can access her whole life insurance policy’s cash surrender value without surrendering the policy itself. And because no withdrawal is actually being made from the policy, no taxes are triggered.**

Interest-free

cash flow

No minimum monthly payments are required, so interest charges are simply added to the line of credit amount. This is good news for Martha’s cash flow, as she doesn’t have to make regular monthly payments.

In time, Martha can introduce her registered assets into the mix to further supplement her retirement income.

Martha's best life is ahead

For Martha, every weekend for the next five years of her working life could be a long weekend.

She spends at least one full day a week with her grandkids and enjoys long-overdue “me time” cycling and finally taking fashion design courses.

By dipping her toe into the water of what retirement life could feel like, Martha feels confident about the many years ahead of her beyond her five-year plan.

Manulife Bank has the solutions and strategies in place to help Canadians live their best lives, whatever they might be.

Insurance Lending

Investment Lending

Commercial Lending